Net profit up by 6% to AED 4.05 billion

Dubai Islamic Bank (DFM: DIB), the first Islamic bank in the world and the largest Islamic bank in the UAE by total assets, today announced its results for the year ended December 31, 2016.

Full Year 2016 Results Highlights:

Sustained performance amidst a year of market volatilities

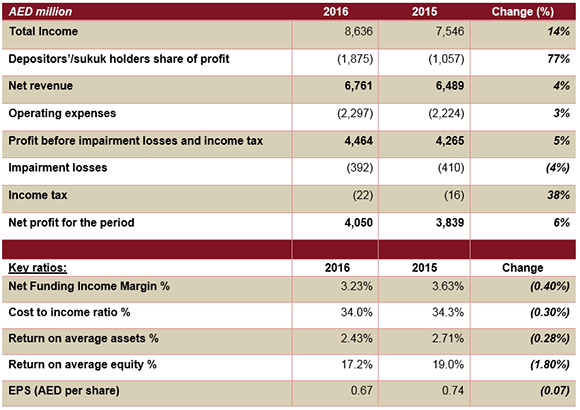

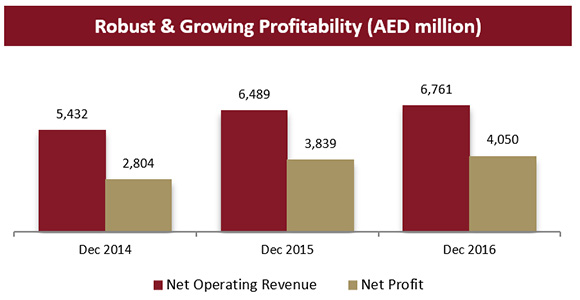

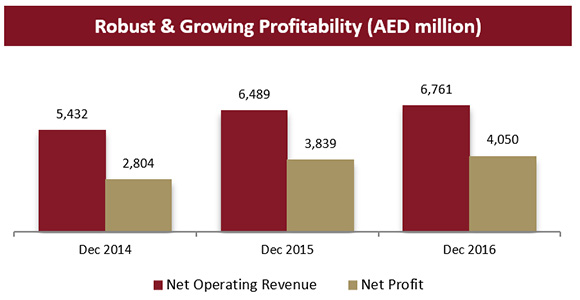

- Group Net Profit increased to AED 4,050 million, up 6% compared with AED 3,839 million in 2015.

- Total income increased to AED 8,636 million, up 14% compared with AED 7,546 million in 2015.

- Net Operating Revenue increased to AED 6,761 million, up 4% compared with AED 6,489 million in 2015.

- Impairment losses declined to AED 392 million compared with AED 410 million in 2015.

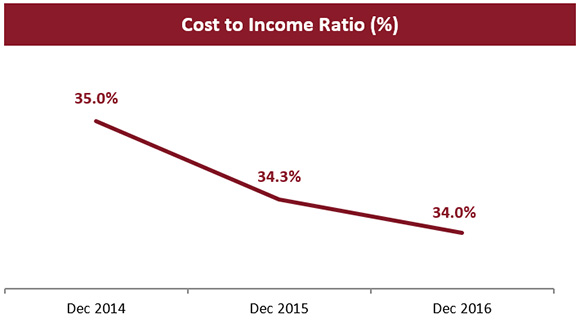

- Cost to income ratio remained stable at 34.0% compared with 34.3% in 2015.

- Net interest margins stood at 3.23% compared with 3.63% in 2015.

- Net fees and commission increased by 10% to AED 1,425 million from AED 1,295 million in 2015.

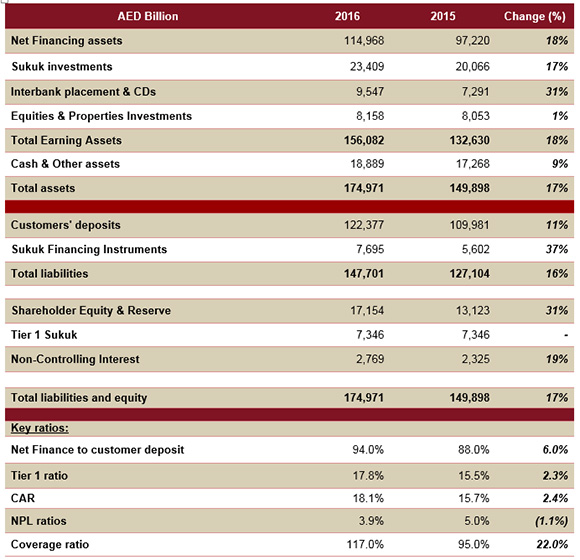

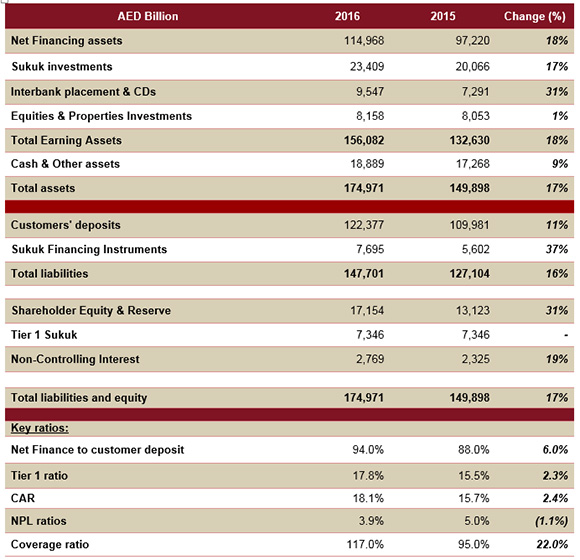

Asset growth remains robust

- Net financing assets rose to AED 115.0 billion up by 18%, compared to AED 97.2 billion in 2015.

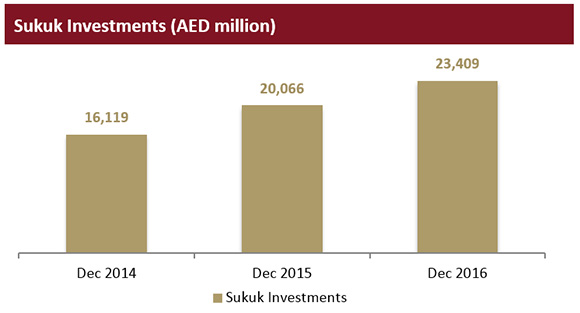

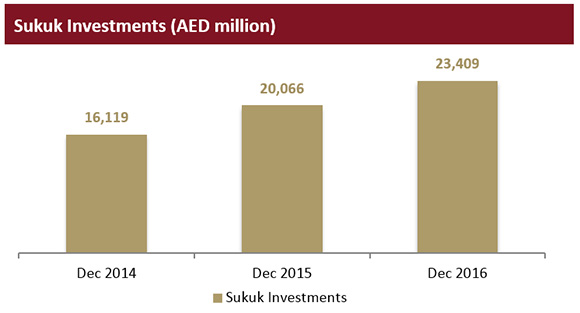

- Sukuk investments increased to AED 23.4 billion, a growth of 17%, compared to AED 20.1 billion in 2015.

- Total Assets stood at AED 175.0 billion, an increase of 17%, compared to AED 149.9 billion in 2015.

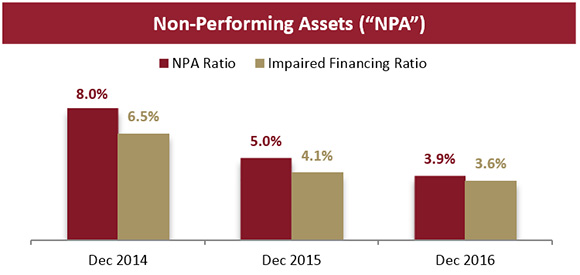

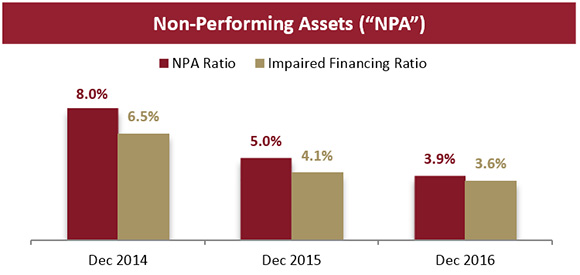

Resilient Asset Quality

- NPL ratio consistently improving to 3.9%, compared to 5.0% in 2015.

- Provision coverage ratio improved to 117%, compared to 95% in 2015. Overall coverage including collateral at discounted value now stands at 158%, compared to 147% in 2015.

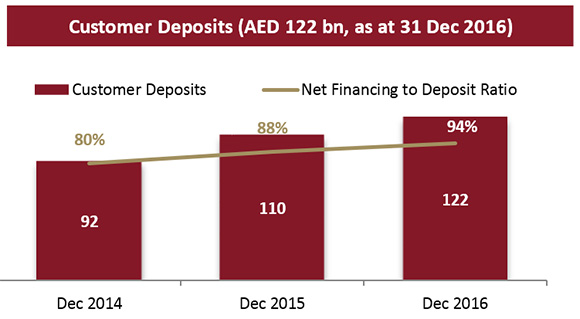

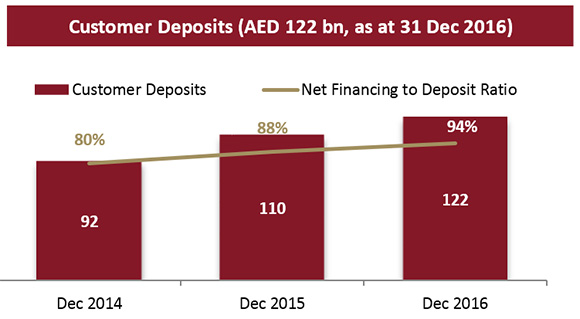

Steady growth in customer deposits

- Customer deposits stood at AED 122.4 billion compared to AED 110.0 billion in 2015, up by 11%.

- CASA constituted 39% of total deposit base compared to 41% in 2015.

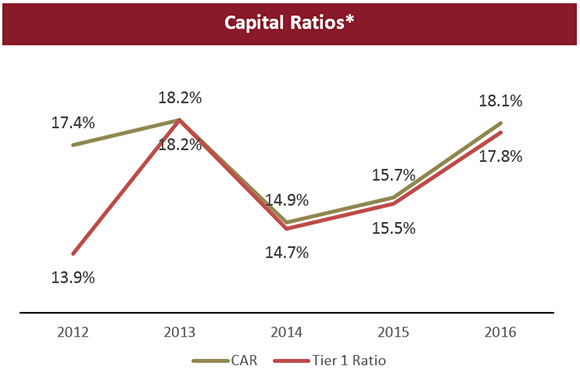

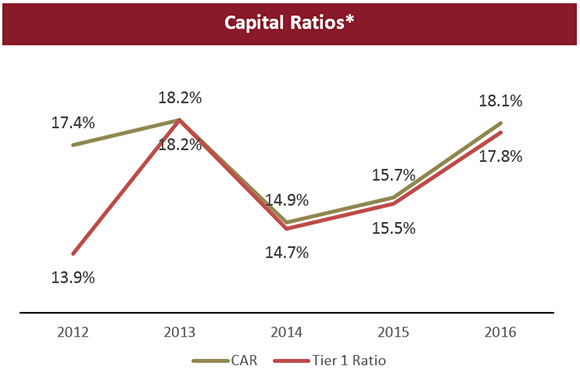

Improved capital position post rights issue

- Capital adequacy ratio remained strong standing at 18.1% vs 15.7% in 2015.

- Tier 1 CAR stood at 17.8% vs 15.5% in 2015.

- Financing to deposit ratio stood at 94% depicting a stable liquidity position.

Shareholders’ return remains robust

- Earnings per share stood at AED 0.67 in 2016 vs AED 0.74 in 2015, a marginal impact despite dilution due to rights issuance.

- Return on assets steady at 2.43% in 2016 vs 2.71% in 2015 standing at the higher end of the market.

- Return on equity stood at 17.2% in 2016 vs 19.0% in 2015, higher end of the market despite dilution due to rights issuance.

- DIB Board of Directors recommends the distribution of a cash dividend of 45%, subject to AGM approval.

Management’s comments on the financial performance for the full year 2016:

His Excellency Mohammed Ibrahim Al Shaibani, Director-General of His Highness The Ruler’s Court of Dubai and Chairman of Dubai Islamic Bank, said:

- Despite global economic and political volatility, Dubai Islamic Bank achieved a number of important milestones and further strengthened its position as a market leader in 2016.

- DIB continues to expand its business in line with the UAE’s impressive growth trajectory and remains committed to supporting the Government’s agenda to become the Islamic finance capital of the world.

- Whilst financial performance and growth continue to drive the strategy, the board and management also remain focused on delivering the highest levels of corporate governance and setting the standard in compliance.

- The board and the management are committed to our objectives, both around the organization’s future and the future and progression of Islamic finance as it continues to grow and prosper as a viable and critical part of global economics.

Dubai Islamic Bank Managing Director, Abdulla Al Hamli, said:

- In line with strong financial performance year on year, the Bank has delivered yet another set of robust financial results in 2016.

- Whilst financial performance remains strong, we take our responsibility to the society very seriously as well.

- Corporate social responsibility remains an important component of DIB’s mandate and we will continue to actively play our part in contributing to important humanitarian causes in the UAE and across the region.

- Our support of the Government’s Emiratization initiatives remains one of our core areas of focus as we train and develop our employees to drive and sustain the long-term development of DIB.

Dubai Islamic Bank Group Chief Executive Officer, Dr. Adnan Chilwan, said:

- The last few years have been an incredible journey for all of us at DIB.

- Given the global economic backdrop, what we have achieved is truly remarkable.

- Over the past decade, our aim was to establish a franchise that would last, that would have the ability to successfully navigate and stay true to its course in even the most unfavorable and turbulent times.

- With oil price volatility and ensuing tighter liquidity along with global economic and political uncertainty, of course there were challenges along the way.

- Despite that, the bank has seen a transformation into a player that offers real and substantial capabilities to its customers, shareholders and the market in general.

- Our recent financial performance has put us at the top end of the market year on year.

- In the last three years, our profitability has grown by nearly two and a half times, our financing portfolio has more than doubled and our balance sheet and underlying liquidity has gone up by over 50%.

- The portfolio quality has simultaneously improved to extremely robust levels with NPLs down from double digits to 3.9%, a testament to the strong risk management practices and systems put in place.

- Clearly, the time and effort extended to build this business over the last few years has rewarded us well, as today, we possess the operational strength and a platform that allows us to create growth opportunities

- With solid capitalization, boosted by the successful rights issue in 2016, we are confident of continuing on successfully implementing our growth plans in the coming years.

Financial Review

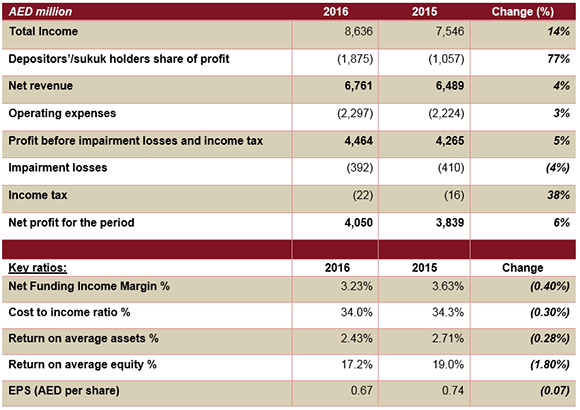

Income Statement highlights:

Total Income

Profitability remained strong despite challenging economic environment. Total income for the year 2016 increased to AED 8,636 million from AED 7,546 million in 2015, an increase of 14% driven primarily by sustained growth in core businesses. Income from

Islamic financing and investing transactions increased by 18% to AED 6,521 million in 2016 from AED 5,520 million in 2015. Fees and commissions have increased by 10% to AED 1,425 million compared to AED 1,295 million in 2015.

Net revenue

Net revenue for the year 2016 amounted to AED 6,761 million, an increase of 4% compared with AED 6,489 million in 2015. The increase is attributed to strong growth in financing and investing transactions as well as commission and fees.

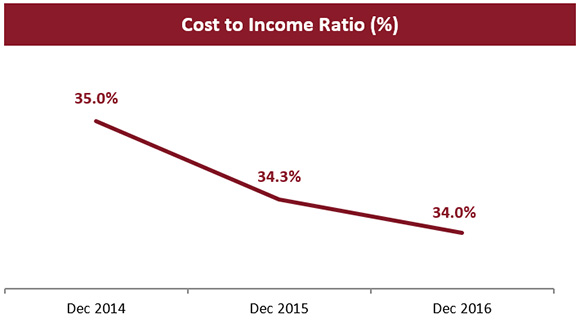

Operating expenses

Operating expenses were marginally up by 3.0% to AED 2,297 million in 2016 from AED 2,224 million in 2015. However, cost to income ratio witnessed a drop standing at 34.0% compared to 34.3% in 2015, in line with guidance for the year.

Impairment losses

With a steady improvement in asset quality, NPL ratio declined from 5.0% in 2015 to 3.9% in 2016 whilst impairment losses also saw a reduction from AED 410 million in 2015 to AED 392 million in 2016.

Profit for the period

Net profit for the period ended September 30, 2016, rose to AED 3,011 million from AED 2,801 million in the same period in 2015, an increase by 7% depicting robust profitability growth despite slow economic environment.

Statement of financial position highlights:

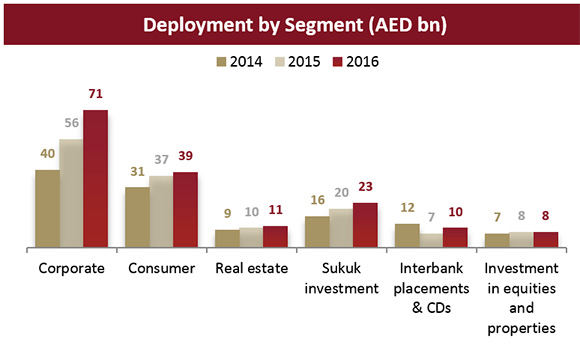

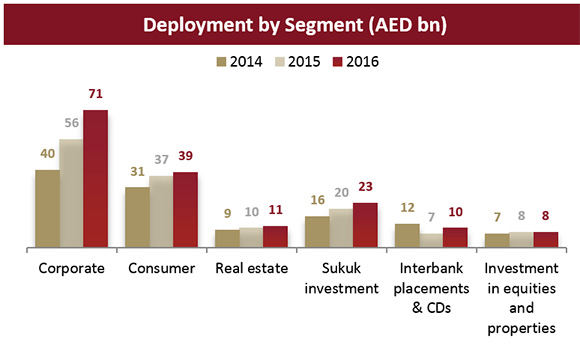

Financing portfolio

Net financing assets grew to AED 115.0 billion in 2016 from AED 97.2 billion in 2015, an increase of 18% as the bank continued its penetration in various targeted sectors particularly on the wholesale side of the business. Corporate banking financing

assets grew at 24% to AED 81 billion whilst consumer business grew by 7% to AED 39 billion.

Asset Quality

Non-performing assets have shown a consistent decline with NPL ratio improving to 3.9% for the year ended 2016, compared with 5.0% in 2015. Impaired financing ratio also improved to 3.6% in 2016 from 4.1% in 2015. The improving NPLs and impaired ratio

is primarily driven by recoveries in legacy portfolio. With continued buildup of provisions, cash coverage improved to 117% in 2016 compared with 95% in 2015. Overall coverage ratio including collateral at discounted value stood at 158% in 2016 compared

to 147% in 2015.

Sukuk Investments

Sukuk investments increased by 17% to AED 23.4 billion in 2016 from AED 20.1 billion in 2015. The primarily dollar denominated portfolio consists of sovereigns and other top tier names many of which are rated.

Customer Deposits

Customer deposits increased by 11% to AED 122 billion in 2016 from AED 110 billion in 2015. CASA component stood at AED 47.4 billion in 2016 compared with AED 44.6 billion in 2015. Investment deposits grew by 15% in 2016 to AED 75.0 billion from AED 65.4

billion in 2015. Financing to deposit ratio is at 94% in 2016 which denotes that the bank remains amongst the most liquid players in the market despite strong financing growth and challenging liquidity environment.

Capital and capital adequacy

Strong profitability along with the recent successful rights issue has led to overall CAR growing to 18.1%. This robust level of capitalization will be a major factor in supporting the future growth agenda of the bank.

* Regulatory Capital Requirements CAR at 12% and Tier 1 at 8%

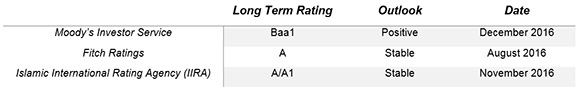

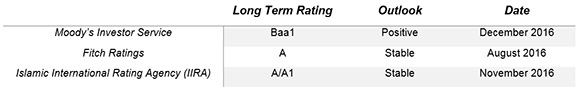

Ratings:

Key business highlights for the 4th quarter of 2016:

- In December 2016, credit rating agency Moody’s re-affirmed DIB’s strong issuer rating to be at ‘Baa1’ reflecting the bank’s established retail franchise within the UAE with solid profitability and capitalization metrics.

The outlook has now been upgraded from ‘Stable’ into ‘Positive’ driven by the improvements in asset quality and loan loss coverage levels. The positive outlook also considers the ongoing improvements in the bank’s

risk management and control environment.

- In November, DIB launched cobranded cards with flydubai. This exclusive partnership allows customers to earn OPEN rewards from flydubai on their card usage and redeem the points for flydubai services.

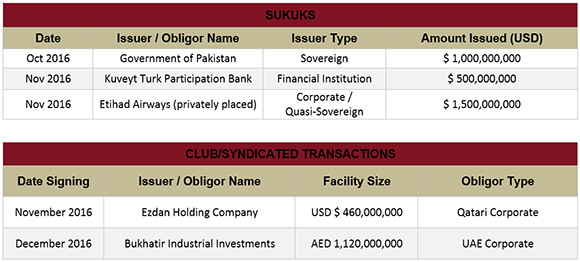

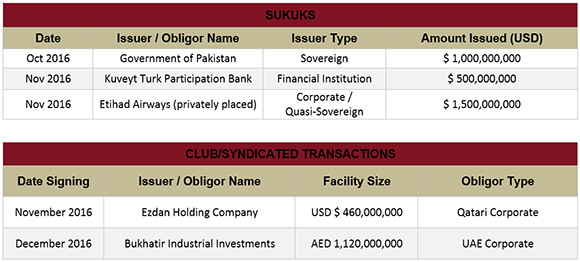

- Some key deals / transactions for the 3rd quarter:

Outlook:

Moving towards the year 2017, the bank has once again outlined a medium term growth strategy amidst the shifting macro-economic landscape. With oil prices starting to stabilize and emerging markets now looking into sustained economic and business growth,

DIB is set to pursue a business expansion agenda primarily through protecting and growing its core businesses. Focus will remain on maximizing business opportunities within the Consumer Banking, continuous enhancement of wallet share in Corporate

Banking, managing and rationalizing its international presence and identifying synergies within the organization to unlock value.

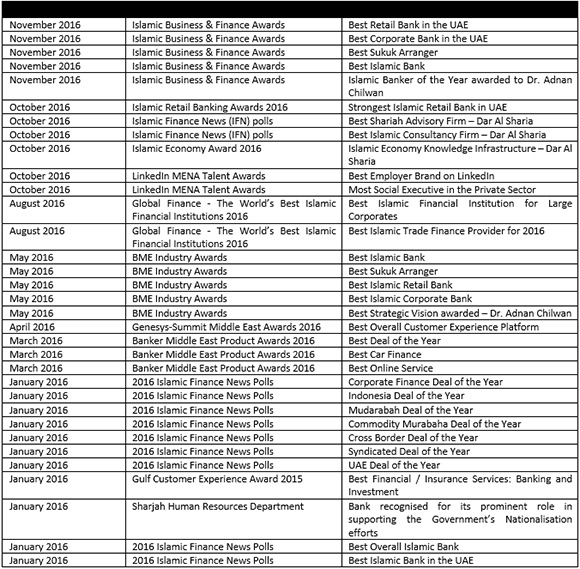

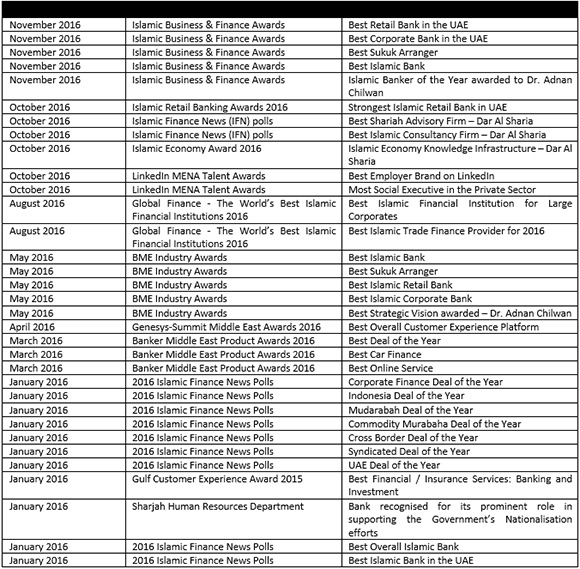

Year to date 2016 Awards: