Dubai Islamic Bank (DFM: DIB), the first Islamic bank in the world and the largest Islamic bank in the UAE by total assets, today announced its results for the year ended December 31, 2013.

Results Highlights

Significant profitability enhancement stemming from core business growth and robust liquidity management

Focused growth in core assets while improving portfolio performance and quality

Strong and Stable Funding base

Significant improvement in asset quality and portfolio visibility

Robust Capitalization

Enhancing value for shareholders

Management’s comments on the financial performance of the financial year

His Excellency Mohammed Ibrahim Al Shaibani, Director-General of His Highness The Ruler’s Court of Dubai and Chairman of Dubai Islamic Bank, said: “On the back of improved market conditions and a focused strategy over the past few years, DIB has posted a strong performance in 2013 with solid financial results. The recent EXPO 2020 win will provide a significant economic boost to all sectors across Dubai and the UAE and given the recent results, DIB is better positioned than ever to take advantage of the current positive market trends and to capitalize on the robust growth platform that the bank and its management has established in 2013.”

Dubai Islamic Bank Managing Director, Mr. Abdulla Al Hamli, said: “Our strong performance in 2013 is a testament to, both the strength of our franchise and the quality of the management team. Dubai’s vision to become the Islamic capital of the world strongly complements DIB’s as we look to position ourselves as the most progressive Islamic financial institution globally. With improved market conditions and positive trends expected to continue, we are confident of an even stronger performance in the years to come.”

“I have always been a strong believer in the unique proposition that Dubai and the UAE offer to the local, regional and global players”, said Dr. Adnan Chilwan, Chief Executive Officer, Dubai Islamic Bank: “On the strength of our beliefs, we implemented a focused consolidation strategy during the crisis years which has allowed us to de-risk and strengthen our balance sheet, improve asset quality, build a cushion against unforeseen events, establish a strong capital position and refocus our efforts on the core business while maintaining ample liquidity. These efforts have yielded strong synergies within the organization which is now comfortably poised to take advantage of the opportunities in the market today and in the foreseeable future. “

“We are now ready to embark on a growth journey, both organic and inorganic, which will not only see the bank expand its reach within the country but also internationally” he added. “As we implement our meticulously crafted strategic agenda, we will always keep our stakeholders at the forefront, ensuring that each step in this journey adds value to the franchise that we have so successfully built over the last four decades.”

Income statement highlights

Net operating revenue

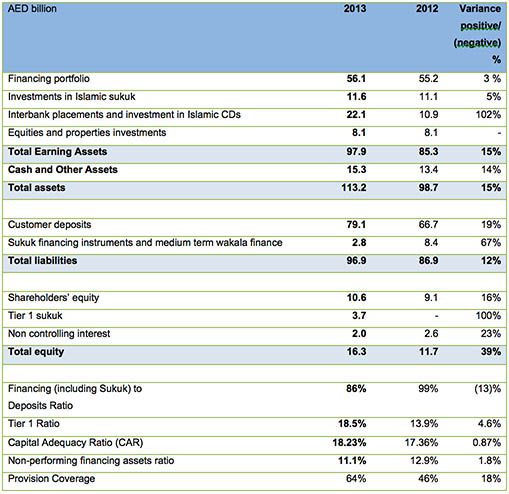

Total income remained steady at AED 5.28 billion despite low financing rate environment and deliberate run-offs in the legacy commercial real estate portfolio. This was largely due to the rising client activities and credit growth in consumer business and other sectors leading to higher funded and transactional income. Net operating revenue for the year ended December 31, 2013 amounted to AED 4.23 billion, an increase of 7% compared with AED 3.94 billion during the year 2012, which, combined with optimum cost management translated into a 10% growth in operating profit before impairment charges in 2013.

Operating expenses

Operating expenses increased by 4.3% to AED 1.69 billion for the year ended December 31, 2013 from AED 1.62 billion during 2012 due to increase in staff and operating costs in line with expansion of infrastructure and distribution network. However, the cost to income ratio improved to 39.9% from 41.1% in 2012 due to efficient cost management approach and effective utilization of resources.

Impairment losses

DIB continues to manage asset quality and non-performing assets by prudent lending and conservative provisioning approach. Although asset quality has significantly improved, the bank continued to build provisions with the aim to improve provision coverage ratios.

Impairment charges on financial assets decreased to AED 920 million during 2013 from AED 972 million in 2012. The decline is on account of improvement in non performing exposures on the back of significantly improved performance of those customers over an extended period.

Non-performing financing assets ratio reduced to 11.1% at 31 December 2013 compared with 12.9% at December 31, 2012. Impaired financing ratio also improved from 9.9% in 2012 to 8.8% at the end of 2013. The reduction is mainly on account of upgrade of various relationships after a sustained and extended satisfactory performance post restructuring. Provision coverage ratio of non-performing exposures have improved substantially to 64% compared with 46% at December 31, 2012.

Profit for the period

With continued increase in net operating revenue, improved asset quality and declining impairment charges, net profit for the year ended in December 31, 2013 increased by 42% to AED 1.7 billion from AED 1.2 billion during 2012.

Statement of financial position highlights

Investing and Financing Assets

Financing assets and Sukuk grew to AED 72.3 billion at 31 December 2013 from AED 69.9 billion at December 31, 2012, an increase of 3.4% (including impact of legacy real estate run-offs as part of de-risking balance sheet). Consumer Banking assets continue to rise during 2013 despite tighter credit policies and stiff competition. Although Corporate Banking exposure grew as well, the impact of growth in the portfolio, however, was partly offset by the run off of commercial real estate exposures which decreased to 26% of the total financing book compared with 29% in 2012 on account of a focused strategy to reduce the same over the last few years.

Equity investment

Other investments have performed significantly better than last year in line with improved GCC equities market resulting in an upside in other comprehensive income reserves and shareholders’ equity. An increase of AED 275 million is recognized in the shareholders’ equity compared with AED 12 million in 2012.

Customers’ deposits

Customers’ deposits as of December 31, 2013 increased by 18.6% to AED 79.1 billion from AED 66.7 billion as of December 31, 2012 with a significant rise in current and savings account (CASA) of 15.4%. The CASA book continues to represent significant part of deposits at 42.4% giving DIB one of the lowest cost of funds in the market. The substantial increase in customers’ deposits reduced the financing (including Sukuk) to deposits ratio from 99% as of December 31, 2012 to 86% as of December 31, 2013, a decrease by 13%.

Dubai Islamic Bank Full Year 2024 Group Financial Results

DIB increases its stake to 25% in Digital Bank in Türkiye

Crypto.com inks Partnership with Dubai Islamic Bank