*FY’24 Pre-tax profit normalised after adjusting for one-off legacy recovery

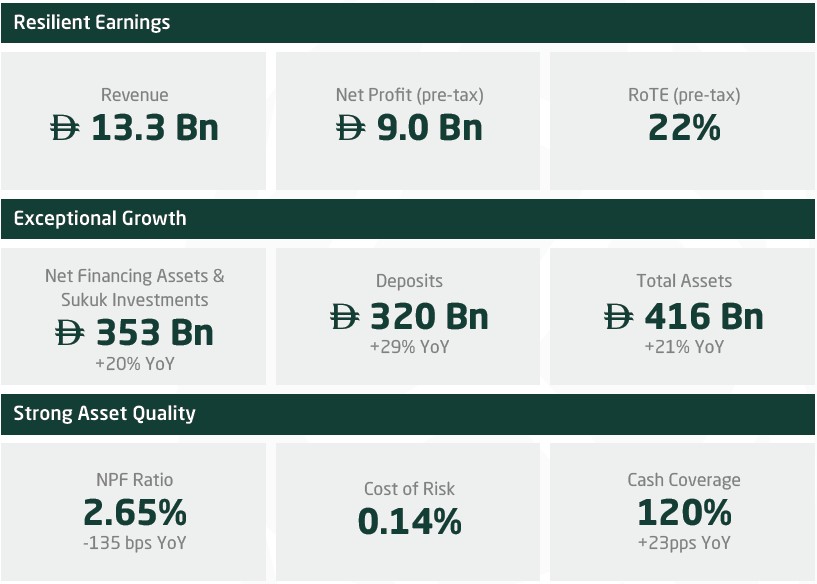

DIB (DFM: DIB), the largest Islamic bank in the UAE, achieved another year of robust financial performance for the full year ended December 31, 2025. The bank’s strong revenue growth to AED 13.3 billion was driven by solid non funded income, resilient funded income, healthy business volumes and stable margins. The bank’s operating efficiency along with solid improvement in cost of risk resulted in 20% YoY increase in pre-tax profit to AED 9.0 billion. Total Assets recorded stellar growth of 21% to AED 416 billion.

Key FY’25 Performance Metrics:

Performance Highlights for FY’25:

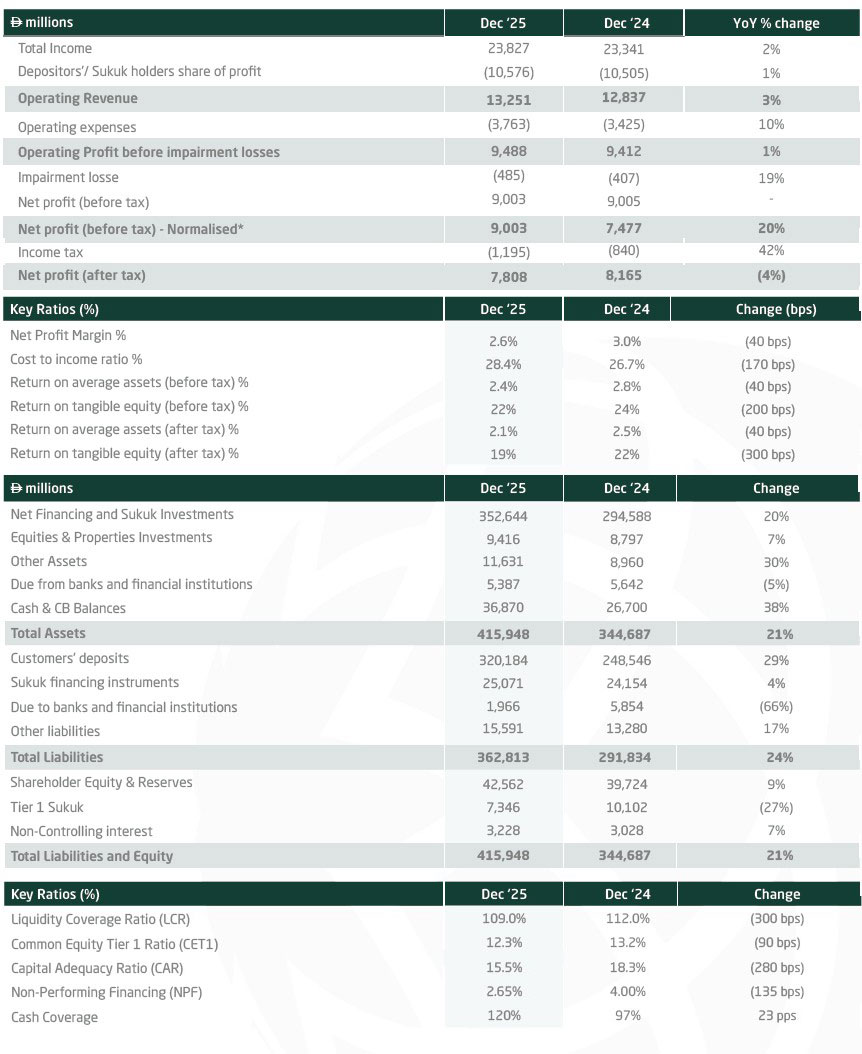

Income Statement:

Balance Sheet:

Asset Quality:

Capital and Liquidity:

FY’25 Business Highlights:

Consumer Banking:

Local & Cross‑Border Wholesale Banking:

Sustainability:

Intelligence at Scale, Discipline at the Core

In 2025, DIB accelerated the shift from stand-alone AI use cases to enterprise deployment, embedding intelligence where it matters most: customer experience, business growth, and operational control. The Bank’s approach is disciplined and governance-led, ensuring AI adoption scales with accountability, aligns with strategic priorities, and remains consistent with the principles that underpin Shariah-compliant banking.

A unified AI roadmap was established to govern the end-to-end lifecycle of delivery. It covers requirements intake, enablement, capacity planning, prioritisation, governance, and production deployment, providing a structured path from idea to execution. This framework enables scale with discipline, ensuring AI initiatives are prioritised transparently, delivered consistently, and deployed responsibly across the organisation.

This approach is already translating into measurable outcomes across service delivery, portfolio expansion, and operational oversight:

DIB’s focus is now on extending these outcomes across priority journeys and core processes, using AI to deliver faster, more consistent service, better-informed decisioning, and stronger operational resilience. This is intelligence at scale, with discipline at the core, translating technology adoption into durable value for customers, stakeholders, and the wider economy.

Digital:

His Excellency Mohammed Ibrahim Al Shaibani, Director-General of His Highness The Ruler’s Court of Dubai and Chairman of DIB

“The UAE’s economic progress has been shaped by a clear national direction: to strengthen competitiveness, enable private-sector growth, attract investment, and build resilience that endures. These priorities are not abstract; they require strong institutions, sound governance, and financial systems that mobilise and utilise capital responsibly while safeguarding stability and trust. Within this framework, DIB’s role is to serve as a reliable partner to the real economy—supporting productive sectors and communities through Shariah-compliant banking that is rooted in long-term stewardship.

In 2025, DIB’s performance reflected the strength of this model. The Bank continued to expand, sustained its earnings capacity, and strengthened the quality of its balance sheet, while maintaining a prudent approach to risk and capital. This is a defining feature of responsible growth: performance delivered without compromising resilience. It reinforces the Bank’s ability to support customers through changing conditions and to contribute meaningfully to the UAE’s continuing economic momentum.

The Board’s focus is to ensure that DIB’s growth remains aligned with strategic priorities and delivered with institutional rigour, anchored in the highest standards of governance, transparency and accountability. This ensures that performance is matched by strong controls and prudent decision-making. It includes embedding risk discipline at every level of decision-making, investing in capabilities that strengthen operational resilience and elevate customer experience, and ensuring that capital is deployed efficiently to support sustainable growth and long-term value creation.

In this context, the Bank’s results provide a strong foundation for the future. DIB delivered another year of strong balance sheet progress, with total assets growing by 21% to AED 416 billion in 2025, reflecting the continued strengthening of the Bank’s franchise. This growth was supported by a robust expansion in customer deposits, which grew by 29% to AED 320 billion, reinforcing the stability and resilience of our funding base built on customer trust. Together, these outcomes reinforce DIB’s capacity to support the real economy responsibly and at scale, while serving customers across retail, SME and corporate segments.

As DIB continues to strengthen its regional and international footprint, it will do so while remaining anchored in the UAE’s economic priorities and in the same principles that protect trust and reinforce resilience. DIB will continue to play its role—supporting growth through Shariah-compliant finance, strengthening the foundations of confidence and stability, and creating enduring value for shareholders, customers and the wider economy.”

Dr. Adnan Chilwan, Group Chief Executive Officer of DIB

“In 2025, our focus was on converting momentum into measurable delivery—strengthening the balance sheet, improving the quality of earnings, and sustaining a risk profile that supports growth at scale. Throughout the year, management priorities were anchored in execution: sharpening portfolio discipline, strengthening revenue composition, and reinforcing the operating platform to deliver faster, more consistently, and with greater resilience across the Bank.

This was reflected in solid financial outcomes. Operating revenues reached AED 13.3 billion, and pre-tax profit totalled AED 9.0 billion, supported by healthy business volumes and resilient margins. Revenue diversification strengthened further, with non-funded revenues rising to AED 4.3 billion (+10.1%), supporting a more balanced revenue profile. Net financing assets and Sukuk investments grew by 20% to AED 353 billion, reflecting continued momentum across our core businesses. This growth was underpinned by AED 124 billion in new gross financing and Sukuk investments, representing a solid 80% YoY increase.

Crucially, performance continued to be delivered with strengthening risk indicators. The non-performing financing (NPF) ratio improved to 2.65% (down 135 bps YoY), coverage strengthened to 120%, and cost of risk (CoR) remained exceptionally low at 0.14%. These outcomes reflect consistent underwriting standards, prudent provisioning and active portfolio management, ensuring that growth remains well-supported.

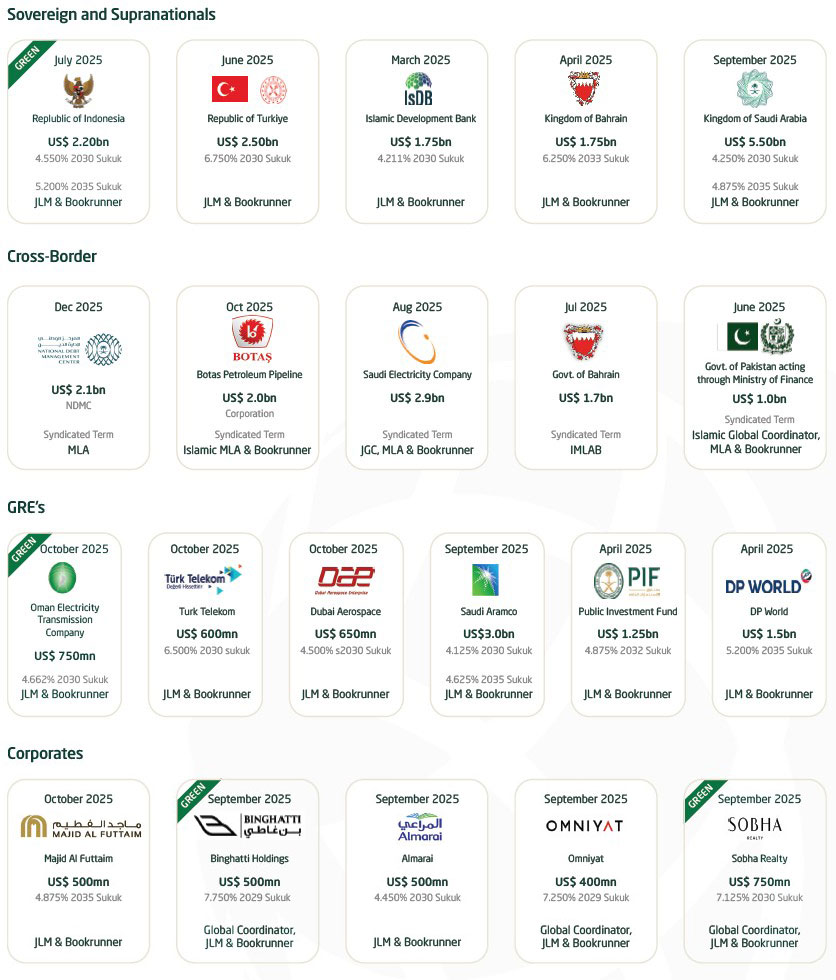

Along with financial delivery, 2025 also reflected DIB’s capability to execute on complex mandates and national priorities. The Bank continued to deliver sovereign and strategic financings, advanced aviation-related structured transactions, and participated in the UAE’s Digital Dirham pilot, supporting a landmark government transaction completed in less than two minutes as part of the UAE’s Central Bank Digital Currency (CBDC) initiative. These milestones reinforce the breadth of our execution capabilities, and the role DIB continues to play in enabling priority sectors and national initiatives through Shariah-compliant solutions.

Looking ahead, our priorities remain clear: sustain disciplined growth, protect balance sheet quality, deploy capital efficiently, and continue investing in operational resilience and customer experience, guided by a simple principle: ‘Progress Never Stops’. So that performance remains durable and DIB continues to support the UAE’s real economy with consistency and strength.”

Financial Review:

Awards: FY’25:

Select DCM and Syndicated Deals: FY’25:

DIB Successfully Issues Debut Sustainability-Linked Financing Sukuk

DIB and HCLTech Forge Strategic AI Innovation Partnership