Dubai Islamic Bank (DFM: DIB), the largest Islamic bank in the UAE, today announced its results for the period ending March 31, 2023.

Q1 2023 Highlights:

Management’s comments for the period ending 31st March 2023:

His Excellency Mohammed Ibrahim Al Shaibani, Director-General of His Highness The Ruler’s Court of Dubai and Chairman of Dubai Islamic Bank

Dr. Adnan Chilwan, Group Chief Executive Officer

Financial Review:

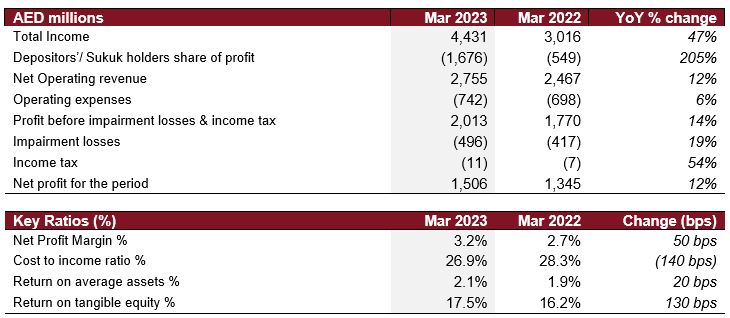

Income statement summary

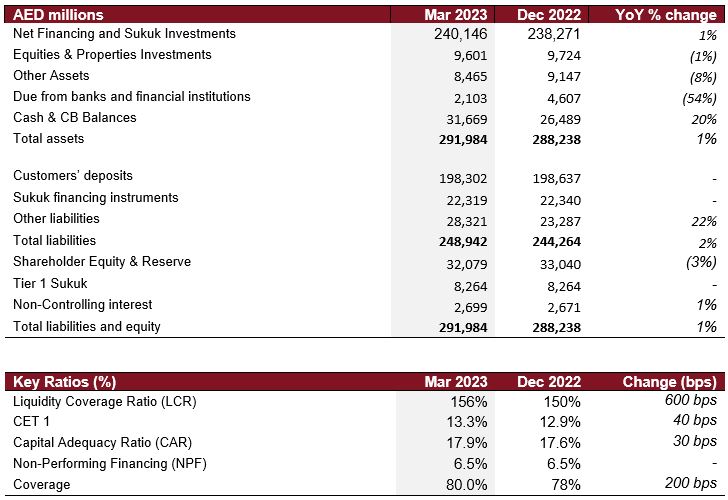

Balance Sheet Summary

Operating Performance

The bank’s total income rose to AED 4,431 million in Q1 2023 demonstrating a notable YoY growth of 47% compared to AED 3,016 million primarily driven by strong income from financing assets. This is clearly reflected in the Net Operating Revenue which grew by 12% YoY to reach to AED 2,755 million compared to AED 2,467 million last year.

Pre-impairment profit increased by 14% YoY reaching to AED 2,013 million compared to AED 1,770 million. On a QoQ basis impairment charges dropped by 24% to AED 496 million.

Operating expenses amounted to AED 742 million during Q1 2023 vs AED 698 million in Q1 2022, exhibiting a 6% YoY increase. The bank’s growth plans are well underway including continued enhancements on digital and transactional banking and further improvements on the customer experience journey. Following higher revenue growth and controlled cost growth, cost income ratio stood at 26.9%, lower 140 bps YoY, well within the guidance.

As a result, the bank’s Group Net Profit witnessed a strong increase of 12% YoY to reach AED 1,506 million, the highest quarterly net profit in the banks history vs AED 1,345 million in Q1 2022.

Net profit margin increased to 3.2% (+50bps YoY) with ROA and ROTE at a healthy 2.1% and 17.5% up by 10 bps and 50 bps YTD respectively.

Balance Sheet Trends

Net financing & Sukuk investments stood at AED 240 billion, up 1% YTD from AED 238 billion in FY 2022, supported by sukuk investments, which grew 5.6% YTD to reach to AED 55 billion.

DIB witnessed healthy overall YoY growth in gross new financing and sukuk in Q1 2023 amounting to nearly AED 21 billion, up 40% compared to AED 15 billion in Q1 2022. Gross corporate financing origination of nearly AED 11 billion (+ 41% YoY) driven mainly by government related entities and large corporates, while new bookings from consumer financing accounted for AED 5 billion (+25% YoY), continued to exhibit DIB’s competence in deploying financing assets despite the ongoing market volatilities. Whilst routine repayments of AED 9 billion and AED 4 billion from the corporate and consumer segments respectively were expected, excess liquidity in the market and sustained high rate environment led to early settlements and prepayments of around AED 4 billion which came mainly from the corporate portfolio. Despite this, net movement in the financing & sukuk book was positive coming at AED 2 billion in Q1 2023.

Customer deposits stood at AED 198 billion as of Q1 2023, with CASA now standing at AED 80 billion, comprising 40% of deposits. Migration to wakala deposits was apparent during the quarter due to the current global rate scenario. This is reflected through an increase in the wakala portfolio (investment deposits) which is up 6% YTD comprising a higher share of 60% of total deposits versus 56% in YE 2022. Liquidity coverage ratio (LCR) at 156%, up from 150% FY 2022, and NSFR at 108% up from 106% in FY 2022, both above regulatory requirement, depicting strong liquidity position.

During Q1 2023, DIB further enhanced its funding base by issuing USD 1 billion of sustainable sukuk. This brings the total sustainable sukuk issuance by DIB to USD 1.75 billion.

Non-performing financing (NPF) ratio remained constant YTD to 6.5%, yet down 20 bps compared to Q1 2022 ratio. NPF on an absolute basis has declined by AED 162 million YTD (-1.2% YTD), to AED 12,824 million from AED 12,986 million in FY2022. The main improvement in NPF was due to ongoing recoveries from NMC and NOOR POCI which resulted in a decline of 6% in their NPF accounts. Additionally, coverage ratio on both accounts increased. For NMC coverage increased by 400 bps to 78% YTD and by 600 bps to 34% for the NOOR POCI account. Finally, core DIB NPF account remained intact at AED 10.7 billion flat YTD.

Stage 3 coverage accordingly improved to 62.8%, (+160 bps) from FY2022 on the back of collections. Additionally, asset quality improvement has been depicted across the Stage 2 account on a YTD basis. Stage 2 coverage is also on an upward trajectory to 7.7% compared to 7.5% in FY2022.

Cash coverage ratio improved to 80% (+200 bps YTD, +700 bps vs Q1 2022) and overall coverage including discounted collateral also significantly improved to 113% (+310 bps YTD and 1010 bps vs Q1 2022) underpinning DIB’s commitment to enhancing its coverage ratio. Cost of risk for Q1 2023 now stands at 80 bps compared to 84 bps for the year 2022, an improvement of 4 bps YTD.

Capital ratios continue to remain strong with CAR now at 17.9% (up 30 bps YTD) and CET 1 ratio at 13.3% (up 40 bps YTD), both well above the regulatory requirement.

Business Performance (Q1 2023)

Consumer Banking financing portfolio stood at AED 53 billion up 2% from AED 52 billion in FY2022 on the back of Home Finance and Personal Finance. The portfolio’s total new underwriting reached AED 5 billion during the quarter compared to AED 4 billion in Q1 2022. The business generated AED 1.2 billion in revenues during the year up 19% YoY from AED 968 million during Q1 2022. Blended yield on consumer financing grew by 77 bps YoY to reach to 6.5%. Separately, on the funding side, it is worth noting consumer deposits witnessed 5% growth YTD underpinning the bank’s solid consumer franchise.

Corporate banking financing portfolio now stands at AED 132 billion with government and service sectors contributing 30% to this portfolio. New wholesale lending for 1Q 2023 registered AED 11 billion, while repayments came in at AED 9 billion and unexpected early settlements in the tune of AED 4 billion were witnessed during the quarter. Revenues featured double digit growth reaching AED 1.1 billion, up 47%YoY compared to AED 773 million in Q1 2022. Yield on corporate financing portfolio expanded by 330 bps YoY to 6.1% compared to 2.8%.

Key Business Highlights (Q1 2023)

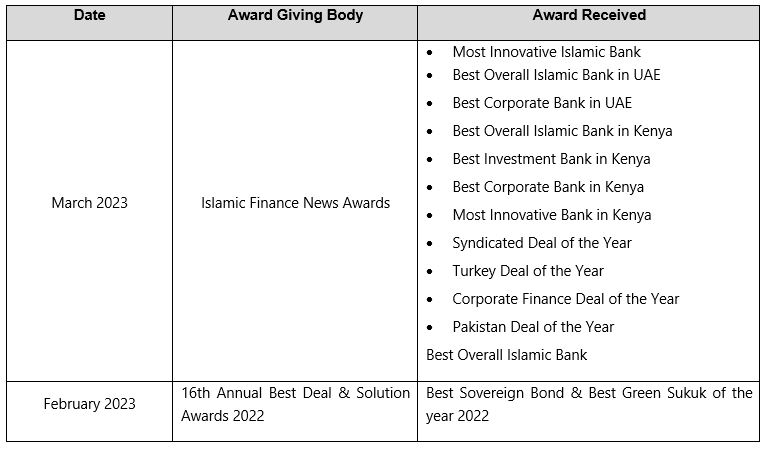

Awards List (as of Q1 2023)

DIB Successfully Issues Debut Sustainability-Linked Financing Sukuk

DIB and HCLTech Forge Strategic AI Innovation Partnership