Dubai Islamic Bank Group, the oldest Islamic bank in the world and the largest in the UAE by total assets, today announced its results for the nine-month period ended September 30, 2013.

Results Highlights

Management’s comments on the financial performance of the period

His Excellency Mohammed Ibrahim Al Shaibani, Director-General of His Highness The Ruler’s Court of Dubai and Chairman of Dubai Islamic Bank, said: With the continuous improvement in markets across Dubai and the UAE, DIB is ready to embark on a strong growth agenda as evidenced by the recent results. In this respect, the bank continues to be a critical pillar not only to progress the Islamic Finance agenda for the emirate of Dubai but also to promote the growth and innovation in the banking sector of UAE.

Dubai Islamic Bank Managing Director, Mr. Abdulla Al Hamli, said: Throughout the last few years of the global financial crisis, we at DIB have been preparing ourselves for the market to turnaround. I feel proud of the management and the team for the way they have worked together to successfully develop and execute the plans despite the tough economic environment and position the bank for robust and stable growth going forward.

Dubai Islamic Bank Chief Executive Officer, Dr. Adnan Chilwan, said: At DIB, our focus is to always create value for the bank’s stakeholders. Hence, despite the crisis, we continued to invest and innovate to provide need-based, relevant and high quality products and services to our growing customer base while simultaneously ensuring that the bank remains profitable, thereby meeting the shareholder’s expectations of consistent returns on their investment. As evidenced by the results so far in 2013, the bank is clearly on a strong growth agenda and optimally positioned to take advantage of the positive signals emanating from the market here in Dubai and the UAE. With improved economic conditions, and given our track record, we are confident that our strategy will further enhance the franchise value ensuring that we remain aligned to our customers and shareholders expectations in 2013 and beyond.

Financial Review

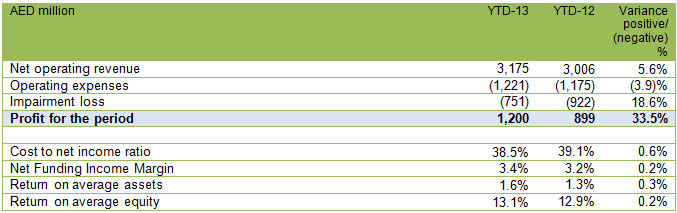

Income statement highlights

Net operating revenue

Net operating revenue for the period ended September 30, 2013 amounted to AED 3,175 million; an increase of 5.6% compared with AED 3,006 million in the same period of 2012. The increase in net operating revenue is mainly due to the rise in client activities resulting in increase in funded and transactional income, coupled with decrease in cost of deposits during the period.

Operating expenses

Operating expenses increased by 3.9% to AED 1,221 million for the period ended September 30, 2013 from AED 1,175 million in the same period in 2012 mainly due to increase in employees’ expenses. However the cost to income ratio improved to 38.5% from 39.1% in the same period of 2012 due to efficient cost management approach.

Impairment losses

DIB continues to manage asset quality and non-performing assets by cautious lending and conservative provisioning approach. Although asset quality has shown improvements, the bank continued to build provisions amounting to AED 751 million during the current period with the aim to improve coverage ratios.

Profit for the period

As a result of increased core business and lower provision requirements due to improved asset quality, net profit for the period ended September 30 2013, increased to AED 1.2 billion from AED 899 million during the same period of 2012, an increase by 33.5%.

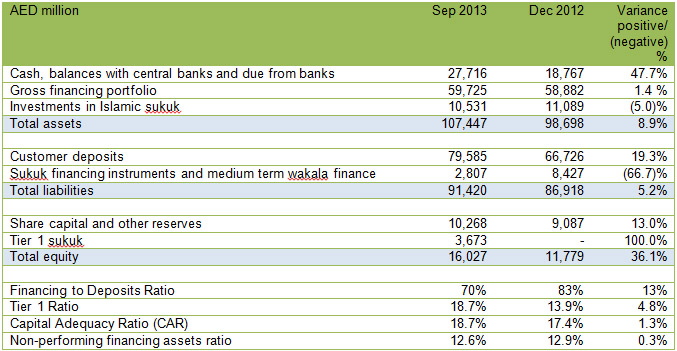

Statement of financial position highlights

Financing portfolio and customers’ deposits

Whilst gross financing portfolio as of September 30, 2013 increased by 1.4% to AED 59.7 billion from AED 58.9 billion as of December 31, 2012, strong growth in core areas of consumer and corporate businesses has been partly offset by the strategic de-risking of commercial real estate portfolio, thereby leading to better asset quality and a stronger balance sheet.

Customers’ deposits as of September 30, 2013 increased by 19.3% to AED 79.6 billion from AED 66.7 billion as of December 31, 2012, The bank’s ability to grow the low cost or profit-free deposits consistently is a key factor in providing DIB with one of the lowest cost of funds in the market as the CASA book now forms nearly 43% of the deposit base. The increase in deposits is principally contributed by large local companies and Government related entities tapping the capital markets earlier this year.

The significant increase in customers’ deposits reduced the financing to deposits ratio from 83% as of December 31, 2012 to 70% as of September 30, 2013, decreased by 13%.

Cash, balances with central banks and due from banks

The increase in cash, balances with central banks and due from other banks is mainly due to the rise in the customers’ deposits. Non-profit bearing deposits increased by 15.6% from AED 29.2 billion as of December 2012 to AED 33.8 billion as of September 2013, whereas investment deposits have surged by 22.1% from AED 37.5 billion as of December 2012 to AED 45.8 billion as of September 2013.

Strong liquidity and Capital Structure

In March 2013, the Bank successfully tapped the capital markets with a Tier 1 sukuk amounting to USD 1 billion (AED 3.7 billion) which was oversubscribed 14 times by local and international fixed income investors. This issuance improved DIB’s Tier 1 Capital Adequacy Ratio to 18.7% as of September 30, 2013, positioning the bank very comfortably above the regulatory requirement in UAE.

The enhanced capital position and strong liquidity allowed the bank to early repay both the Ministry of Finance medium term wakala of AED 3.75 billion and Tamweel’s financial obligations amounting to AED 3.8 billion, well ahead of scheduled maturity. These combined with the repayment of Tamweel’s sukuk of AED 2.2 billion has had a significant impact in lowering the cost of fund of the bank.

Dubai Islamic Bank Full Year 2024 Group Financial Results

DIB increases its stake to 25% in Digital Bank in Türkiye

Crypto.com inks Partnership with Dubai Islamic Bank