Dubai Islamic Bank Group Nine Months Financial Results

Net profit up by 36% to AED 2,801 million

Dubai Islamic Bank (DFM: DIB), the first Islamic bank in the world and the largest Islamic bank in the UAE by total assets, today announced its results for the period ended September 30, 2015.

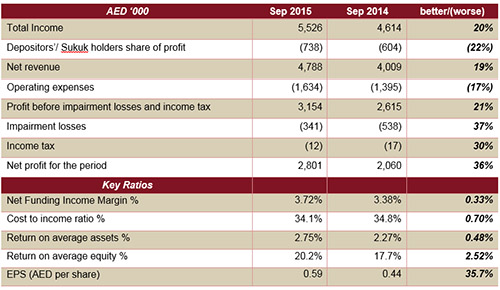

Year to Date Results Highlights:

Robust Profitability Growth:

- Group net profit increased to AED 2,801 million, up 36% compared with AED 2,060 million for the same period of 2014.

- Total income increased to AED 5,526 million, up 20% compared with AED 4,614 million for the same period of 2014.

- Net revenue increased to AED 4,788 million, up 19% compared with AED 4,009 million for the same period of 2014.

- Impairment losses declined to AED 341 million compared with AED 538 million for the same period of 2014.

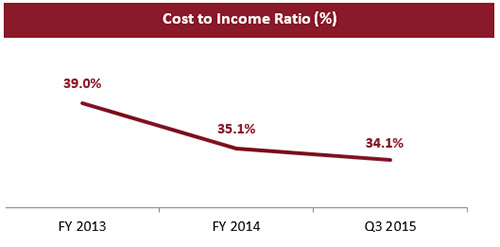

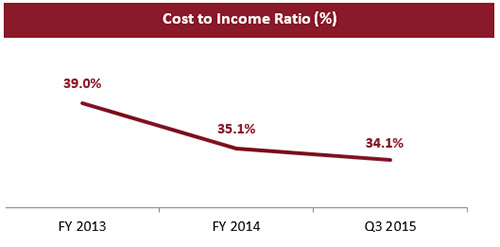

- Cost to income ratio improved to 34.1% from 34.8% for the same period of 2014.

- NIM improved to 3.72% from 3.38% for the same period of 2014.

- Net fees and commission increased by 25% to AED 975 million from AED 780 million in 30 September 2014.

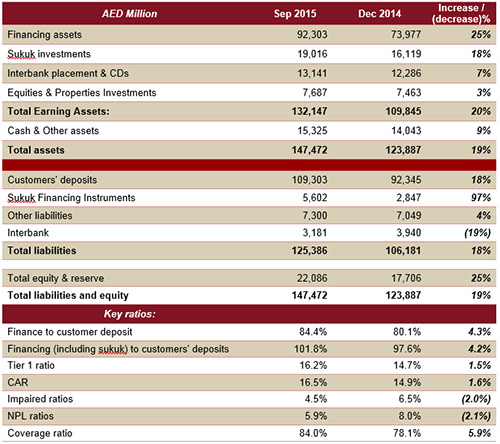

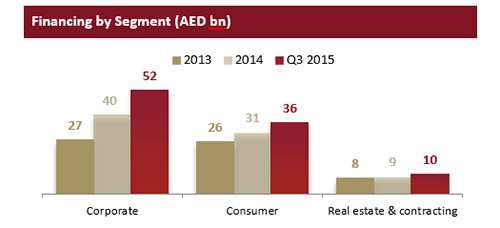

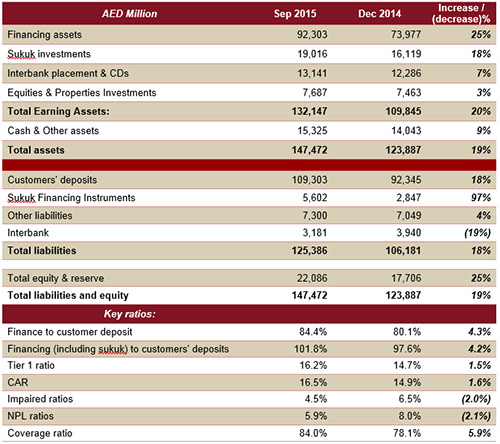

Strong growth in earning assets across all business segments

- Net financing assets at AED 92.3 billion, up by 25% compared to AED 74.0 billion at end of 2014.

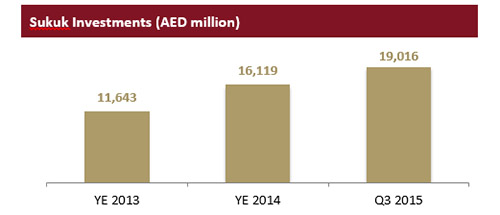

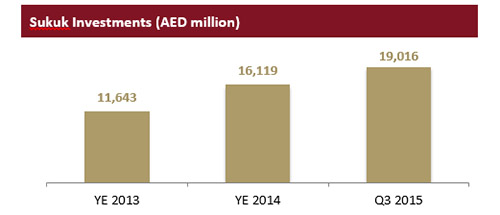

- Sukuk investments at AED 19.0 billion, an increase of 18%, compared to AED 16.1 billion at end of 2014.

- Total assets at AED 147.5 billion, an increase of 19%, compared to AED 123.9 billion at end of 2014.

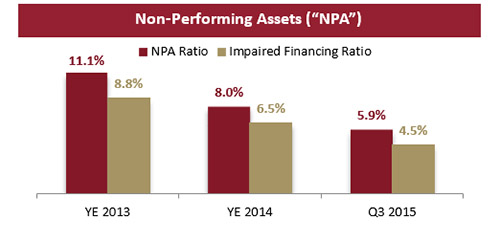

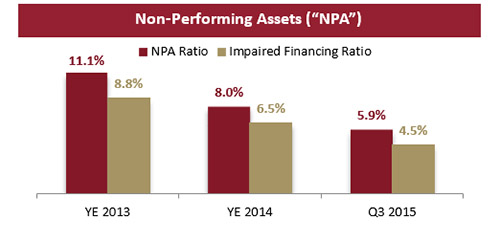

Continuous improvements in asset quality

- NPLs on a consistent decline with NPL ratio improving to 5.9%, compared to 8.0% at end of 2014.

- Impaired financing ratio also improved at 4.5%, from 6.5% at end of 2014.

- Provision coverage ratio improved to 84%, compared to 78% at end of 2014.

- Cost of risk decreased from 0.71% in 2014 to 0.47% for the nine months ending September 30, 2015

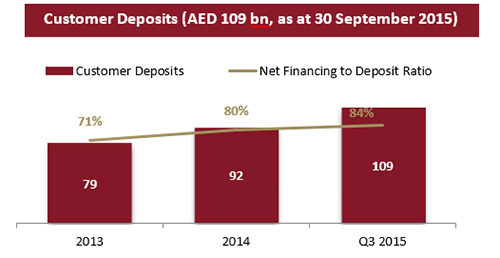

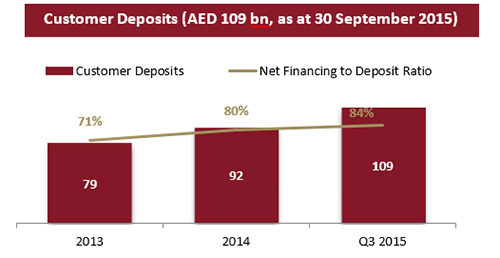

Increasing customer’s deposits

- Customer deposits reached AED 109 billion compared to AED 92 billion at end of 2014, up by 18%.

- Low cost deposits continue to remain significant with a large and stable CASA book at 40% of total deposits.

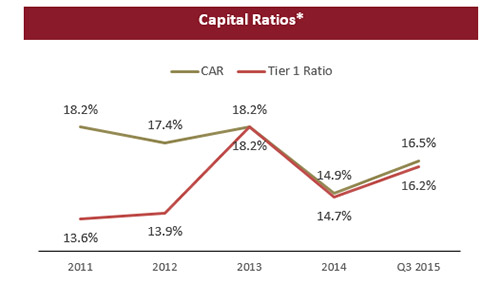

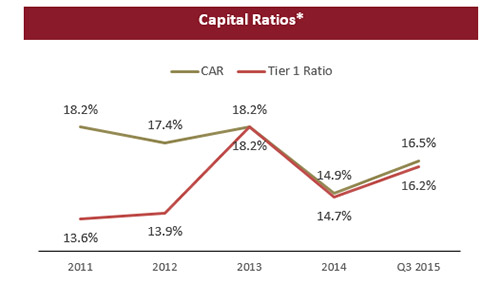

Strong capitalization and liquidity position

- Capital adequacy ratio at 16.5% vs 14.9% at end of 2014.

- Financing to deposit ratio stood at 84%, one of the strongest in the market.

- Liquid assets to total assets ratio maintained at 16% as of September 30, 2015.

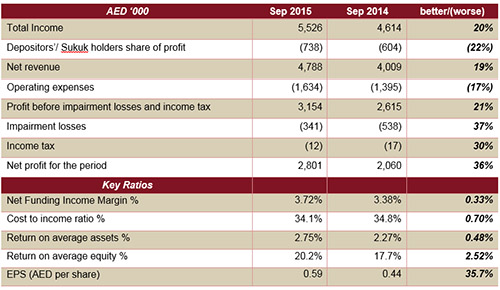

Enhancing value for shareholders

- Earnings per share increased to AED 0.59 in Q3 2015 from AED 0.44 in Q3 2014.

- Return on assets increased by 48 bps to 2.75% in Q3 2015 from 2.27% in Q3 2014.

- Return on equity increased by 252 bps to 20.2% in Q3 2015 from 17.7% in Q3 2014.

Management’s comments on the financial performance of the financial period:

His Excellency Mohammed Ibrahim Al Shaibani, Director-General of His Highness The Ruler’s Court of Dubai and Chairman of Dubai Islamic Bank, said:

- Once again, DIB has a declared a robust and solid set of results as the bank ventures into new economic sectors that have strong growth potential and are aligned to Dubai and the UAE’s growth agenda.

- The bank’s commitment towards the leadership’s vision of making Dubai the global capital for Islamic economy has been relentless. The bank has demonstrated clearly that it continues to support the growth of Islamic Finance as well as the other critical pillars of the Islamic economy.

Dubai Islamic Bank Managing Director, Abdulla Al Hamli, said:

- Over the course of 2015, we have further enhanced our products and offerings which now caters to a broader domestic market.

- Our year to date performance and strong results are driven by the strategy we had embarked in early 2014 and I am confident the bank will continue to deliver the greatest value to its shareholders.

Dubai Islamic Bank, Group Chief Executive Officer, Dr. Adnan Chilwan, said:

- The strong year-to-date business performance of DIB was helped by solid revenue growth across all core businesses with total income up by 20% to AED 5.5bn and net profit by 36% to AED 2.8bn.

- Our focus on new to bank sectors and diversification continues to yield strong dividends with growth across all product suites and sectors within our core businesses.

- A test to the robustness of our growth agenda supported by solid risk management practices, both asset quality improvement and margin expansion continue on the positive trend as the bank’s share of wallet grows across all its core businesses.

- Despite the strong growth, capitalization remains robust with ample liquidity, indicating the strength of the franchise to generate funding and deposits in this highly competitive environment.

- The increasing coverage for the bank in the local and international financial markets is a testament to the growing value of our franchise and the interest of local, regional and international investors.

Financial Review

Income Statement highlights

Total Income

Total income for the period ending September 30, 2015 stood at AED 5,526 million from AED 4,614 million for the same period in 2014, an increase of 20%. The increase is due to consistent growth in core businesses across all segments. Deliberate focus on customer and multi-sector penetration has led to both consumer and corporate financing registering significant increase resulting in a rise in funded income by 25% over three quarters of 2014. Associated fees and commissions also registered an increase of 25% growing to AED 975 million compared to AED 780 million for the same period of 2014.

Net revenue

- Net revenue for the period ending September 30, 2015 amounted to AED 4,788 million, an increase of 19% compared with AED 4,009 million in the same period of 2014 primarily on the back of strong growth in core business.

- NIMs for the period ending September 30, 2015 stood at 3.72%, up by 0.33% from 3.38% for the same period of last year.

Operating expenses

- Operating expenses increased by 17% to AED 1,634 million for the period ending September 30, 2015, from AED 1,395 million in the same period in 2014. The increase is largely attributed to variable operating cost in line with increase in business volumes, including direct sales and marketing costs primarily related to staff.

- Despite cost growth, the cost to income ratio improved to 34.1% on account of higher revenue leading to widening of cost-income jaws.

Impairment losses

Net impairment losses declined to AED 341 million for the period ending September 30, 2015 compared with AED 538 million for the same period in 2014, a clear sign of consistent improvement in asset quality.

Profit for the period

With notable increase in net revenue and improved asset quality, the latter leading to declining impairment charges, net profit for the for the period ending September 30, 2015, rose to AED 2,801 million from AED 2,060 million for the same period in 2014, an increase by 36%.

Statement of financial position highlights:

Financing portfolio

- Net financing assets grew to AED 92.3 billion for the period ending September 30, 2015 from AED 73.9 billion as of end of 2014, an increase of 25%.

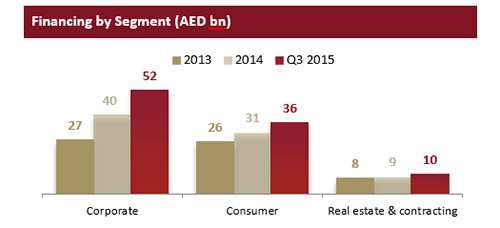

- Consumer banking gross financing assets increased by 16% to AED 35.5 billion for the period ended September 30, 2015, compared with AED 30.6 billion at the end of 2014. The business has been leveraging its asset products to its 1.5 million retail customer base with growth seen across the entire consumer product suite.

- Corporate banking saw another strong quarter growing by 31% to AED 52.0 billion for the period ended September 30, 2015, compared with AED 39.8 billion at 2014 year end. The growth is mainly driven by private sector largely and public sector to some extent through a strong emphasis on diversification of portfolio and quality of credit.

Sukuk Investments

Sukuk investments increased by 18% for the period ending September 30, 2015 to AED 19.0 billion from AED 16.1 billion at end of 2014, primarily consisting of mostly sovereigns, the portfolio not only provides a healthy yield but can also help generate liquidity if required.

Asset Quality

- Non-performing assets have shown a consistent decline with NPL ratio improving to 5.9%, compared with 8.0% at the end of 2014.

- Impaired financing ratio also improved to 4.5% for the period ended September 30, 2015 from 6.5% at the end of 2014, primarily because of the reduction in absolute NPLs due to settlements and recoveries.

- Cash coverage ratio improved to 84% compared with 78% at end of 2014.

- Overall coverage ratio including collaterals at discounted values, maintained at 134%.

Customer Deposits

- Customer deposits for the period ended September 30, 2015 increased by 18% to AED 109.3 billion from AED 92.3 billion as of end of 2014.

- CASA continues to be a significant portion comprising 40% of total deposits, primary reason for the low cost of funds that the bank enjoys.

Capital and capital adequacy

Capital adequacy ratio stands at 16.5% as of September 30, 2015, and T1 ratio at 16.2%, depicting strong capitalization with both ratios being well above regulatory level.

* Regulatory Capital Requirements CAR at 12% and Tier 1 at 8%

Key highlights for the 3rd quarter of 2015:

- In August 2015, Fitch Ratings has affirmed Dubai Islamic Bank’s (DIB) long and short term issuer default ratings (IDR). The long term IDR was affirmed at ‘A’ with a “stable” outlook. The rating continues to be underpinned by the bank's strong domestic franchise, comfortable liquidity and funding, predominantly due to its large and stable deposit base and high proportion of liquid assets.

- DIB continuous to actively meet with investors and analysts throughout the period. Key investor roadshows and meetings for the 3rd quarter were held in UK and the GCC. The successful meetings with investors has led to increasing analysts coverage for the bank.

- The bank continuous its investments in talented resources and human capital through various programs launched during the 3rd quarter period.

- High Potential Employee Program under the umbrella of Masaar – the bank’s talent management initiative providing staff career development opportunities and developing a sustainable pipeline of leaders.

- “Iktaseb” Annual summer training program. Inaugurated in August 2015 designed to train a new generation of banking professionals and support the country’s Emiratisation initiative by contributing to the development of the local economy.

- DIB was a lead sponsor / strategic partner in the recent 2nd Global Islamic Economic Summit (GIES 2015) which was attended by international businesses and government officials. The bank continuous its relentless support to the growth of the Islamic economy in line with the government’s vision through various initiatives and programs catered towards the sector.

- New products / services for the period:

- Extension of the Foreign Exchange service at DIB’s Emirates Headquarter branch and Dubai Mall Branch. Effective from July 2015, all DIB and non-DIB customers will now be able to buy and sell their foreign currency at the branches.

- Effective August 2015, all customers registered for online banking, mobile banking & business online can now make instant payments for ADDC which is an electric & water distribution authority for Abu Dhabi.

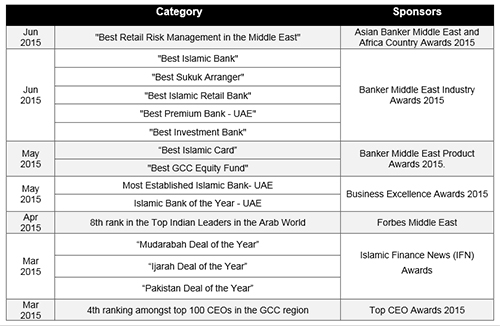

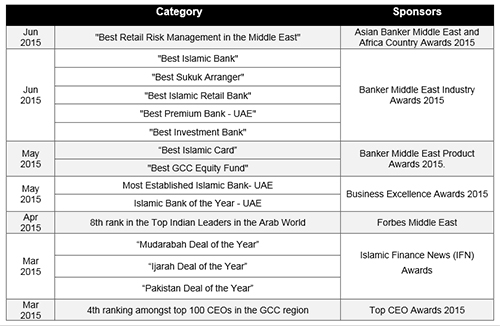

Year to date Awards: