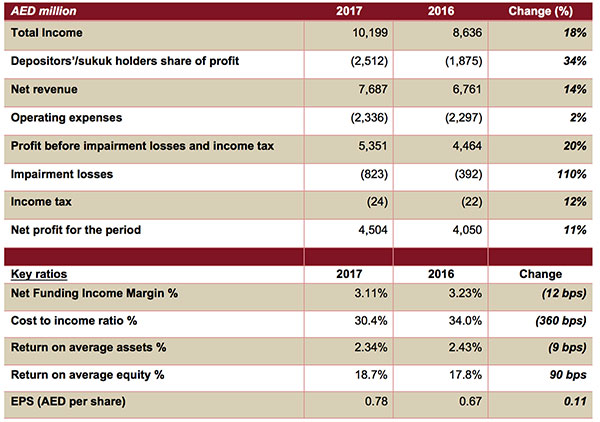

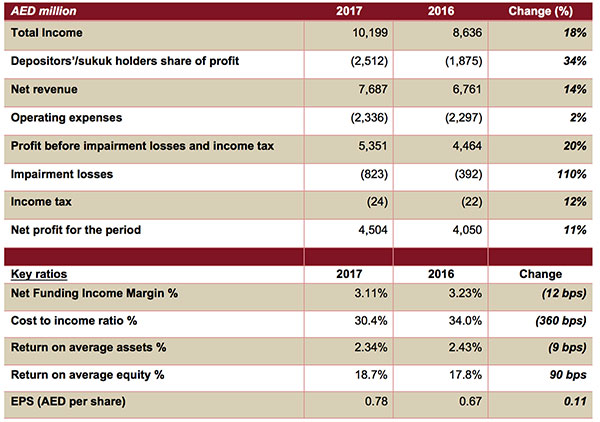

Net profit crosses AED 4.50 billion, up by 11%:

- Total income crosses AED 10 billion mark, up by 18%

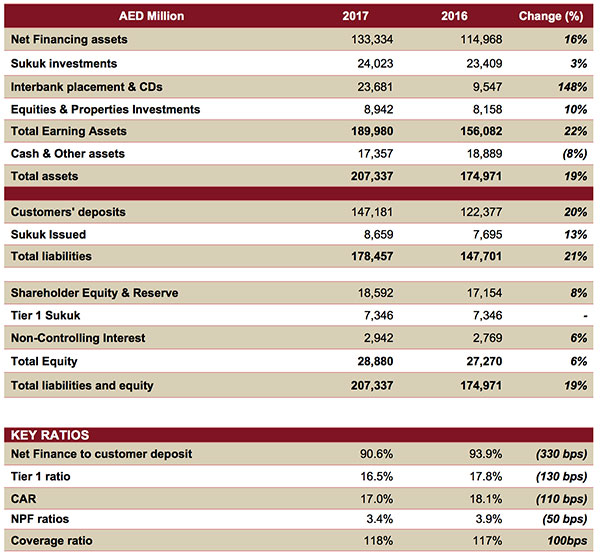

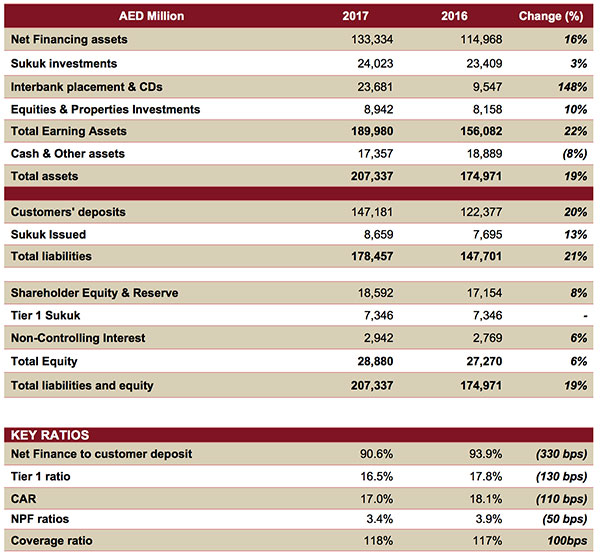

- Total assets grew by 19% to reach to AED 207.3 billion

- Financing assets increased by 16% to AED 133.3 billion

- Deposits rose by 20% to AED 147.2 billion

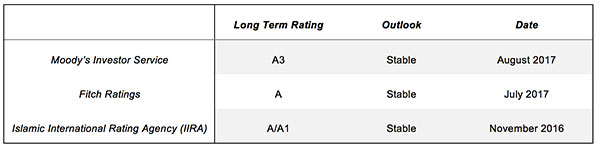

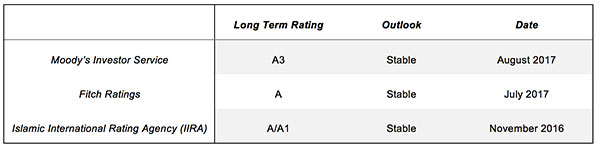

- Credit ratings saw upgrades during the year with outlook as Stable

Dubai Islamic Bank (DFM: DIB), the first Islamic bank in the world and the largest Islamic bank in the UAE, today announced its results for the year ended December 31, 2017.

Full Year 2017 Results Highlights:

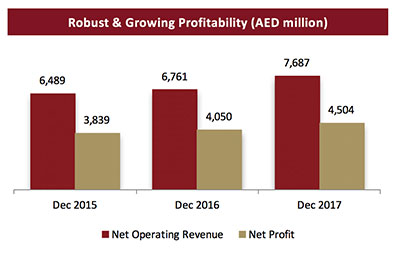

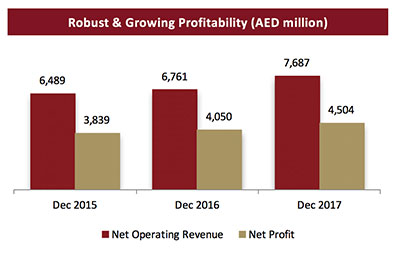

Profitability remains on a robust northbound trajectory driven by core business growth and effective cost management

- Group Net Profit increased to AED 4,504 million, up 11% compared to AED 4,050 million for 2016.

- Total income increased to AED 10,199 million, up 18% compared to AED 8,636 million for 2016.

- Net Operating Revenue increased to AED 7,687 million, up 14% compared to AED 6,761 million for 2016.

- Efficient and proactive cost management resulted in operating expenses remaining nearly flat at AED 2,336 million compared to AED 2,297 million for 2016.

- Net operating income before impairment charges grew by 20% to AED 5,351 million compared to AED 4,464 million for 2016.

- Cost of credit risk reduced to 60 bps compared to 80 bps in 2016.

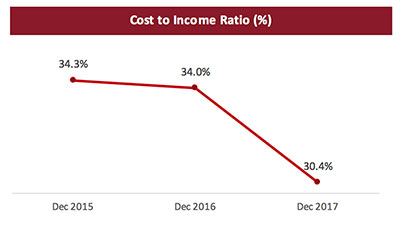

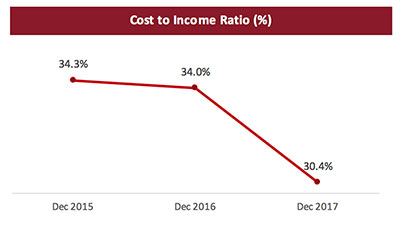

- Cost to income ratio declined to 30.4% compared to 34.0% at the end of 2016.

Financing continues to drive balance sheet growth as share of wallet rises to around 9% of the market

- Net financing assets rose to AED 133.3 billion, up by 16%, compared to AED 114.9 billion at the end of 2016.

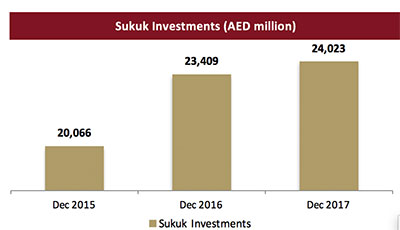

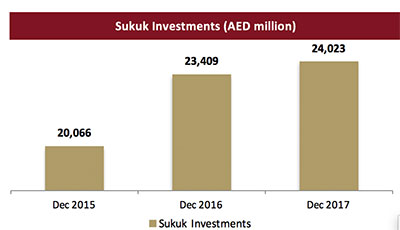

- Sukuk investments increased to AED 24.0 billion, a growth of 3%, compared to AED 23.4 billion at the end of 2016.

- Total Assets stood at AED 207.3 billion, an increase of 19%, compared to AED 174.9 billion at the end of 2016.

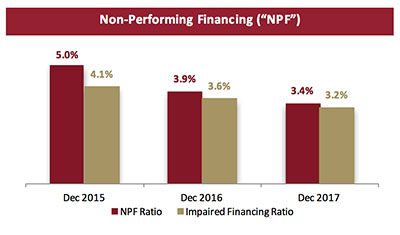

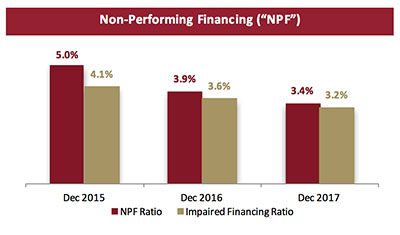

Asset quality improvement continues as the Non Performing Financing Ratio drops to below guidance levels

- NPF ratio continues its downward trajectory improving to 3.41%, compared to 3.9% in 2016.

- Cash coverage ratio maintained at 118%.

- Overall coverage including collateral at discounted value now stands at 157%.

Liquidity impact despite market beating financing growth

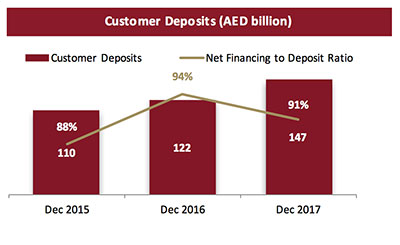

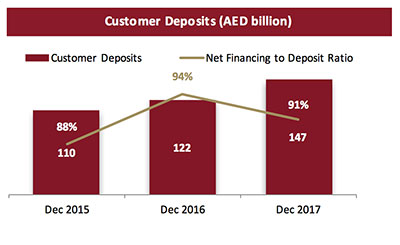

- Customer deposits stood at AED 147.2 billion compared to AED 122.4 billion at the end of 2016, up by 20%.

- CASA deposits increased by nearly 13% to AED 53.6 billion from AED 47.4 billion as at end of 2016 leading to a robust 36% constitution of the total deposit base.

- Financing to deposit ratio stood at just under 91%, indicating a healthy liquidity position

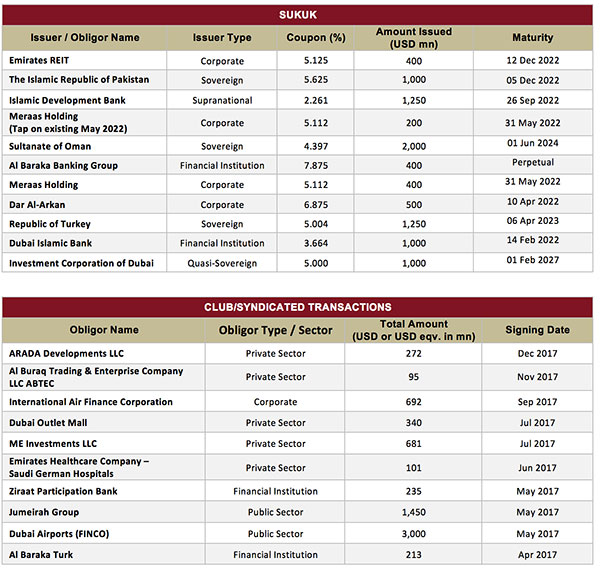

- Focus on diversification and securing long term funding saw another successful senior sukuk issuance of USD 1 billion during Q1 2017.

Robust capitalization levels creating growth capacity

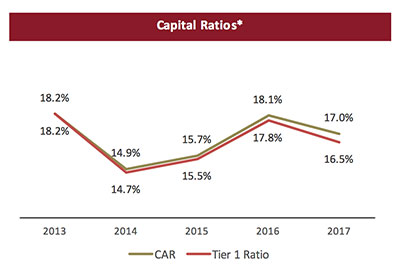

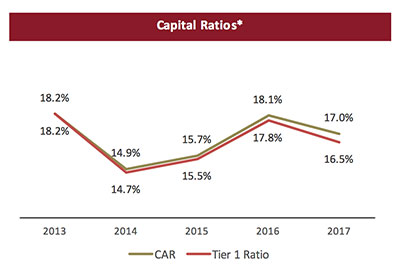

- Capital adequacy remained strong at 17.0%, as against 12% minimum required.

- Tier 1 CAR stood at 16.5% under Basel II, against minimum requirement of 8%.

Quality growth in profitability continues to support shareholder returns

- Earnings per share stood at AED 0.78 in 2017.

- Return on equity stood at 18.7% in 2017.

- Return on assets steady at 2.34% in 2017.

Management’s comments on the financial performance for the FY2017:

His Excellency Mohammed Ibrahim Al Shaibani, Director-General of His Highness The Ruler’s Court of Dubai and Chairman of Dubai Islamic Bank, said:

- The UAE banking system retains its strong financial fundamentals with sector assets crossing the USD 700 bln mark, making it the largest in the GCC. The growth was supported by strong capitalization as well as robust profitability.

- 2017 has been another remarkable year for the bank as we continue to make progress on our growth and expansionary agenda in both local and international markets.

- The bank has weathered the challenges across the region as well as those emanating from the global economic slowdown extremely well and with a more positive outlook forecasted for the UAE and global economy, the coming years look even more promising.

- We remain fully in sync with Dubai and the UAE’s plans in building a diversified and attractive economic hub for Islamic finance that serves to connect the globe from our home base here.

Dubai Islamic Bank Managing Director, Abdulla Al Hamli, said:

- The UAE continues to be one of the leading Islamic finance markets, with assets now reaching around $150 billion, a 7% growth this year.

- We remain well-positioned to capitalize on improving economic conditions in UAE, where GDP is expected to increase in 2018 in the run up towards major economic events such as the EXPO 2020.

- Our ongoing investments in digital technology and services has transformed DIB into a more efficient and secure banking institution that is able to provide its customers with a highly enhanced banking experience across a diversified and robust network of branches and channels.

Dubai Islamic Bank Group Chief Executive Officer, Dr. Adnan Chilwan, said:

- Nearly a decade ago, we established our plans to bring the company out from the effects of the global economic meltdown and back on track. As the incredible growth story of DIB unfolded, so did the challenges of oil prices and economic slowdown. But these have only made us stronger, more resilient and even more focused than ever before.

- The evolution in the last four years has seen a complete transformation in size and business with the balance sheet as well related key metrics of financing and deposits nearly doubling or more during the period. Further, the profitability has risen nearly three times with both ROEs and ROAs witnessing a steep climb as well. Simultaneously, the business model has completely transformed with a significantly more diversified portfolio minimizing concentration risks.

- The momentum established in the first three year of growth has carried through from the preceding period with the bank registering another 16% jump in the financing book in 2017. Despite this strong performance, liquidity remains intact with 91% Finance to Deposit Ratio as the bank continues to preserve its capacity to maintain the impetus into the new year.

- A double digit rise of 11% in profitability is a clear indication of the focus on quality growth with Group Net Profit crossing AED 4.5 billion and this will remain a critical objective going into 2018 as well.

- Creating capacity to support growth and optimizing costs whilst maintaining a competitive edge in offerings and technology will also remain the key drivers in 2018.

- The constantly improving asset quality with NPF ratio falling below even the guided level to 3.4% has been the result of robust and superior underwriting, a fact recognized by the rating agencies with upgrades and stable outlooks crowning DIB’s performance in 2017.

- As we enter the second year of the bank’s Growth 2.0 strategic agenda, you will see us remain focused on the quality opportunities within our home base of Dubai and the UAE and the three key “PIK” markets which denote our international forays into Pakistan, Indonesia and Kenya.

Financial Review

Income Statement highlights:

Total Income & Net Revenue

Profitability remained strong with total income for the year 2017 increasing to AED 10,199 million from AED 8,636 million for 2016, an increase of 18% compared to 2016. Net revenue for 2017 amounted to AED 7,687 million, an increase of 14% compared with AED 6,761 million in 2016. Increasing share of wallet and market penetration supported by new to bank clients remained key drivers for the double digit rise in profitability.

Operating expenses

Operating expenses were held nearly flat at AED 2,336 million for 2017 compared to AED 2,297 million in 2016, primarily due to efficient cost management. This resulted in the cost to income ratio improving to 30.4% compared to 34.0% at the end of 2016.

Profit for the period

Net profit for 2017, rose to AED 4,504 million from AED 4,050 million in 2016, an increase by 11% emanating from a combination of robust core business growth and effective and efficient cost management.

Statement of financial position highlights

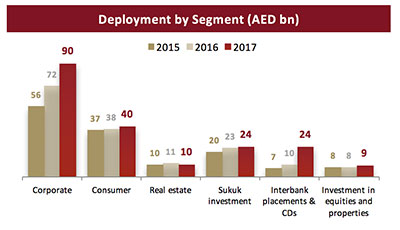

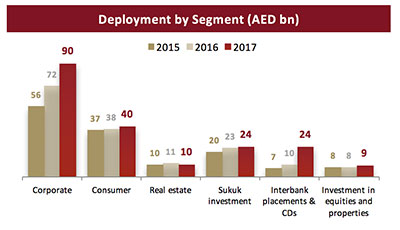

Financing portfolio:

Net financing assets grew to AED 133.3 billion for 2017 from AED 114.9 billion at the end of 2016, an increase of 16% driven primarily by the continued growth of core businesses. Gross corporate banking including real estate financing assets grew by 20% to AED 99.3 billion whilst gross consumer business ended the year at AED 39.7 billion. Commercial real estate concentration maintained at around 19% and in line with targeted guidance numbers.

Asset Quality

Non-performing financing have shown a consistent improvement with NPF ratio improving to 3.4% for 2017, compared to 3.9% at the end of 2016. Impaired financing ratio stood at 3.23% for 2017 from 3.59% at the end of 2016. With the buildup of provision continuing, driven primarily by collective provisioning, cash coverage stood at 118% for 2017 compared to 117% at the end of 2016. Overall coverage ratio including collateral at discounted value maintained at 157%.

Sukuk Investments

Sukuk investments increased to AED 24.0 billion in 2017 from AED 23.4 billion at the end of 2016. The portfolio, primarily built up of listed and UAE based issuers, consists of sovereigns and other top tier names, many of which are rated.

Customer Deposits

Early capacity creation, with liquidity mobilization continues to spur growth. Customer deposits for 2017 increased by 20% to AED 147.2 billion at the end of 2017, compared to AED 122.3 billion as at the end of 2016. Financing to deposit ratio of 91% as at the end of 2017 indicates one of the strongest liquidity positions in the sector.

Capital Adequacy

Capital adequacy ratio remained robust at 17.0% as of December 31, 2017, whilst T1 ratio stood at 16.5%; both ratios are well above regulatory requirement.

* Regulatory Capital Requirements CAR at 12% and Tier 1 at 8% under Basel 2.

Ratings:

- Aug 2017 – Moody’s upgraded DIBs long-term issuer ratings to ‘A3’ from Baa1; outlook ‘Stable’.

- Jul 2017 - Fitch has upgraded the bank’s standalone VR to ‘bb+’' from ‘bb’ citing robust and continuous improvement across the major key metrics including profitability and asset quality.

- The moves clearly point towards not just the financial strength of the existing franchise but the confidence the stakeholders have in its ability to sustain the performance in the foreseeable future.

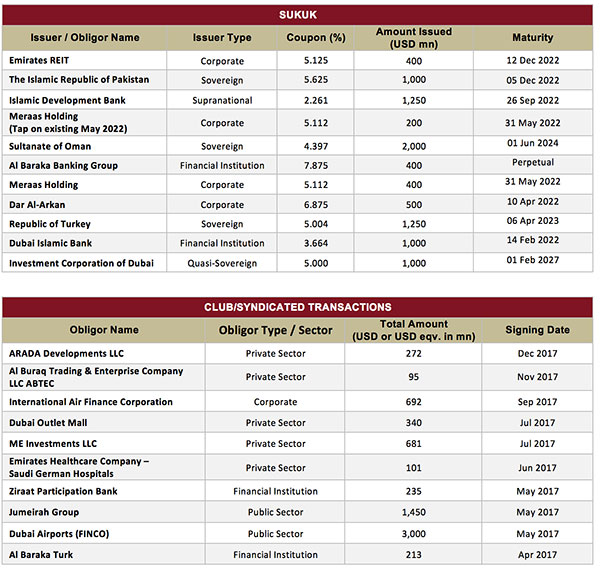

Year to Date key deals:

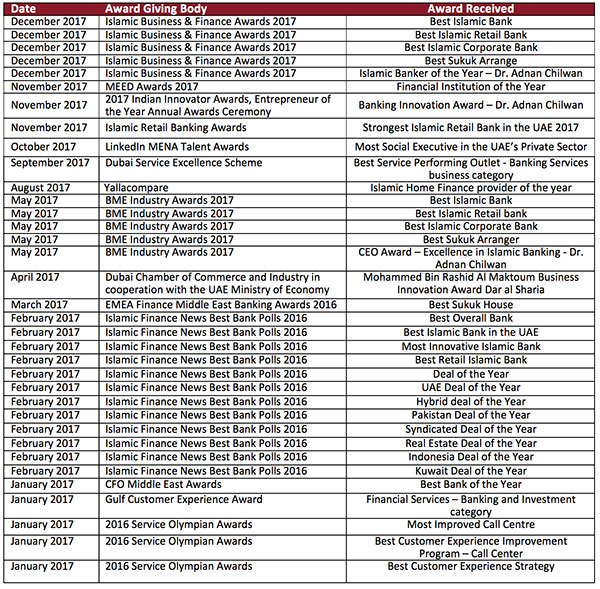

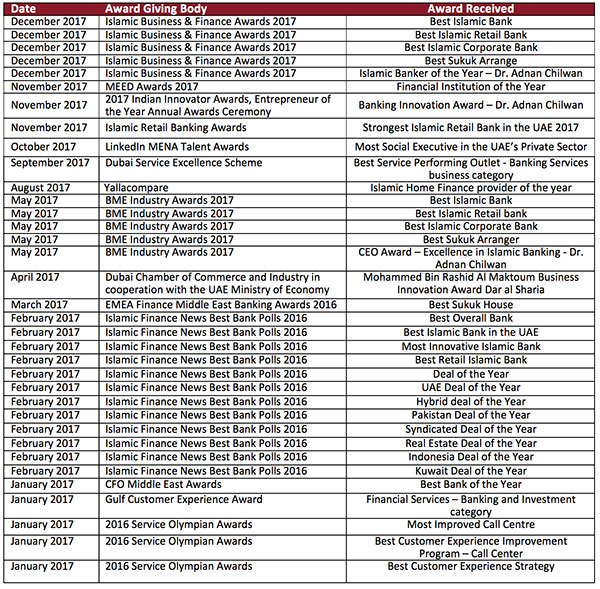

2017 Awards: