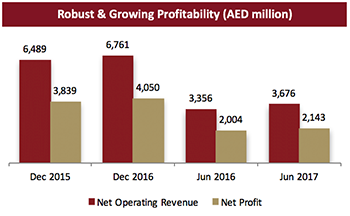

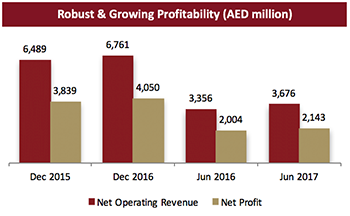

Robust profitability growth continues with net profit rising by 7% YoY to AED 2.143 billion

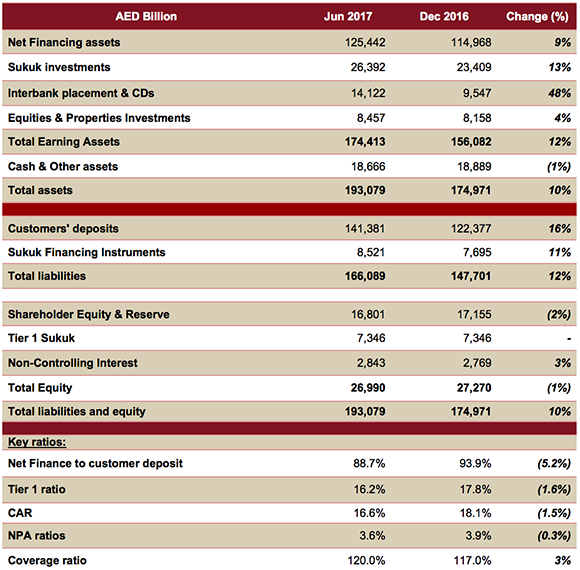

- Financing assets grew by 9% YoY to AED 125.4 billion

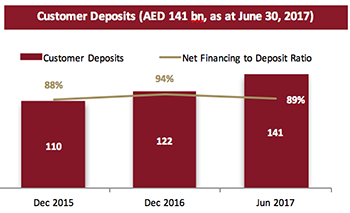

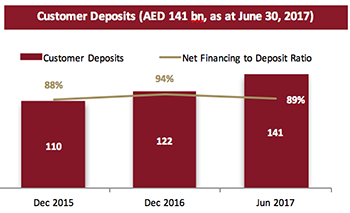

- Deposits increased by 16% YoY to AED 141.4 billion

Dubai Islamic Bank (DFM: DIB), the first Islamic bank in the world and the largest Islamic bank in the UAE by total assets, today announced its first half results for the period ended June 30, 2017.

H1 2017 Results Highlights:

Sustained profitability and growth on the back of managed expenses

- Group Net Profit increased to AED 2,143 million, up 7% compared with AED 2,004 million for the same period in 2016.

- Total income increased to AED 4,865 million, up 15% compared with AED 4,235 million for the same period in 2016.

- Net Operating Revenue increased to AED 3,676 million, up 10% compared with AED 3,356 million for the same period in 2016.

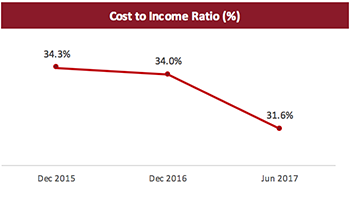

- Efficient and proactive cost management led to operating expenses remaining nearly flat at AED 1,162 million compared to AED 1,151 million for the same period in 2016.

- Gross cost of credit risk reduced to 55 bps compared to 75 bps for the same period in 2016.

- Cost to income ratio declined to 31.6% compared with 34.0% at the end of 2016.

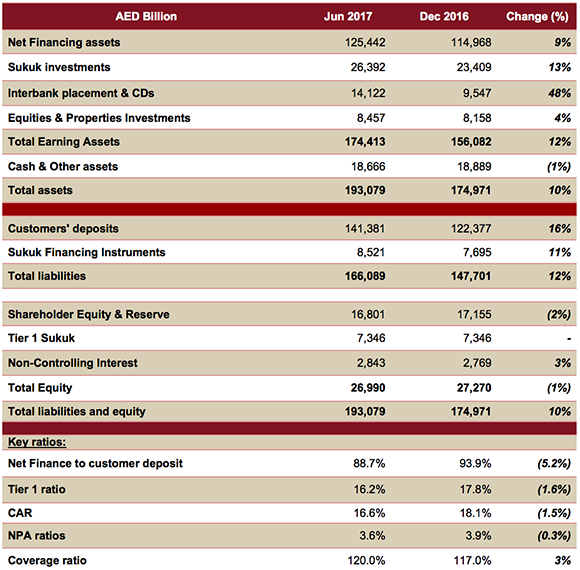

Asset growth remains robust across all core businesses

- Net financing assets rose to AED 125.4 billion up by 9%, compared to AED 114.9 billion at the end of 2016.

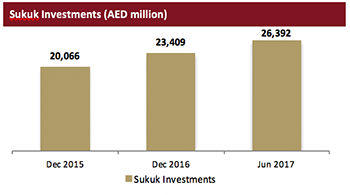

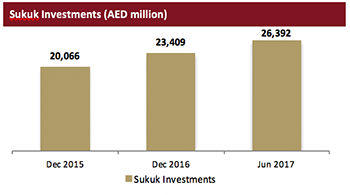

- Sukuk investments increased to AED 26.4 billion, a growth of 13%, compared to AED 23.4 billion at the end of 2016.

- Total Assets stood at AED 193.1 billion, an increase of 10%, compared to AED 174.9 billion at the end of 2016.

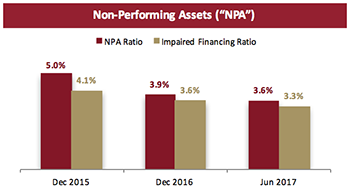

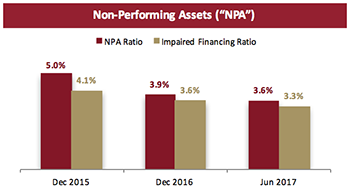

Asset quality remains resilient as a result of quality underwriting

- NPA ratio continues its downward trajectory improving to 3.6%, compared to 3.9% at the end of 2016.

- Provision coverage ratio improved to 120%, compared to 117% at the end of 2016.

- Overall coverage including collateral at discounted value now stands at 161%, compared to 158% at the end of 2016.

Strong liquidity continues to support asset growth

- Customer deposits stood at AED 141.4 billion compared to AED 122.3 billion at the end of 2016, up by 16%.

- CASA deposits increased by nearly 13% to AED 53.5 billion from AED 47.4 billion as at end of 2016 leading to a robust 38% constitution of the total deposit base.

- Financing to deposit ratio stood at 89%.

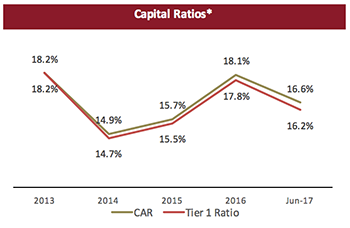

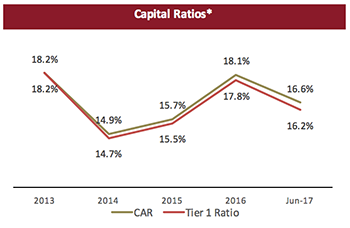

Robust Capitalization

- Capital adequacy ratio remained strong standing at 16.6%, as against 12% minimum required.

- Tier 1 CAR stood at 16.2% under Basel II, against minimum requirement of 8%.

Shareholders’ return remains robust – in line with guidance for the year

- Earnings per share stood at AED 0.37 at the end of first half 2017.

- Return on assets steady at 2.34% at the end of first half 2017.

- Return on equity stood at 18.4% at the end of first half 2017.

Management’s comments on the financial performance for period ended June 30, 2017

His Excellency Mohammed Ibrahim Al Shaibani, Director-General of His Highness The Ruler’s Court of Dubai and Chairman of Dubai Islamic Bank, said:

- The UAE retains its strong economic fundamentals following an upgrade in its credit outlook to “Stable” during the quarter from Moody’s. The non-oil economy, which is expected to grow above 3% this year, will be a key driver towards

the economic growth of the UAE in the coming years.

- DIB continues to show remarkable progress with total income now reaching nearly AED 5 billion, a significant increase of 15% compared to the same period last year.

- Our international expansion is on track as the bank officially received its license in April from the Central Bank of Kenya to start our operations. This paves the way for the bank’s aspirations in Africa and proliferation of Islamic finance

across Asia, Middle East and the East African Belt.

Dubai Islamic Bank Managing Director, Abdulla Al Hamli, said:

- The bank’s first half performance continues to remain at the top end of the market.

- The strong growth throughout the past few years has now squarely positioned DIB amongst the top 3 Islamic banks in the world.

- Over the first half of 2017, the bank also remained focused on serving the UAE community with particular support for healthcare initiatives in line with UAEs vision to be one of the happiest nations in the world

Dubai Islamic Bank Group Chief Executive Officer, Dr. Adnan Chilwan, said:

- DIB continues to demonstrate robust earnings on the back of strong and unyielding focus on key economic growth sectors in the markets and jurisdictions we operate. The 9% growth in financing assets supported by the 16% rise in customer deposits clearly

showcases the franchise’s incredible ability to continue to generate liquidity at will while simultaneously deploying the same in quality earning assets.

- Despite the strong financing growth, capitalization remains solid with robust CET 1 levels, thanks to the detailed and meticulous capital planning put in place when rolling out our strategy and we remain comfortable even as Basel III is implemented

in the near future.

- With liquidity pressure easing this year along with hikes in Fed rates, we expect relative improvement in margins, as a significant portion of our financing book will have a favorable impact due to its variable pricing nature.

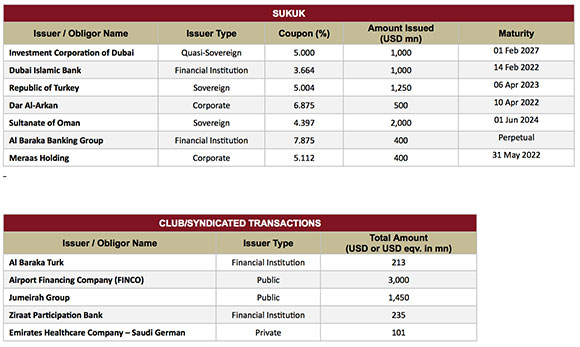

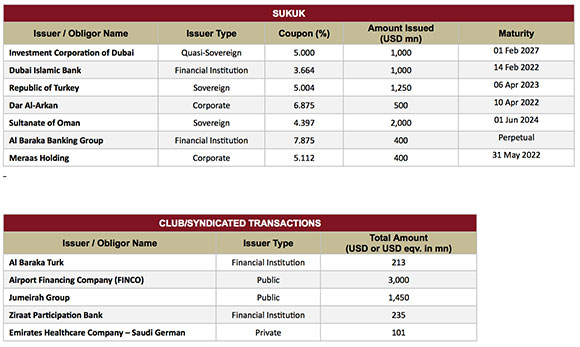

- DIB continues to be a leading player on the Bloomberg League Tables with the last quarter witnessing nearly AED 5 bln worth of syndicated deals.

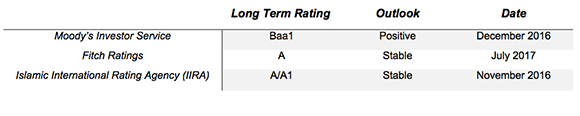

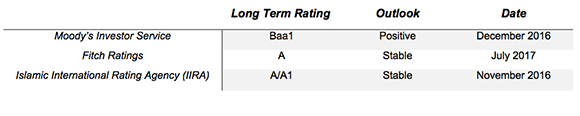

- The significantly enhanced financial position, robust profitability and consistently improving asset quality has led to an upgrade in DIB’s standalone Viability Rating to “bb+” by Fitch. This, along with Moody’s move to change

the outlook from ”Stable” to “Positive” earlier is a testament to constantly improving risk profile of the bank and the confidence of the market in DIB’s credit standing.

Financial Review

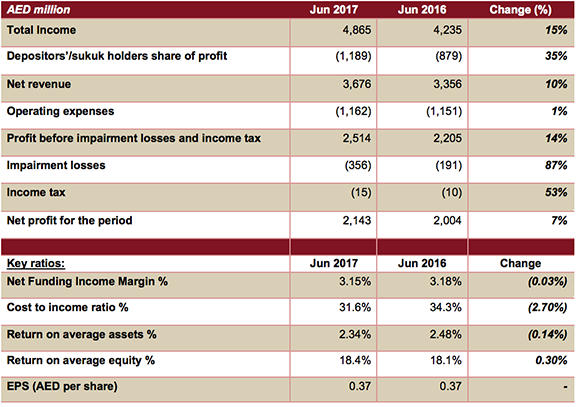

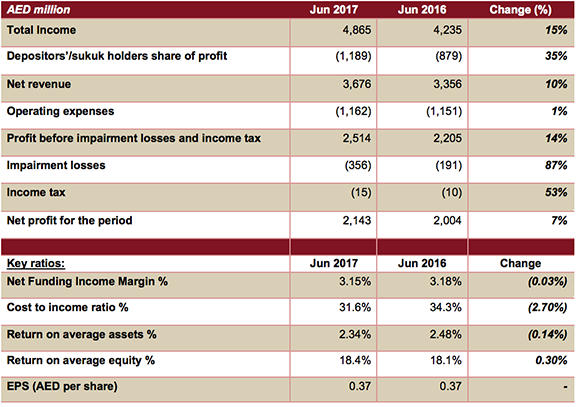

Income Statement highlights:

Total Income

Profitability remained strong with total income for the period ended June 30, 2017 increasing to AED 4,865 million from AED 4,235 million for the same period in 2016. The 15% rise is driven primarily by sustained growth in all core businesses with income

from Islamic financing and investing transactions increasing by 18% to AED 3,713 million compared to AED 3,157 million for the same period in 2016.

Net revenue

Net revenue for the period ended June 30, 2017 amounted to AED 3,676 million, an increase of 10% compared with AED 3,356 million in the same period of 2016. The increase is attributed to strong growth in the financing book as the bank continues to enhance

its share of wallet across all key economic sectors.

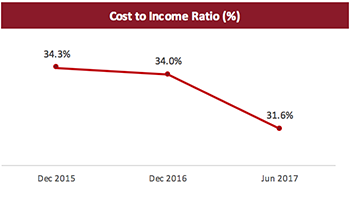

Operating expenses

Operating expenses were held nearly flat to AED 1,162 million for the period ended June 30, 2017 compared to AED 1,151 million in the same period in 2016. Simultaneously, efficient cost management led to cost to income ratio improving to 31.6% compared

to 34.0% at the end of 2016.

Profit for the period

Net profit for the period ended June 30, 2017, rose to AED 2,143 million from AED 2,004 million in the same period in 2016, an increase by 7% emanating from continuous robust core business growth and effective and efficient cost management.

Statement of financial position highlights:

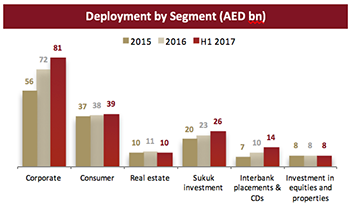

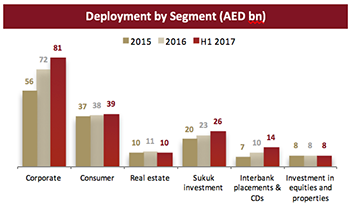

Financing portfolio

Net financing assets grew to AED 125.4 billion for the period ended June 30, 2017 from AED 114.9 billion as of end of 2016, an increase of 9% driven primarily by the core growth across wholesale and retail. Corporate banking financing assets grew by 13%

to AED 81 billion whilst consumer business grew by 3% to AED 39 billion. Commercial real estate concentration remains low at around 18% and in line with targeted guidance numbers.

Asset Quality

Non-performing assets have shown a consistent decline with NPA ratio improving to 3.6% for the period ended June 30, 2017, compared with 3.9% at the end of 2016. Impaired financing ratio stood at 3.3% for the period ended June 30, 2017 from 3.6% at the

end of 2016. With continued buildup of provisions, cash coverage stood at 120% for the period ended June 30, 2017 compared with 117% at the end of 2016. Overall coverage ratio including collateral at discounted value stood at 161% compared to 158%

at the end of 2016.

Sukuk Investments

Sukuk investments increased by 13% to AED 26.4 billion for the period ended June 30, 2017 from AED 23.4 billion at the end of 2016. The portfolio, mainly in UAE, consists of sovereigns and other top tier names many of which are rated.

Customer Deposits

Customer deposits for the period ended June 30, 2017 increased by 16% to AED 141 billion from AED 122 billion as at end of 2016. CASA component stood at AED 53.5 billion as of June 30, 2017 compared with AED 47.4 billion as at end of 2016 showing consistent

rise in low cost deposits. Financing to deposit ratio of 89% as of June 30, 2017 indicates one of the strongest liquidity position in the sector.

Capital Adequacy

Capital adequacy ratio remained robust at 16.6% as of June 30, 2017, whilst T1 ratio stood at 16.2%; both ratios are well above regulatory requirement.

* Regulatory Capital Requirements CAR at 12% and Tier 1 at 8%

Ratings:

-

Fitch has upgraded the bank’s standalone VR to ‘bb+’' from ‘bb’ citing robust and continuous improvement across the major key metrics including profitability and asset quality.

Key business highlights for the 2nd quarter of 2017:

- In May 2017, Dubai Islamic Bank PJSC has been given the license by the Central Bank of Kenya (CBK) to operate its subsidiary, DIB Kenya Ltd, in the country. This will serve as a launch pad for the bank to expand its reach into East Africa.

- DIB launched the “DIB Express Transfer” an instant remittance solution that guarantees that funds can be wired to any ICICI bank account in India within 60 seconds and any other bank in India within 1 hour.

- DIB hosted the 2nd UAE Sharia Departments Forum in Dubai. The event which was established a year earlier, serves as a platform for Sharia departments of Islamic financial institutions to conceptualize, evolve and drive the development of Sharia compliance

in the UAE.

- Amongst the leader in the Bloomberg League Tables (EMEA Islamic Financing Bookrunner for H1 2017). Other 1st half 2017 key deals:

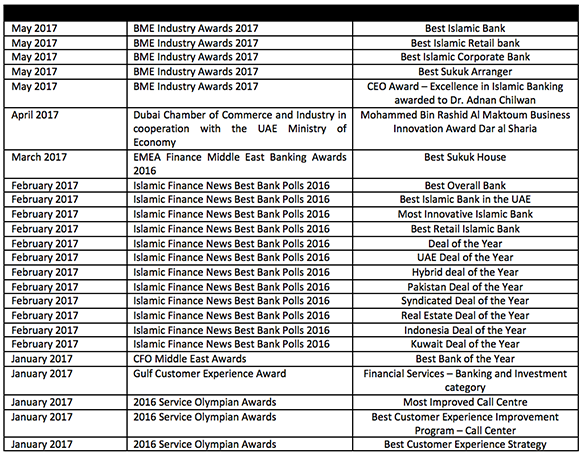

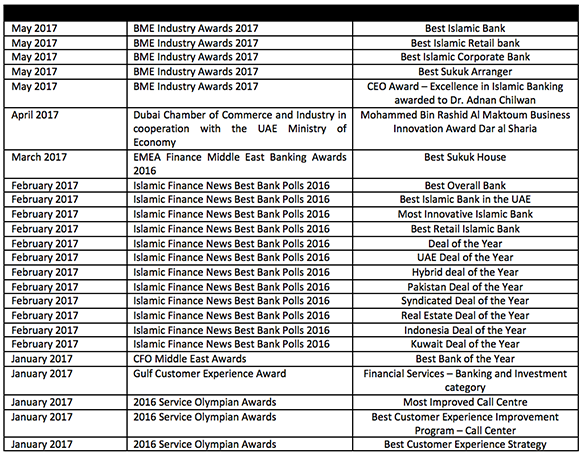

1st Half 2017 Awards