Nine Months 2014 net profit up by 72% to AED 2,060 million

Q3 2014 net profit up 57% to AED 723 million

Dubai Islamic Bank (DFM: DIB), the first Islamic bank in the world and the largest Islamic bank in the UAE by total assets, today announced its Nine Months (9M) 2014 results for the period ended September 30, 2014.

Results Highlights

Significant enhancement in profitability stemming from growth in core business:

Strong growth in earning assets across business segments:

Continued improvement in asset quality with increase in provision coverage

Strong and stable funding base with consistent growth in customers’ deposits

Robust Capitalization and liquidity position

Enhancing value for shareholders

Recent Awards

Management’s comments on the financial performance of the financial period:

His Excellency Mohammed Ibrahim Al Shaibani, Director-General of His Highness The Ruler’s Court of Dubai and Chairman of Dubai Islamic Bank, said:

Dubai Islamic Bank Managing Director, Abdulla Al Hamli, said:

Dubai Islamic Bank Chief Executive Officer, Dr. Adnan Chilwan, said:

Financial Review

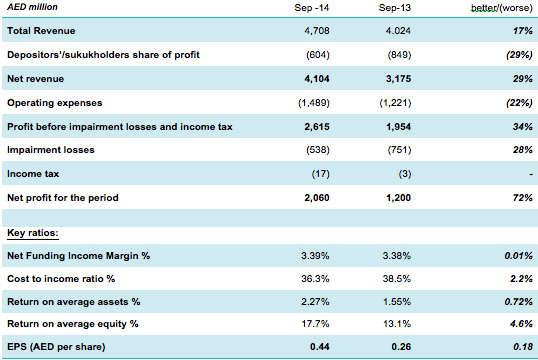

Income Statement highlights for the 9M ended 30 Sep 2014

Total revenue

Total revenue for 9M 2014 increased to AED 4,708 million from AED 4,024 million in 9M 2013, an increase of 17%. The increase is mainly due to robust growth in financing activities across both wholesale and consumer businesses alongwith rise in the quality Sukuk investment portfolio. With intensifying positive customer sentiments and the intense customer penetration drive as part of the strategy to gain market share, corporate business has seen a surge in all areas resulting in higher funded and non-funded income. Consumer banking operations continue to expand delivering strong credit and fee income growth. Overall fees and commissions have increased by 38% to AED 874 million for the 9M 2014 from AED 635 million for the same period in 2013 largely due to a focused agenda to increase DIB’s share of wallet in 2014 in both corporate and consumer banking segments.

Net revenue

Net revenue for the period ended Sept 30, 2014 amounted to AED 4,104 million; an increase of 29% compared with AED 3,175 million in the same period of 2013. The increase in net revenue is mainly due to higher total revenue coupled with savings achieved due to early settlement of high cost funding using bank’s surplus liquidity. Despite intense competition and aggressive pricing seen in the market, the bank was able to maintain the net funded income margin at 3.39% by changing the mix and re-deploying liquidity in high yielding assets.

Operating expenses

Operating expenses increased by 22% to AED 1,489 million for the period ended September 30, 2014 from AED 1,221 million in the same period in 2013 in line with rise in business activities. Despite the rise in costs, the cost to income ratio improved to 36.3% from 38.5% in the same period of 2013 due to consistent increase in revenue and effective cost management.

Impairment losses

DIB continues to strengthen its balance sheet by cautious lending and conservative provisioning approach. Though asset quality has shown further improvements, the bank continued to build provision during the current period leading to a significant improvement in provision coverage ratio, which now, stands at more than 76%.

Profit for the period

With significant increase in net revenue and improved asset quality leading to declining impairment charges, net profit for the period ended September 30, 2014, increased to AED 2,060 million from AED 1,200 million during the same period of 2013, an increase by 72%.

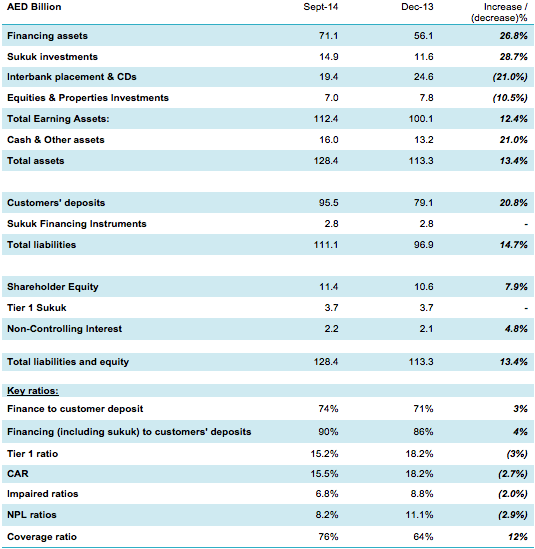

Statement of financial position highlights:

Financing portfolio

Net financing assets grew to AED 71.1 billion at September 30, 2014 from AED 56.1 billion at December 31, 2013, an increase of 27%. Consumer banking financing assets increased by 16% to AED 30.7 billion at September 30, 2014 compared with balances at December 31, 2013. Corporate banking finance grew significantly by 29% to AED 44.1 billion at September 30, 2014 compared with AED 34.2 billion at December 31, 2013.

Non-performing assets have shown a consistent decline with NPL ratio improving to 8.2% at September 30, 2014 compared to 11.1% at the end of 2013. Impaired financing ratio also improved to 6.8% in September 30, 2014 from 8.8% at the end of 2013. The reduction is mainly due to reduction in NPL coupled with increase in overall performing assets. Provision coverage improved to 76% in September 30, 2014 compared to 64.0% at the end of 2013.

Sukuk Investments

Sukuk investments increased by 29% in 9M 2014 to AED 15 billion from AED 11.6 billion at end of 2013, as a deliberate strategy divert excess liquidity to higher earning assets.

Customer Deposits

Customer deposits as of September 30, 2014 increased by 21% to AED 95.5 billion from AED 79.1 billion as of December 31, 2013. And though the customer deposits have grown, CASA continues to be a significant comprising 40% of total deposits amounting to AED 37.9 billion at September 30, 2014 compared with AED 33.8 billion at December 31, 2013.

Investment deposits have also grown by 27% in 9M 2014 to AED 57.5 billion as at September 30, 2014 from AED 45.4 billion as at 31st December 2013.

The increase in customer deposits is in line with the growth in investing and financing assets resulted maintaining financing to deposit ratio at 74.5% as of September 30, 2014.

Capital and capital adequacy

Capital adequacy ratio stood at 15.5% at the end of September 30, 2014. Tier 1 CAR remained strong at 15.2 % with both overall CAR and Tier 1 well above the required regulatory level.

Dubai Islamic Bank Full Year 2024 Group Financial Results

DIB increases its stake to 25% in Digital Bank in Türkiye

Crypto.com inks Partnership with Dubai Islamic Bank