Dubai Islamic Bank Group 1st Quarter 2015 Financial Results

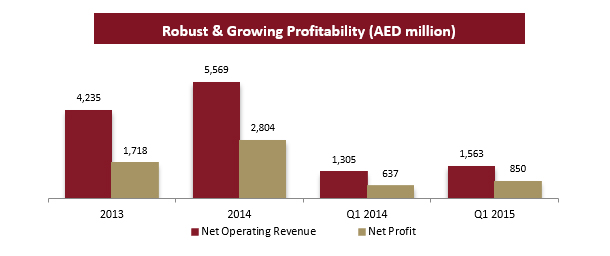

Q1 2015 net profit up by 34 per cent to AED 850 million

Dubai Islamic Bank (DFM: DIB), the first Islamic bank in the world and the largest Islamic bank in the UAE by total assets, today announced its 1st quarter results for the period ended March 31, 2015.

1Q 2015 Results Highlights:

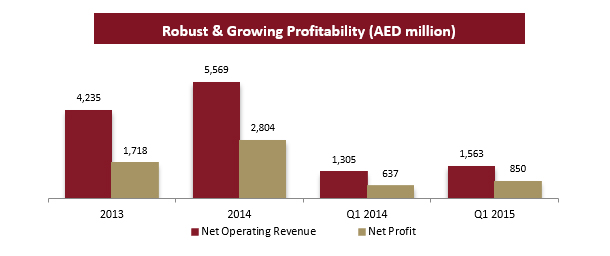

Robust profitability growth:

- Group net Profit increased to AED 850 million, up 34% compared with AED 637 million for the same period in 2014.

- Total Income increased to AED 1,772 million, up 19% compared with AED 1,495 million for the same period in 2014.

- Net Operating Revenue increased to AED 1,563 million, up 20% compared with AED 1,305 million for the same period in 2014.

- Impairment losses declined to AED 136 million compared with AED 195 million for the same period in 2014.

Strong growth in earning assets across all business segments:

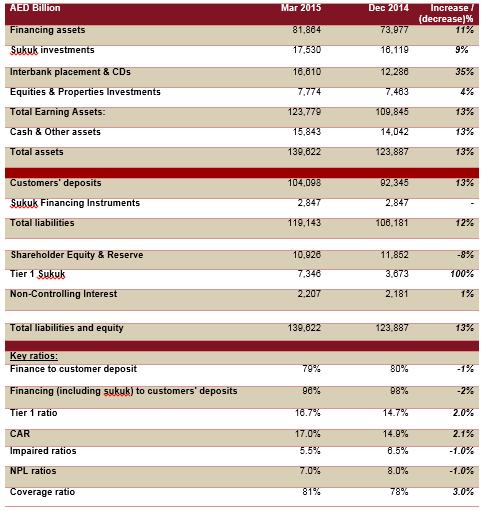

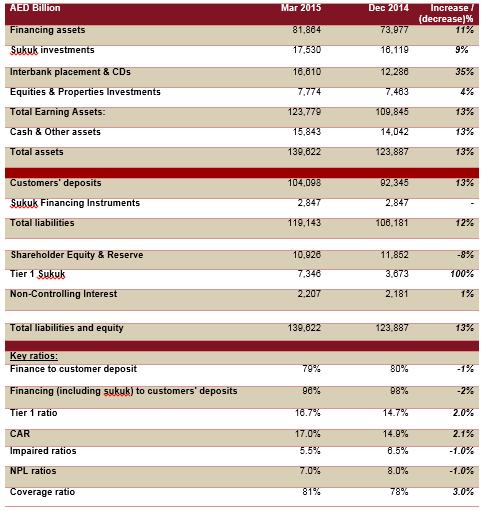

- Net financing assets at AED 82 billion up by 11%, compared to AED 74 billion at the end of 2014.

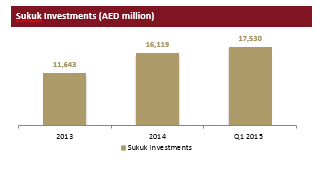

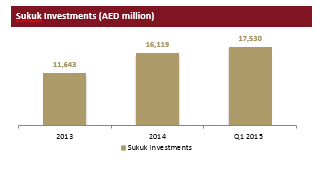

- Sukuk investments at AED 17.5 billion, an increase of 9%, compared to AED 16.1 billion at the end of 2014.

- Total Assets at AED 139.6 billion, an increase of 13%, compared to AED 123.8 billion at the end of 2014.

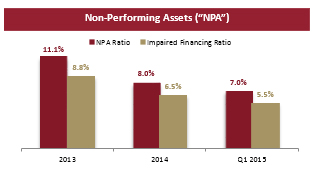

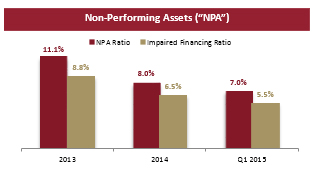

Continuous improvements in asset quality

- NPLs on a consistent decline with NPL ratio improving to 7.0%, compared to 8.0% at the end of 2014.

- Impaired financing ratio also improved to 5.5%, from 6.5% at the end of 2014.

- Cash coverage ratio improved to 81%, compared to 78% at the end of 2014. Overall coverage including collateral at discounted value now at 135%.

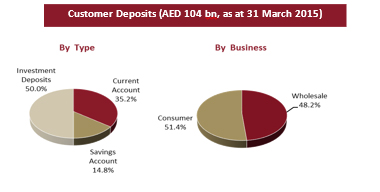

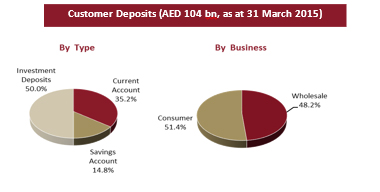

Increasing customers’ deposits

- Customer deposits at AED 104.1 billion compared to AED 92.3 billion at the end of 2014, up by more than 13%.

- Low cost deposits continue to remain a significant chunk with a large and stable CASA book comprising 50% of total deposit base.

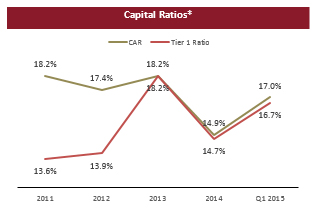

Strong Capitalization and liquidity position

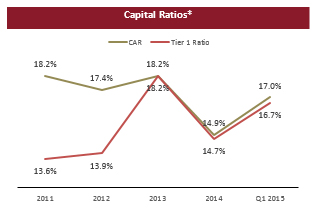

- Capital adequacy ratio at 17.0%, as against 12% minimum required, following successful additional T1 issuance in January 2015.

- Financing to deposit ratio is at 79%, one of the strongest in the market.

Enhancing value for shareholders

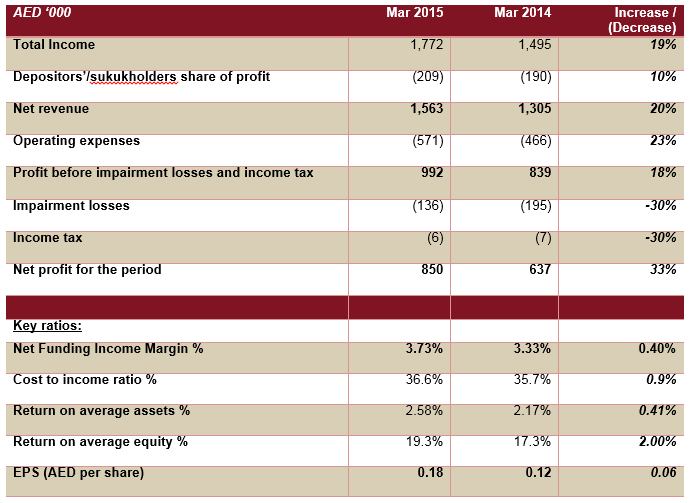

- Earnings per share increased to AED 0.18 in Q1 2015 from AED 0.12 in Q1 2014.

- Return on assets increased by 42 bps to 2.58% in Q1 2015 from 2.17% in Q1 2014.

- Return on equity increased by 204 bps to 19.3% in Q1 2015 from 17.3% in Q1 2014

Management’s comments on the financial performance of the financial period:

His Excellency Mohammed Ibrahim Al Shaibani, Director-General of His Highness The Ruler’s Court of Dubai and Chairman of Dubai Islamic Bank, said:

- The strong first quarter results demonstrate the bank’s strength and capability to continuously grow and expand its franchise despite the global market volatilities.

- As the bank celebrates its 40 year anniversary in 2015, DIB is proud to have been a key pillar in the growth of this remarkable nation achieving numerous and significant milestones in its long legacy, heritage and journey. The bank will continue to be at the forefront in the national development and growth of Dubai and the whole of UAE and will also continue to lead the global Islamic banking industry into a new era of innovation and progress.

Dubai Islamic Bank Managing Director, Abdulla Al Hamli, said:

- Our strong start to the year reflects DIB’s robust positioning as the bank looks to tap new sectors and segments.

- Our continued investments in technology and infrastructure backed by a renewed sales focus provides the bank with an unparalleled competitive edge in the market.

- Following the success of our SMART banking campaign last year, we are now seeing a strong outcome on our business performance.

Dubai Islamic Bank Chief Executive Officer, Dr. Adnan Chilwan, said:

- DIB has once again demonstrated a robust and solid performance marking a strong start to 2015. We have generated exceptionally strong organic growth for the bank and have already set plans in motion to support the same with an inorganic growth agenda looking beyond our traditional borders.

- Building on the momentum of last year, and aided by the strength of our balance sheet, we continue to capture greater market share in our relentless bid to promote Islamic finance as a viable norm rather than an alternative.

- Expanding our financing book at two to three times the market has been achieved through a multi-pronged approach combining product innovation, technology, renewed sales and service focus and optimization of balance sheet to create additional growth capacity.

- Islamic finance assets in the UAE have crossed USD 100 bln mark with the sector now more than one-fifth of the total banking and finance business in the country. The segment is expected to grow by 2.5-3 times in the coming five years and DIB is well positioned to take advantage of and support this growth in its drive to help establish Dubai as the global capital of Islamic economy.

- We reiterate our commitment to continuously strive to deliver attractive returns to our shareholders and to deliver the best in class products and services to our customers.

Financial Review

Income Statement highlights:

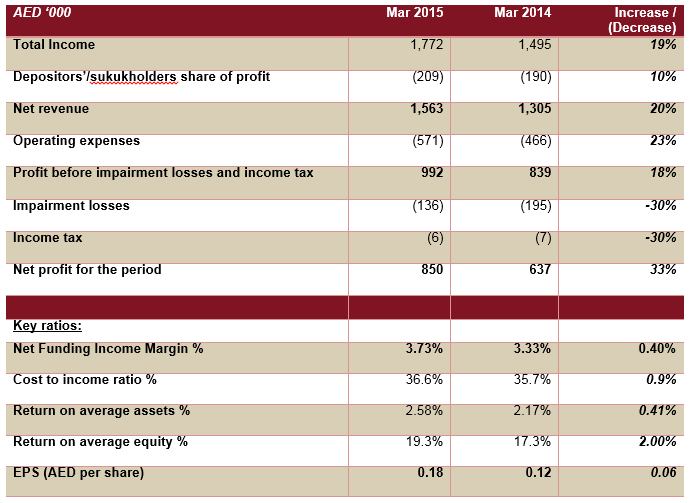

Total Income

Total revenue for the period ended March 31, 2015 increased to AED 1,772 million from AED 1,495 million for the same period in 2014, an increase of 19%. The increase is due to consistent growth in core banking assets across all business segments. With continued positive customer sentiments and customer penetration drive as part of the strategy, both consumer and corporate banking assets have registered significant increase resulting in growth in funded income by 24% over Q1 2014. Fees and commissions have increased by 19% to AED 348 million compared to AED 293 million for the same period in 2014.

Net revenue

Net revenue for the period ended March 31, 2015 amounted to AED 1,563 million, an increase of 19.8% compared with AED 1,305 million in the same period of 2014. The increase is attributed to growth in funded income and fees and commissions as well as improvement in deposit mix with a growing CASA component, thereby increasing net funded income margin to 3.73% from 3.33% compared to the same period last year.

Profit for the period

With strong increase in net revenue and improved asset quality leading to declining impairment charges, net profit for the period ended March 31, 2015, increased to AED 850 million from AED 637 million in the same period in 2014, an increase by 34%.

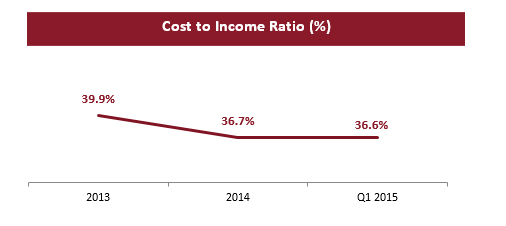

Operating expenses

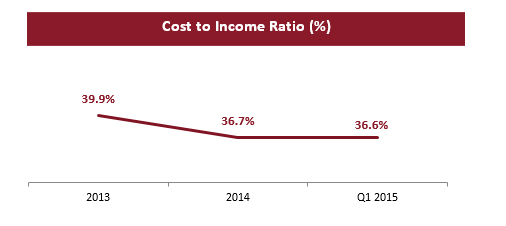

Operating expenses increased by 22.7% to AED 571 million for the period ended March 31, 2015, from AED 466 million in the same period in 2014. The increase is largely attributed to variable operating costs in line with increase in business volumes. As a result, cost to income ratio maintained at 36.6%.

Impairment losses

Impairment losses declined to AED 136 million compared with AED 195 million for the same period in 2014. There has been significant improvement in credit quality during Q1 2015 compared with Q1 2014 resulting in lower impairment charges during this period.

Statement of financial position highlights:

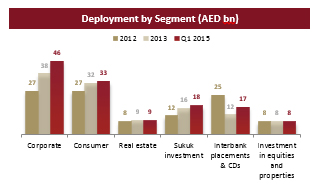

Financing portfolio

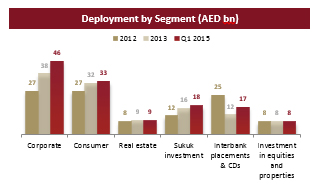

Net financing assets grew to AED 81.8 billion for the period ended March 31, 2015 from AED 73.9 billion as of end of 2014, an increase of 11%. Consumer banking gross financing assets increased by 6.2% to AED 32.5 billion for the period ended March 31, 2015, compared with AED 30.6 billion in 2014. Corporate banking gross finance grew strongly by 12.1% to AED 54.4 billion (including Real Estate) for the period ended March 31, 2015, compared with AED 48.5 billion in 2014.

Asset Quality

Non-performing assets have shown a consistent decline with NPL ratio improving to 7.0% for the period ended March 31, 2015, compared with 8.0% at the end of 2014. Impaired financing ratio also improved to 5.5% for the period ended March 31, 2015 from 6.5% at the end of 2014. This is mainly due to reduction in absolute NPLs coupled with increase in overall performing assets. With continued provisions, provision coverage improved to 81% compared with 78% at December 2014. Overall coverage ratio remained steady at 135%.

Customer Deposits

Customer deposits for the period ended March 31, 2015 increased by 13% to AED 104.1 billion from AED 92.3 billion as of end of 2014. CASA continues to be a significant portion comprising 50% of total deposits amounting to AED 52.0 billion compared with AED 41.9 billion in 2014. Investment deposits have also grown by 3.4% for the period ended in March 31, 2015 to AED 52.1 billion from AED 50.4 billion in 2014. The increase in customer deposits has led to a financing to deposit ratio of just under 79% as of Q1 2015.

Sukuk Investments

Sukuk investments increased by 9% for the period ended March 31, 2015 to AED 17.5 billion from AED 16.1 billion at end of 2014, as part of a deliberate strategy to deploy excess liquidity in higher earning assets. Primarily a UAE based portfolio including sovereign and non-sovereign names, this provides a strong yield and can also be used to generate liquidity through repos and other mechanisms if and when required by the bank.

Capital and capital adequacy

Capital adequacy ratio stands at 17.0% as of March 31, 2015, and T1 ratio at 16.7%, both ratios are above regulatory level. Recently, the bank has successfully concluded issuance of T1 capital amounting to USD $1 billion which resulted in increasing overall CAR to 17.0%.

* Regulatory Capital Requirements CAR at 12% and Tier 1 at 8%

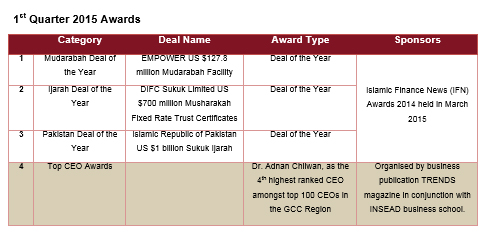

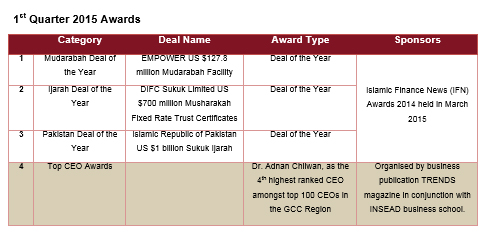

Key business highlights for the 1st quarter of 2015:

- In January 2015, Dubai Islamic Bank announced the successful pricing of a US$ 1 billion Tier 1 capital-eligible issuance with a perpetual (non-call 6) maturity. Despite volatile market conditions, the issue was oversubscribed reflecting the strong demand and confidence investors have in the institution and also represented both the debut deal of the year and the first capital market transaction of 2015.

- In March 2015, DIB acted as a joint lead manager in the Emirates successful pricing of USD $913,026,000 certificates due in 2025. The proceeds from the issuance of the Certificates will be used to fund the acquisition of four Airbus A380-800. The issuance of the Certificates with a tenor of 10 years, marks the world’s first Sukuk financing supported by UKEF and the largest ever capital markets offering in the aviation space with an Export Credit Agency guarantee. The transaction also represents the first time that a Sukuk has been used to pre-fund the acquisition of aircraft and the first ever Sukuk financing for A380 aircraft.

- DIB celebrated its momentous 40th anniversary at a special ceremony held in the presence of His Highness Sheikh Mohammed bin Rashid Al Maktoum, Vice President and Prime Minister of the UAE, and Ruler of Dubai. Held at the Dubai World Trade Centre on February 2015, over 3,000 guests including DIB Board and Management, bank's employees, and government officials gathered to commemorate the occasion.

Other key deals include:

- National Petroleum Construction Company - USD 200 mln Islamic tranche of total deal size of USD 600 mln. 33.3% of the Islamic piece taken by DIB

- TECOM – AED 4 bln syndicated facility with DIB holding AED 875 mln

- Ports and Free Zone World – USD 1.1 bln syndicated facility with DIB funding USD 240 mln