- Balance Sheet expands to AED 327 billion, up 4% YTD.

- Strong growth in Total income by 27% YoY to AED 5.6 billion.

- Net Profit (Pre-Tax) of AED 1.85 billion, a robust growth of 22% YoY.

- Asset quality improved to 4.97% down 43 bps YTD.

- Settlement reached between DIB and NMC Healthcare.

Dubai Islamic Bank (DFM: DIB), the largest Islamic bank in the UAE, today announced its results for the period ending March 31, 2024.

Q1 2024 Highlights:

- Net Profit (Pre-Tax) registered AED 1,850 million up 22% YoY due to higher total income and lower impairment charges.

- Net financing and sukuk investments reached AED 277 billion, up 3% YTD. Gross new underwriting and sukuk investments recorded AED 21.1 billion in Q1 2024 vs AED 20.8 billion in the same period of last year. The quarter saw net growth in new financing and sukuk disbursements to AED 8.9 billion compared to AED 1.9 billion in the prior year.

- Total income reached to AED 5,607 million compared to AED 4,431 million, a solid expansion of 26.5% YoY.

- Net Operating Revenues showed a robust increase of 8.8% YoY to reach AED 2,998 million.

- Net Operating Profit came at AED 2,149 million, a 6.7% YoY increase compared to AED 2,013 million in Q1 2023.

- Balance sheet expanded by a solid 4% YTD to AED 327 billion.

- Strong growth in Customer deposits increasing to AED 236 billion, up 6% YTD with CASA comprising 38% of DIB’s deposit base.

- Impairment charges were lower at AED 299 million against AED 496 million in Q1 2023, significantly down by 40% YoY.

- NPF declined to 4.97% compared to 5.40% in YE 2023, lower by 43 bps YTD. Cash Coverage rose to 93%, up 300 bps YTD.

- Cost to income ratio marginally up by 120 bps YTD and 140 bps YoY to 28.3% as the bank continue to build its resources in key areas and functions in line with its growth strategy.

- Liquidity remains healthy with LCR at 167.6%.

- RoA and RoTE (pre-tax) remains strong at 2.3% up 20 bps YTD and 20.4% up 40 bps YTD respectively.

- CET1 stands at 13.1% (+30 bps YTD) and CAR at 17.5% (+20 bps YTD).

- DIB is pleased to have reached a settlement with NMC where DIB will receive cash consideration and Holdco notes in settlement of claims.

Management’s comments for the period ended 31st March 2024:

His Excellency Mohammed Ibrahim Al Shaibani, Director-General of His Highness The Ruler’s Court of Dubai and Chairman of Dubai Islamic Bank

- Despite tighter market conditions on elevated rate environment and geopolitical turbulence, the UAE remains steadfast in its economic growth with rising business confidence, increasing tourism inflows and expanding PMI index levels. The domestic financial market saw strong activities from new listings as well as institutions delivering healthy returns to their shareholders and investors. The banking system remains well capitalized supported by higher earnings with stable funding and liquidity.

- DIB has remained a strong and solid player in the market. Irrespective of the introduction of corporate tax into our earnings and regional tensions, the bank has managed to deliver a net profit (pre-tax) of AED 1.85 billion, achieving robust growth of 22% YoY.

Dr. Adnan Chilwan, Group Chief Executive Officer

- The global markets remain volatile with elevated inflation levels and regional instability that have led to further business challenges. Undeterred by global events, the UAE remains strong supported by robust business fundamentals and economic policies that have paved the way for continuous growth of both the public and private sectors over the past few years. The UAE banking sector remains financially sound supporting credit growth in key sectors such as construction, manufacturing as well as retail and wholesale trade sectors.

- The bank’s balance sheet continues to expand now reaching AED 327 billion depicting a stable growth of 4% YTD. Growth was supported by gross new financing across the key business to the tune of AED 21 billion during the quarter. We continue to reinforce our fixed income book with sukuk portfolio now reaching AED 76 billion, a significant increase of 11% YTD.

- DIB is pleased to have reached a settlement regarding its exposure to NMC which as a result led to an improvement in all asset quality metrics.

- Our ESG aspirations remain at the forefront with the successful issuance of our third sustainable sukuk (USD 1 billion) which now brings our total sustainable issuance to USD 2.75 billion. In addition, the bank also acted as a JLM & Bookrunner in various sustainable sukuk transactions, arranging USD 1.85 billion for issuers within the region during the quarter, depicting our strong capabilities within the green and sustainable Islamic capital markets space.

Financial Review

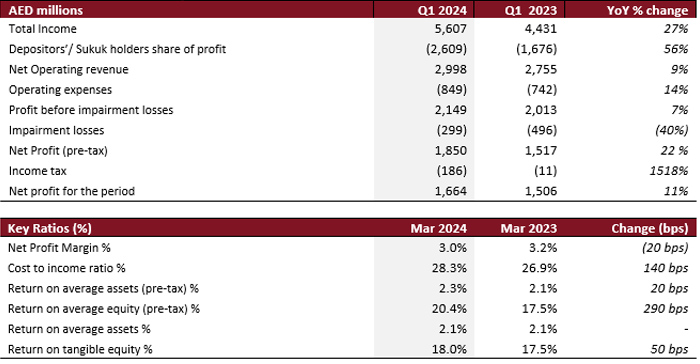

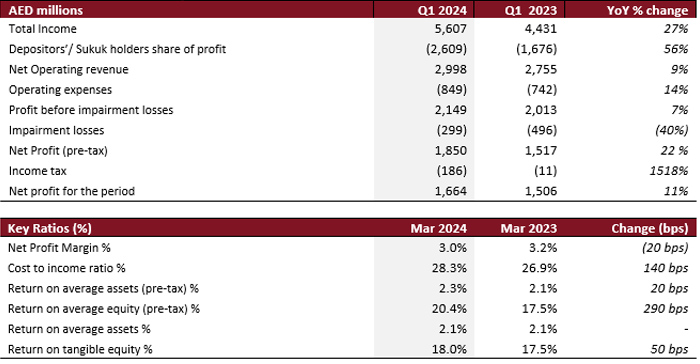

Income statement summary

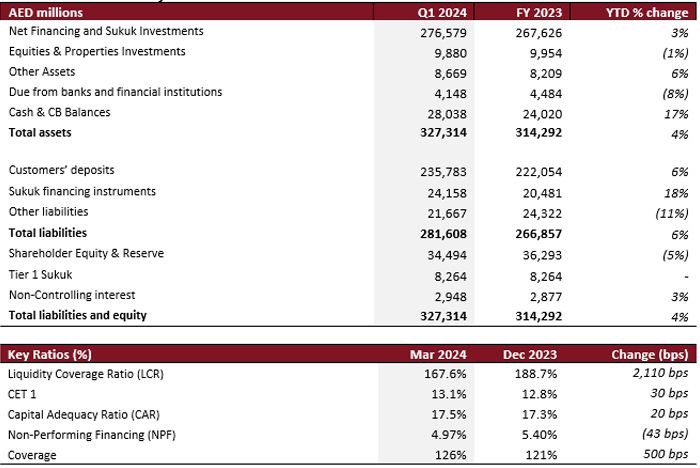

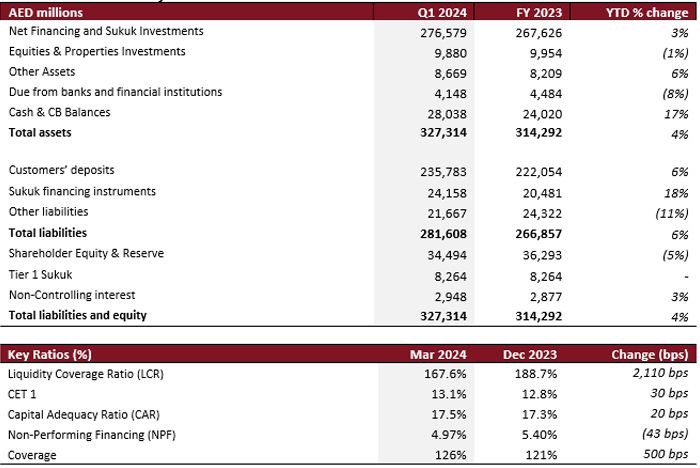

Balance Sheet Summary

Operating Performance

The bank’s Total Income rose to AED 5,607 million in Q1 2024 demonstrating a solid growth of 27% YoY compared to AED 4,431 million. Non-funded income advanced by 44% YoY over the reporting period supported by fees & commissions and other income account due to one off item gains. Net Operating Revenue grew by 9% YoY to reach AED 2,998 million compared to AED 2,755 million last year.

Pre-impairment profit increased by 7% YoY reaching AED 2,149 million compared to AED 2,013 million. Impairment charges stood at AED 299 million down by a significant 40% YoY.

Operating expenses amounted to AED 849 million for the year vs AED 742 million in Q1 2023, exhibiting 14.4% YoY increase on the back of higher wages and administrative expenses. Cost income ratio registered 28.3%, up 140 bps YoY.

Net Profit (pre-tax) grew by 22% YoY to reach AED 1,850 million.

Net profit margin registered 3.0% in line with full year guidance. RoA and RoTE (pre-tax) stood at 2.3% up 20 bps YTD and 20.4% up 40 bps YTD respectively.

Balance Sheet Trends

Net financing & Sukuk investments stood at AED 277 billion, up 3.3% YTD from AED 268 billion in FY 2023.

DIB witnessed stable overall YoY growth in gross new financing and sukuk in Q1 2024 amounting to AED 21.2 billion, up nearly 2% compared to AED 20.8 billion in Q1 2023. Gross new consumer financing origination came in nearly at AED 6.2 billion, (+ 19% YoY), driven mainly by auto finance, personal finance and a pick-up in mortgage. On the other hand, gross new corporate bookings came in at AED 7.2 billion. Routine repayments for the period continued to flow in at a slower rate totaling AED 8.7 billion down from AED 13.6 billion in Q1 2023. Additionally, the momentum of early settlements continued to retract over the period by 27% YoY to AED 3.2 billion compared to AED 4.3 billion last year. This has resulted in net positive financing incremental growth of AED 1.5 billion in DIB’s portfolio over the Q1 2024 period.

Customer deposits registered AED 236 billion up by 6.2% YTD. CASA now stands at AED 89 billion up 9.1% YTD and comprising 38% of deposits. Migration to wakala deposits (investment deposits) was a persistent trend over the year due to the current global rate scenario. Liquidity coverage ratio (LCR) at 167.6%, down from 188.7% FY 2023, remains above regulatory requirement, depicting strong liquidity position.

Non-performing financing (NPF) ratio improved to 4.97%, down by 43 bps compared to FY 2023 NPF ratio of 5.40%. The NPF absolute amount decreased by 7.6% from AED 11.5 billion during YE 2023 to AED 10.6 billion. This improvement is primarily attributed to the settlement DIB has reached with NMC whereby it will receive cash and a stake in HoldCo for its outstanding exposure. Accordingly, DIB’s coverage ratio improved significantly on a YTD basis by 300 bps to 93%.

Stage 1 financing increased by 1% to AED 184 billion while Stage 2 financing remained stable at AED 14 billion; both well provisioned for. Similarly, Stage 3 coverage improved to 72.8%, (+450 bps) from FY2023 as stage 3 exposure dropped to just below AED 11 billion, the lowest level over the past 3 years.

Cash coverage ratio rose to 93% (+300 bps YTD) and overall coverage including collateral at 126% (+500 bps YTD). Cost of risk on gross financing assets improved to 40 bps compared to 80 bps in Q1 2023.

Capital ratios continue to remain strong with CAR at 17.5% and CET 1 ratio at 13.1%, both well above the regulatory requirement.

Business Performance (Q1 2024)

Consumer Banking portfolio reached AED 57 billion up 2% YTD. The portfolio’s total new underwriting of AED 6.2 billion during the year increased from AED 5.2 billion, up 19% YoY. All consumer segments witnessed strong growth particularly auto finance. Despite routine repayments of AED 4.8 billion, the portfolio added AED 1.4 billion of net new underwriting in Q1 2024 versus AED1 billion in Q1 2023. Blended yield on consumer financing grew by 46 bps YoY to reach to 7%. Separately, on the funding side, consumer deposits increased by 2% YTD to AED 90 billion while consumer CASA remained steady YoY at almost AED 47 billion.

Corporate banking portfolio now stands at AED 144 billion up nearly 1% YTD. Revenues increased by 7% YoY to AED 796 million. Yield on corporate financing portfolio expanded by 66 bps YoY to 6.7% compared to 6.1%. On the funding side, corporate deposits increased by 9% on a YTD basis while CASA advanced by 23% also on YTD level as the bank continued to attracts strategic corporate clients.

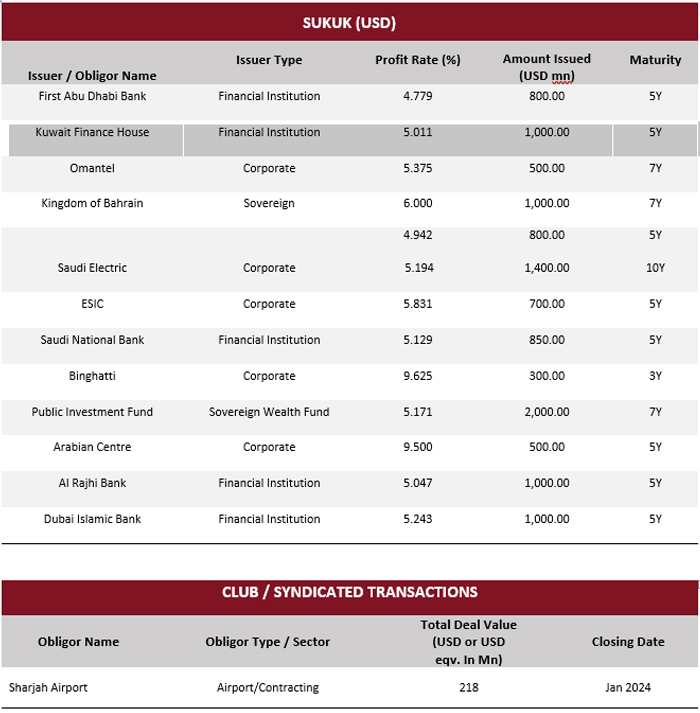

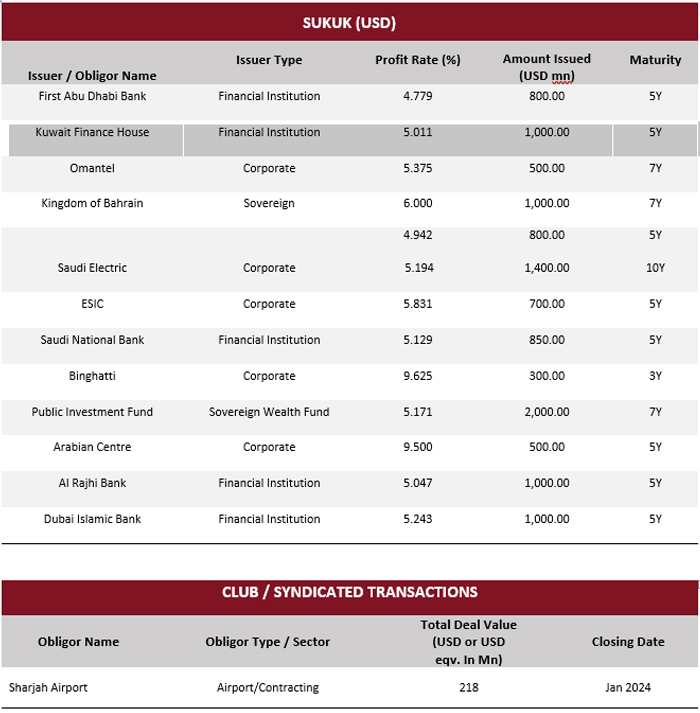

Treasury continued to provide a strong engine for growth as the curator of the bank’s fixed income book. The sukuk investment portfolio now stands at AED 76 billion, up a significant 37% YoY and 11% YTD, constituting a noteworthy 23% of the bank’s assets. Gross new sukuk investments during the year amounted to AED 7.8 billion, up 56% YoY. The portfolio carries an attractive yield of 4.8% up 27 bps YoY.

Key Highlights (Q1 2024)

- Dubai Islamic Bank successfully priced its third Sustainable Sukuk a landmark USD1 billion 5-year senior issue with a profit rate of 5.24% per annum representing a spread of 95 bps over 5-Year US Treasuries. The issuance was 2.5x over subscribed, a clear indication of how well the Bank's financial and sustainability story resonates with the regional and global investor base.

- During the quarter, the bank launched “SHAMS” Credit Card in partnership with Visa. The SHAMS Visa credit card is tailored for the diverse needs of every segment, including the affluent and emerging affluent. The card goes beyond rewards, offering a comprehensive suite of daily relevance and lifestyle benefits including 5% back on dining spends, 5% back on travel expenditure, complimentary Fitness First access, Costa Coffee, golf rounds, valet parking and many more benefits. SHAMS cardholders can also collect Wala’a rewards on their spends, with the flexibility to redeem them against flights, hotels, cash, retail transactions, and many other options.

- During the Holy Month of Ramadan DIB embarked on a bold new initiative further propelling its ESG agenda with the launch of the Ramadan Move-a-Thon. This campaign promoted a healthy lifestyle whilst including a culture of giving. The Ramadan Move-a-thon campaign, in partnership with Fitze, an innovative fitness app, engaged all participants to be part of a meaningful change by contributing towards a collective goal of 1 billion steps in 30 days. Each step taken supported DIB's pledge to donate AED 100,000 to Dubai Cares, an organization dedicated to making quality education accessible to underprivileged children and youth in developing countries.

DCM and Syndication Deals (Q1 2024)

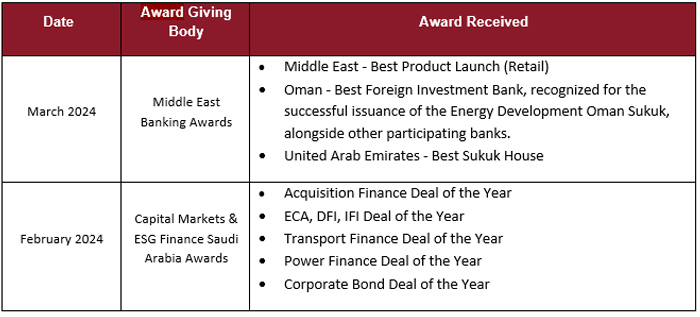

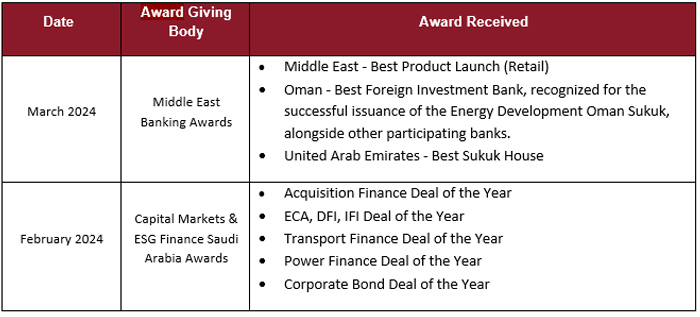

Awards List (2024 YTD)