Dubai Islamic Bank (DFM: DIB), the first Islamic bank in the world and the largest Islamic bank in the UAE by total assets, today announced its first quarter results for the period ended March 31, 2014.

Results Highlights

Significant profitability enhancement stemming from core business growth and robust liquidity management

Focused growth in core assets while improving portfolio performance and quality

Strong and Stable Funding base: Customer deposits - continue to grow steadily

Continued improvement in asset quality

Robust Capitalization

Enhancing value for shareholders

Recent Awards (Q1 2014)

Management’s comments on the financial performance of the financial period:

His Excellency Mohammed Ibrahim Al Shaibani, Director-General of His Highness The Ruler’s Court of Dubai and Chairman of Dubai Islamic Bank, said:

Dubai Islamic Bank Managing Director, Abdulla Al Hamli, said:

Dubai Islamic Bank Chief Executive Officer, Dr. Adnan Chilwan, said:

Financial Review

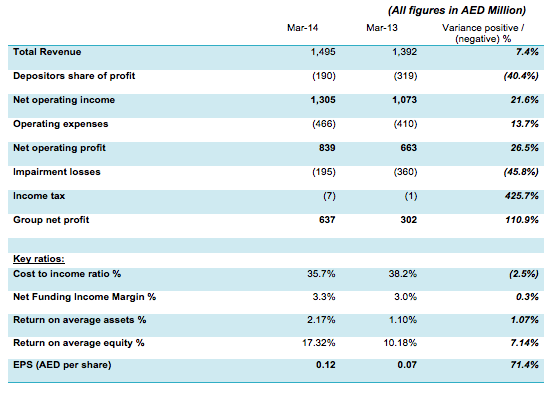

Income Statement highlights for the quarter ended 31st March 2014

Net operating income

Net operating income for the period ended March 31, 2014 amounted to AED 1,305 million; an increase of 21.6% compared with AED 1,073 million in the same period of 2013. The increase in net operating revenue is mainly due to robust growth in both corporate and consumer banking assets coupled with measures taken to rationalize high cost of funding. Fee and commission have increased by 33% to AED 293 million Q1 2014 from AED 220 million in Q1 2013.

Operating expenses

Operating expenses increased by 13.7% to AED 466 million for the period ended March 31, 2014 from AED 410 million in the same period in 2013. The cost to income ratio improved to 35.7% from 38.2% in the same period of 2013 due to increase in total revenue and enhanced operational efficiency.

Impairment losses

Asset quality continued to improve leading to a sustained decline in non-performing financing. Though asset quality has shown improvement, the bank made additional provisions amounting to AED 195 million during the current period with the aim to improve coverage ratios.

Profit for the period

With continued increase in net operating income and improved asset quality with lower impairment charge, net profit for the period ended March 31, 2014, increased to AED 636.6 million from AED 301.7 million during the same period of 2013, an increase by 111%.

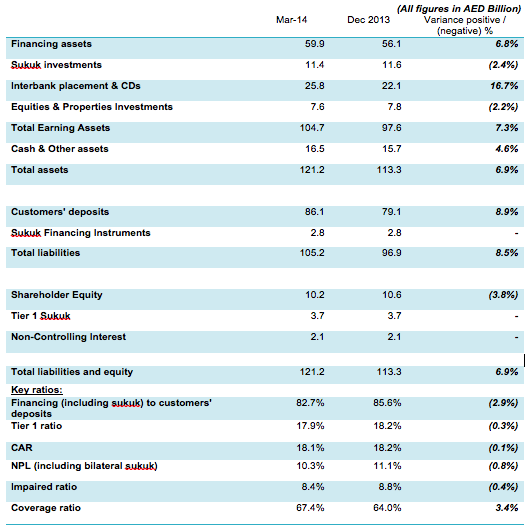

Statement of financial position highlights:

Financing portfolio

Net financing assets grew to AED 59.9 billion at March 31, 2014 from AED 56.1 billion at December 31, 2013, an increase of 6.8%.

Overall credit has grown significantly during Q1 2014 outpacing the market. Consumer banking assets reported a consistent increase by 4% to AED 27.3 billion compared with AED 26.2 billion at 31 December 2013. Corporate banking assets have also grown significantly by 9% to AED 37.4 billion compared with AED 34.4 billion at 31 December 2013.

Non-performing assets have shown a consistent decline with NPL ratio improving to 10.3% in Q1 2014 compared to 11.1% at the end of 2013. Impaired financing ratio also improved to 8.4% in Q1 2014 from 8.8% at the end of 2013. The reduction is mainly due to full or partial settlement of exposures coupled with increase in overall financing portfolio. Provision coverage improved to nearly 67.4% in Q1 2014 compared to 64% at the end of 2013.

Customer Deposits

Customers’ deposits as of March 31, 2014 increased by 8.9% to AED 86.1 billion from AED 79.1 billion as of December 31, 2013. The customer deposits have grown largely due to increase in CASA which now comprise 46% of total deposits amounting to AED 39.6 billion at March 31, 2014 compared with AED 33.8 billion at December 31, 2013. Due to increase in customer deposits, financing to deposits ratio reduced from 85.6% as of December 31, 2013 to 82.7% as of March 31, 2014.

Dubai Islamic Bank Full Year 2024 Group Financial Results

DIB increases its stake to 25% in Digital Bank in Türkiye

Crypto.com inks Partnership with Dubai Islamic Bank