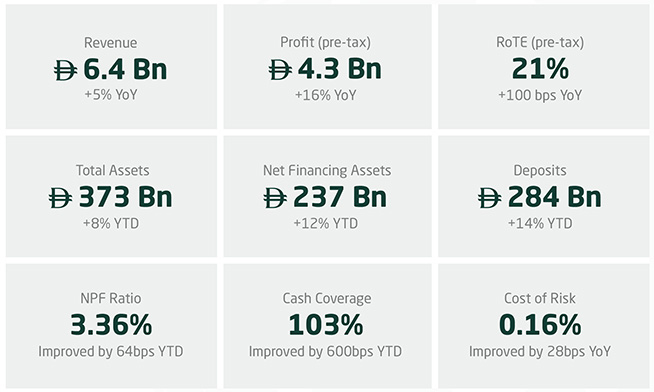

Key H1’25 Performance Metrics:

*YoY refers to the variance of H1’25 and H1’24 (on annualised basis)

DIB showcased another robust performance in the first half of 2025, with operating revenue of AED 6.4 billion, driving a 16% YoY increase in pre-tax profit to AED 4.3 billion. Double-digit growth in financing and deposits, coupled with improved asset quality, underpinned another historic milestone as the balance sheet surpassed the USD 100 billion mark.

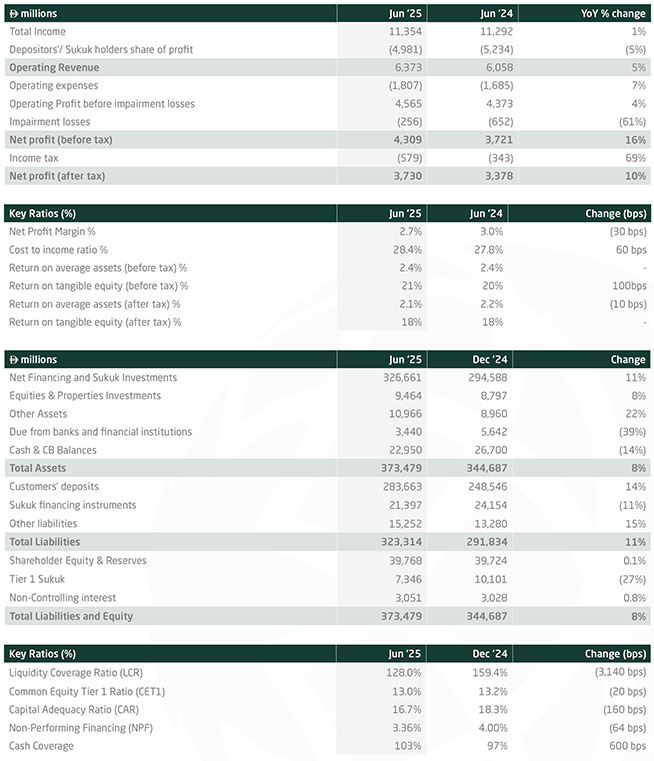

H1’25 Performance Highlights:

Profitability:

Balance Sheet:

Asset Quality:

Capital and Liquidity:

The Intelligence Behind Ethical Progress

Driven by our commitment to ethical innovation, DIB has integrated AI as a strategic lever across the bank. Whilst AI at DIB is targeted at building efficiency, precision, and inclusion in every process and interaction, it is human-led governance that ultimately defines our approach in this space.

This responsible use of technology has translated into measurable gains in service delivery, portfolio growth, and operational control:

Looking ahead, DIB will scale its AI capabilities to not only unlock deeper insights, faster execution, and greater inclusion across all segments, but ultimately to drive our ethos of creating “Happiness with Tech”.

H1’25 Business Performance:

A Landmark Year:

Key Collaborations, Deals and Initiatives:

His Excellency Mohammed Ibrahim Al Shaibani, Director-General of His Highness The Ruler’s Court of Dubai and Chairman of DIB

“The strength of an economy is measured by its capacity to grow responsibly, remain rooted in core principles, and maintain stability amid change. The United Arab Emirates has consistently exemplified these attributes. In the face of evolving global dynamics, it continues to stand as a model of resilience and foresight, underpinned by leadership that harmonises ambition with purpose.

The financial sector plays a central role in reinforcing this foundation. Within it, DIB has sustained its performance through sound governance and a steadfast commitment to value-based banking. The results delivered in the first half of the year reflect a legacy of progress shaped by five decades of alignment with the nation’s development agenda.

This year marks a defining milestone in that journey. Since its founding in 1975, DIB has evolved into a leading Islamic financial institution, with more than AED 65 billion in market capitalisation and AED 370 billion in assets. In the first half of 2025, the bank surpassed USD 100 billion in total assets. This is a marker not only of scale, but also of adaptability and nimbleness to respond to the everchanging global landscape. This progress affirms the strength of a long-term strategy grounded in trust, resilience, and clarity of purpose.

As we reflect on fifty years of achievements, I remain deeply confident in DIB’s ability to navigate the evolving financial landscape. Our strong governance, long-term outlook, and enduring commitment to responsible growth ensure that the bank is well-positioned to continue creating lasting value to all stakeholders.

To the Board of Directors, our shareholders, our customers, and the thousands of employees who have shaped this institution, I extend my sincere appreciation. DIB’s journey has been defined by trust and collective commitment. That same foundation will continue to guide our journey in the years to come.”

Dr. Adnan Chilwan, Group Chief Executive Officer of DIB

“As we advance through this landmark year, marking five decades since DIB’s founding, our first-half performance reflects disciplined execution in clear alignment with the direction defined at the outset of our current growth agenda. The milestone of surpassing USD 100 billion in total assets is not a measure of scale alone, but of a deeply ingrained intent. It is a reflection of disciplined execution against a long-term strategy to transform a concept into a global norm.

Despite the volatilities around we delivered a significant 16% rise in pre-tax profit which exceeded AED 4.3 billion. Whilst the introduction of corporate tax this year adds a new element, our post-tax profit also came in strong at AED 3.7 billion, a solid increase of 10%.

The robust profitability has led to an equally strong return on equity of 21%. It is important to note that the recent 12-month period, has also demonstrated market confidence in the management and franchise strategy as reflected in the share price movement.

Equally important is the continued improvement in asset quality. With the NPF ratio now at 3.36%, the lowest in five years, we are seeing the outcome of a deliberate and embedded approach to risk that supports growth without compromising resilience.

Looking ahead, our focus remains firmly on the substance of our strategy. Islamic finance must move beyond structure to deliver meaningful impact, serving as a platform for real economic progress. It is this clarity of purpose that ensures progress never stops.”

Financial Review

For the remainder of 2025, DIB will focus on sustaining profitable growth while deepening its role as a leading force in Islamic finance. The bank aims to strengthen its capital position, broaden its high-quality asset base, and advance sustainable financing in alignment with the UAE’s national agenda. Expansion into high-potential segments and geographies will be matched with continued investment in digital capabilities and enhanced customer experiences. Guided by disciplined execution and strong governance, DIB remains well-positioned to create lasting value for shareholders, customers, and the wider community.

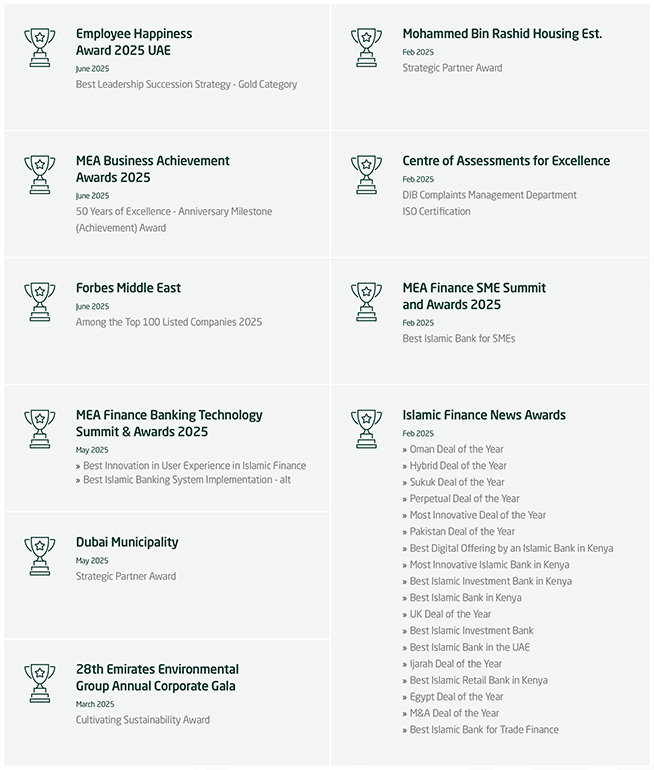

Awards: H1’25

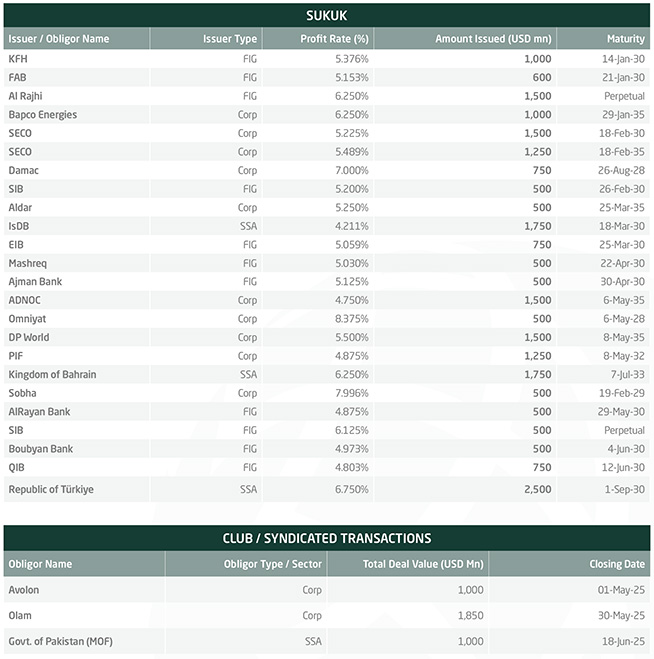

Select DCM and Syndicated Deals: H1’25

Dubai Islamic Bank Full Year 2024 Group Financial Results

DIB increases its stake to 25% in Digital Bank in Türkiye

Crypto.com inks Partnership with Dubai Islamic Bank