Dubai Islamic Bank (DFM: DIB), the largest Islamic bank in the UAE, today announced its results for the period ending June 30, 2024.

1H 2024 Highlights:

Management’s comments for the period ended 30th June 2024:

His Excellency Mohammed Ibrahim Al Shaibani, Director-General of His Highness The Ruler’s Court of Dubai and Chairman of Dubai Islamic Bank

Dr. Adnan Chilwan, Group Chief Executive Officer

Financial Review:

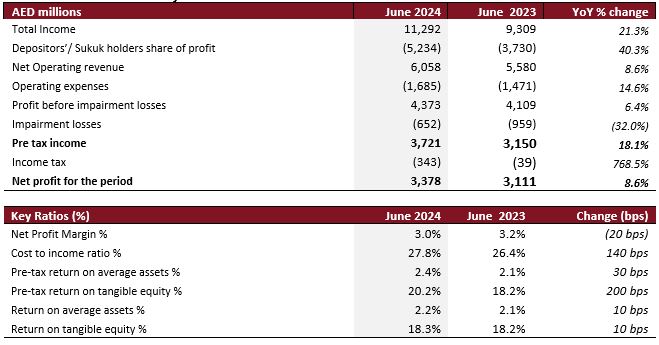

Income statement summary:

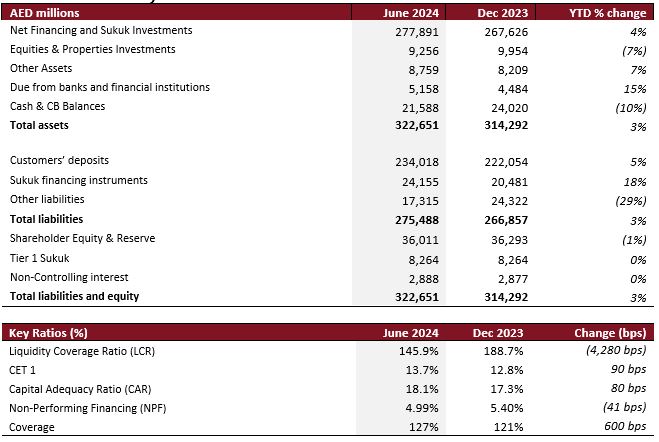

Balance Sheet Summary:

Operating Performance:

The bank’s Total Income rose to AED 11,292 million in H1 2024 demonstrating a solid growth of 21% YoY compared to AED 9,309 million. Non-funded income advanced by 37% YoY over the reporting period supported by income from investment properties and associate income. Net Operating Revenue grew by 8.6% YoY to reach AED 6,058 million compared to AED 5,580 million last year.

Pre-impairment profit increased by 6.4% YoY reaching AED 4,373 million compared to AED 4,109 million. Impairment charges stood at AED 652 million down by a significant 32% YoY.

Operating expenses amounted to AED 1,685 million for the year vs AED 1,471 million in H1 2023, exhibiting 14.6% YoY increase mainly on the back of higher wages. Cost income ratio registered 27.8%, up 140 bps YoY.

Pre-tax profit grew by 18% YoY to reach AED 3,721 million. Despite the introduction of corporate tax, Group Net Profit increased by 8.6% YoY to reach AED 3,378 million vs AED 3,111 million in H1 2023.

Net profit margin at 3.0% remained in line with full year guidance. Meanwhile ROA and ROTE post tax came in at 2.2% and 18% respectively stable YoY while pre-tax ROA and ROTE stood at 2.4% and 20.2% respectively.

Balance Sheet Trends:

Net financing & Sukuk investments stood at AED 278 billion, up 3.8% YTD from AED 268 billion in FY 2023.

DIB witnessed strong gross new underwriting of 20% YoY in the consumer portfolio during the H1 2024 period to AED 12 billion which translated into net consumer portfolio of AED4 billion up 96% YoY. On the corporate front we saw a slight decline in gross new underwriting due to timing on deals which materialized post period end. Net corporate financing account was also significantly impacted due to early settlements to the tune of AED 13 billion.

Customer deposits registered AED 234 billion up by 5.4% YTD. CASA balance rebounded to AED 98 billion up 19.4% YTD and comprising 42% of deposits. Wakala account (investment deposits) contribution retracted to 58% compared to 63% in YE 2023. Liquidity coverage ratio (LCR) at 145.9%, down from 188.7% FY 2023, remains above regulatory requirement, depicting strong liquidity position.

Non-performing financing (NPF) ratio improved to 4.99%, down by 41 bps compared to FY 2023 NPF ratio of 5.40%. The NPF absolute amount decreased by 7.8% from AED 11.5 billion during YE 2023 to AED 10.6 billion. Accordingly, DIB’s coverage ratio improved significantly on a YTD basis by 500 bps to 95%.

Stage 1 financing up by 62 bps to AED 184 billion while Stage 2 financing ended the period at AED 13.5 billion down 6%; both well provisioned for. Similarly, Stage 3 coverage improved to 73.5%, (+520 bps) from FY2023 as stage 3 exposure dropped to just below AED 11 billion, the lowest level over the past 3 years.

Cash coverage ratio rose to 95% (+500 bps YTD, +210 bps QoQ) and overall coverage including collateral at 127% (+500 bps YTD, +100 bps QoQ). Cost of risk came in at 40 bps compared to 60 bps in FY 2023.

Capital ratios continue to remain strong with CAR at 18.1% and CET 1 ratio at 13.7%, both well above the regulatory requirement.

Business Performance (1H 2024):

Consumer Banking portfolio reached AED 60 billion up 7% YTD. The portfolio’s total new underwriting of AED 12.3 billion during the year increased from AED 10 billion, up 20% YoY. All consumer segments particularly credit cards and auto finance were up by 22% and 14% on a YTD basis. Despite routine repayments of AED 8.4 billion, the portfolio added nearly AED 4 billion of net new underwriting in H1 2024 versus AED 2 billion in H1 2023. Blended yield on consumer financing grew by 46 bps YoY to reach to 7.1%. Separately, on the funding side, consumer deposits increased by 4% YTD to AED 92 billion while consumer CASA was also up 3% YTD to nearly AED 50 billion.

Corporate banking portfolio now stands at AED 139 billion. Revenues increased by almost 9% YoY to AED 1.5 billion. Yield on corporate financing portfolio expanded by 47 bps YoY to 6.7% compared to 6.2%. On the funding side, corporate deposits increased by 7% on a YTD basis while CASA advanced by a healthy rate of 40% YTD, as the bank continued to attract strategic corporate clients.

Treasury continued to provide a strong engine for growth as the curator of the bank’s fixed income book. The sukuk investment portfolio now stands at AED 79 billion, up a solid 15% YTD. Net new sukuk investments during the year amounted to AED 10.5 billion, up almost 2% YoY. The portfolio carries an attractive yield of 4.8% up 17 bps YoY.

Key Business Highlights (H1 2024) :

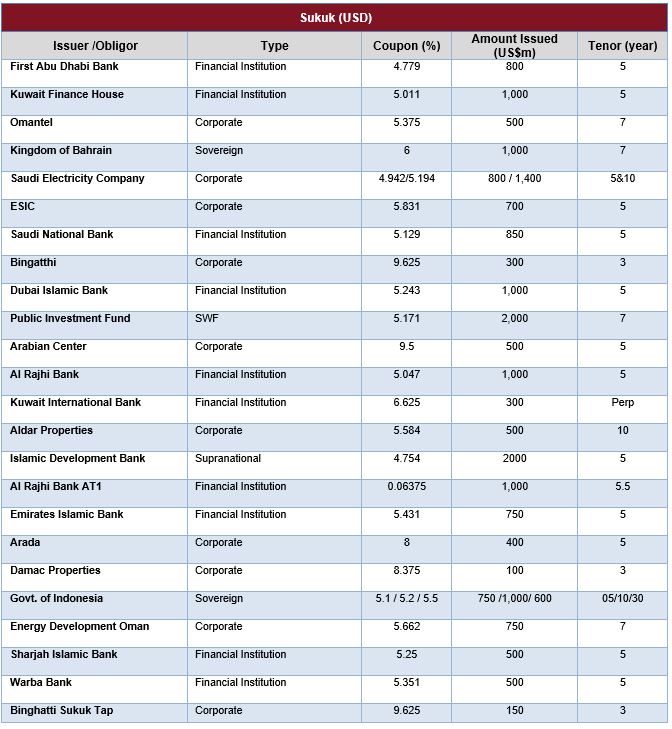

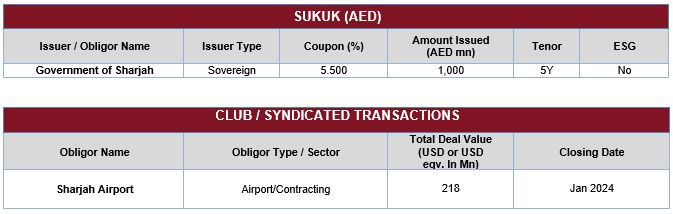

DCM and Syndication Deals (H1 2024):

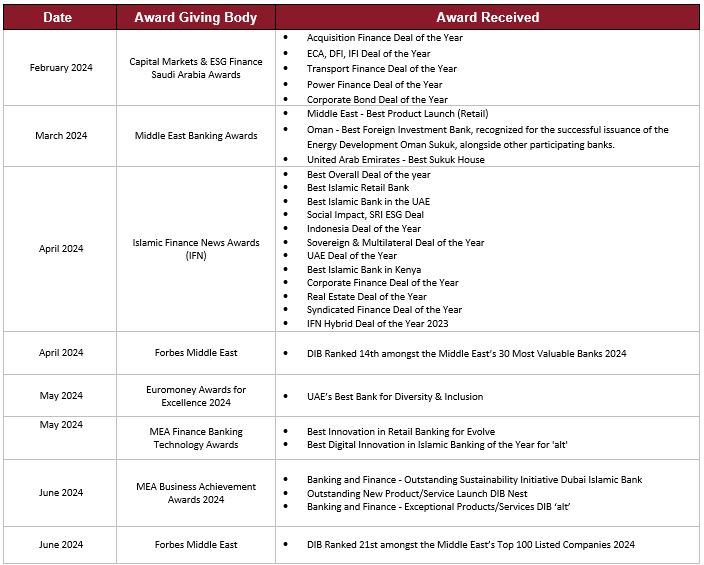

Awards List (1H 2024):

DIB Successfully Issues Debut Sustainability-Linked Financing Sukuk

DIB and HCLTech Forge Strategic AI Innovation Partnership