- Net profit rebounds strongly from last quarter to AED 853 million signifying a clearly improving economic trend.

- Improving profitability supported by a 27% reduction in operating expenses YoY.

- Integration synergies materializing as efficiency build up continues.

- Cost income ratio of 27.5%, the lowest in the financial sector, positioning the bank as the most efficient player in the market.

Dubai Islamic Bank (DFM: DIB), the largest Islamic bank in the UAE and the second largest Islamic bank in the world, today announced its results for the period ending March 31, 2021.

First Quarter 2021 highlights:

- Total income reached AED 2.8 billion as the bank continued to display resilience in the given economic scenario.

- Profit before impairments rose to AED 1,614 million compared to AED 1,592 million in the same period last year.

- Group net profit of AED 853 million whilst lower YoY, excludes the one-off gain in Q1 2020 of AED 1 billion.

- Operating expenses of AED 612 million were lower by 27% year on year vs AED 839 million, driven by stringent cost discipline and materializing of substantial integration cost synergies.

- Cost to income ratio improves by 190 bps to 27.5% from 29.4% at YE2020, positioning the bank as the most efficient player in the sector.

- Impairment charges reduced by a significant margin signifying the success of the risk management strategy as well as improving market trend.

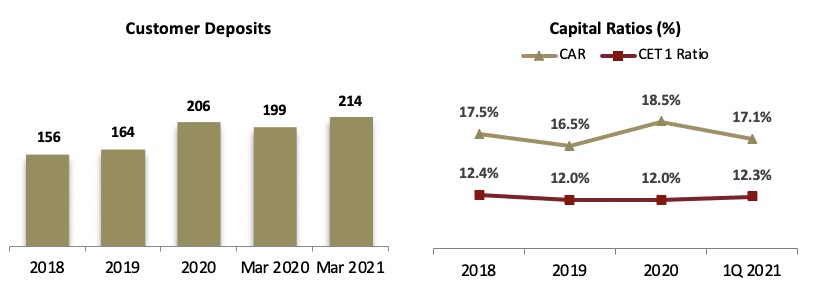

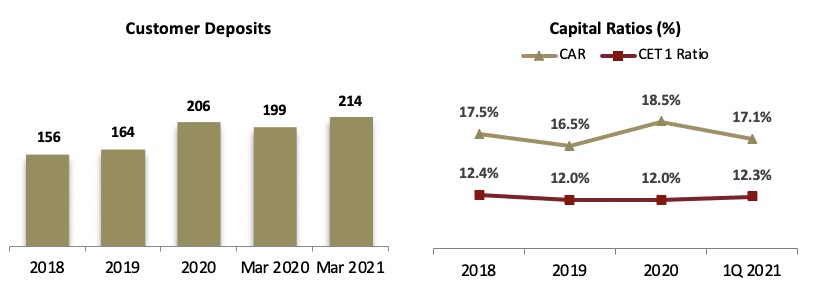

- Customer deposits increased to AED 214 billion from AED 206 billion, rising by 4% YTD and 7% YoY.

- Low cost deposit continue to remain strong with CASA at 40%.

- Strong liquidity position, with financing to deposit ratio at 91.7% and LCR of 127% is well above regulatory requirements under the TESS program.

- ROA at 1.2% and ROE at 9.6% remain robust given the challenging environment.

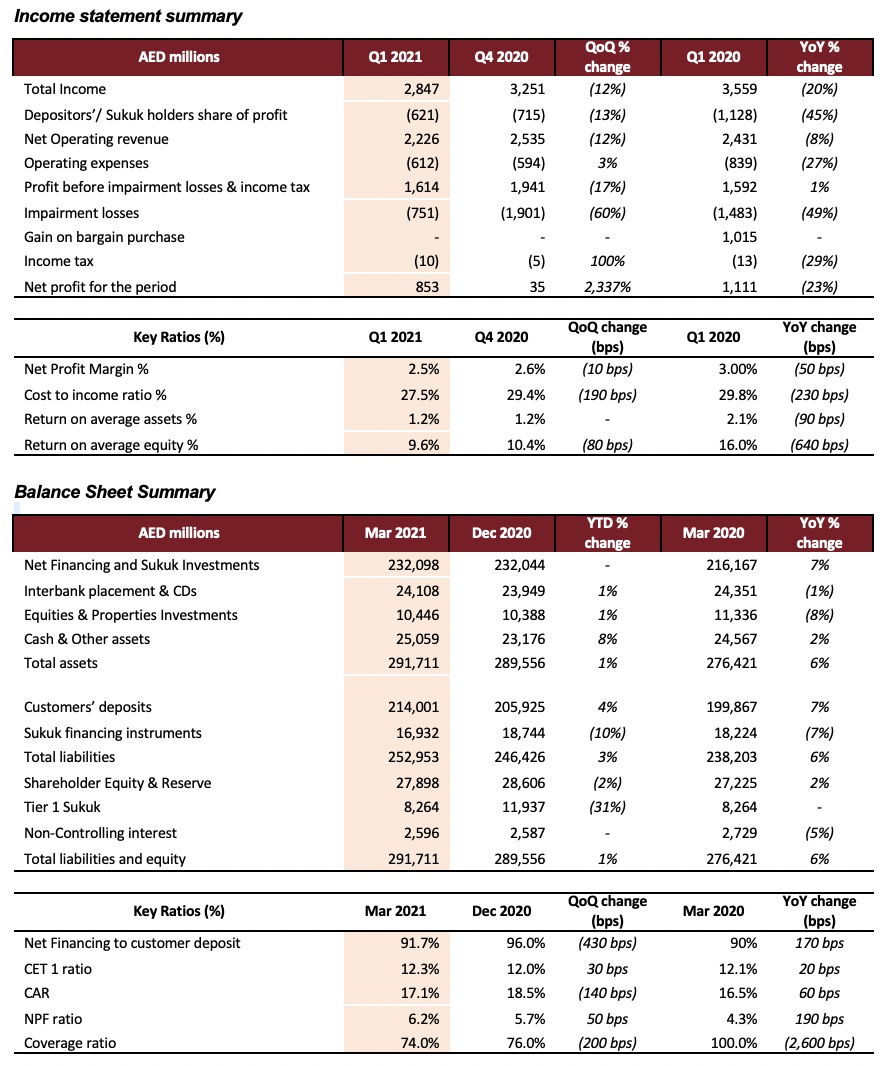

- Capitalization levels remained comfortably above minimum regulatory requirements, with CET1 at 12.3% and CAR at 17.1%.

- Strong year on year growth on key digital metrics.

- Mobile banking users - 20% YoY growth

- Mobile banking transactions – 43% YoY growth

- Internet banking users – 15% YoY growth

- Internet banking transactions – 57% YoY growth

Management’s comments for the first quarter ending March 2021:

His Excellency Mohammed Ibrahim Al Shaibani, Director-General of His Highness The Ruler’s Court of Dubai and Chairman of Dubai Islamic Bank

- IMF has revised positively the economic outlook on the UAE on account of the country’s robust and quick response to the challenges faced in times of the pandemic. Being a global leader in the vaccination race, the economic recovery is expected to accelerate consumer spending and business activities in the coming periods.

- The UAE banking sector continues to remain robust with healthy and well capitalized balance sheets. The further extension of the UAE CB’s TESS program will benefit and support the sector and DIB remains aligned to providing support to the domestic economy throughout this recovery period.

- Amidst the on-going market volatilities, DIB continues to deliver strong operating performance with total income of AED 2.8 billion during the first quarter of 2021. With robust fundamentals in place, DIB is well positioned to connect with the country’s large-scale economic programs such as the World EXPO, Dubai Industrial Strategy 2030 and the Dubai Urban Master Plan that will support future growth of the bank and the emirate of Dubai.

Abdulla Ali Obaid Al Hamli, Board Member and Managing Director

- DIB’s focus on digitization and optimization has further strengthened the bank’s position in the sector. With strong increase year on year on key digital metrics, the bank’s customers are now benefitting from enhanced customer journeys and experiences in a fast evolving operating environment.

- The introduction of agile ways of working have led to enhanced efficiencies and productivity. Digital trainings and virtual collaborations, constant safety and health measures across our branches, simplification of business processes and enhanced business continuity will ensure the bank to be less vulnerable to business disruptions and maintain a robust growth trajectory.

Dr. Adnan Chilwan, Dubai Islamic Bank Group Chief Executive Officer

- The signature strength of the balance sheet with 6% year on year expansion demonstrates the bank’s resilience in challenging conditions as well as the effective execution of its strategy to capture organic growth opportunities during economic uncertainties.

- Liquidity remains a strong suit with robust growth in customer deposits of 7% YoY and 4% YTD to reach to AED 214 billion. With LCR ratio of 127% well above the minimum regulatory requirements, the bank is ideally positioned to capture growth opportunities as market improves.

- Efficiency build up is critical to stability and profitability in a challenging environment. A focused and disciplined approach to managing OPEX has led to a cost income ratio of 27.5%, the lowest in the market.

- As significant headwinds remain in the current environment, we continue to approach the year with extreme prudence, with focus on low risk sectors and those showing consistent signs of recovery as the market improves. The bank has continued to build provisions during the quarter amounting to nearly twice the value for the same period last year on a normalized basis.

- Business momentum remains positive with profit before impairments increasing by 1%. As a result, we have achieved a substantial QoQ net profit increase when compared to Q4 2020, and a modest QoQ net profit decrease when compared to same period last year despite the one-off gain in Q1 2020.

- Our redefined strategy and refreshed institutional purpose and values through the #ReadyForTheNew campaign and the strategic ICARE program is already well underway. This will ensure the alignment of the bank towards the changing norms in the new landscape and bring considerable focus on improving service quality, with digital driving the agenda with major interactions and fulfillment in the times to come.

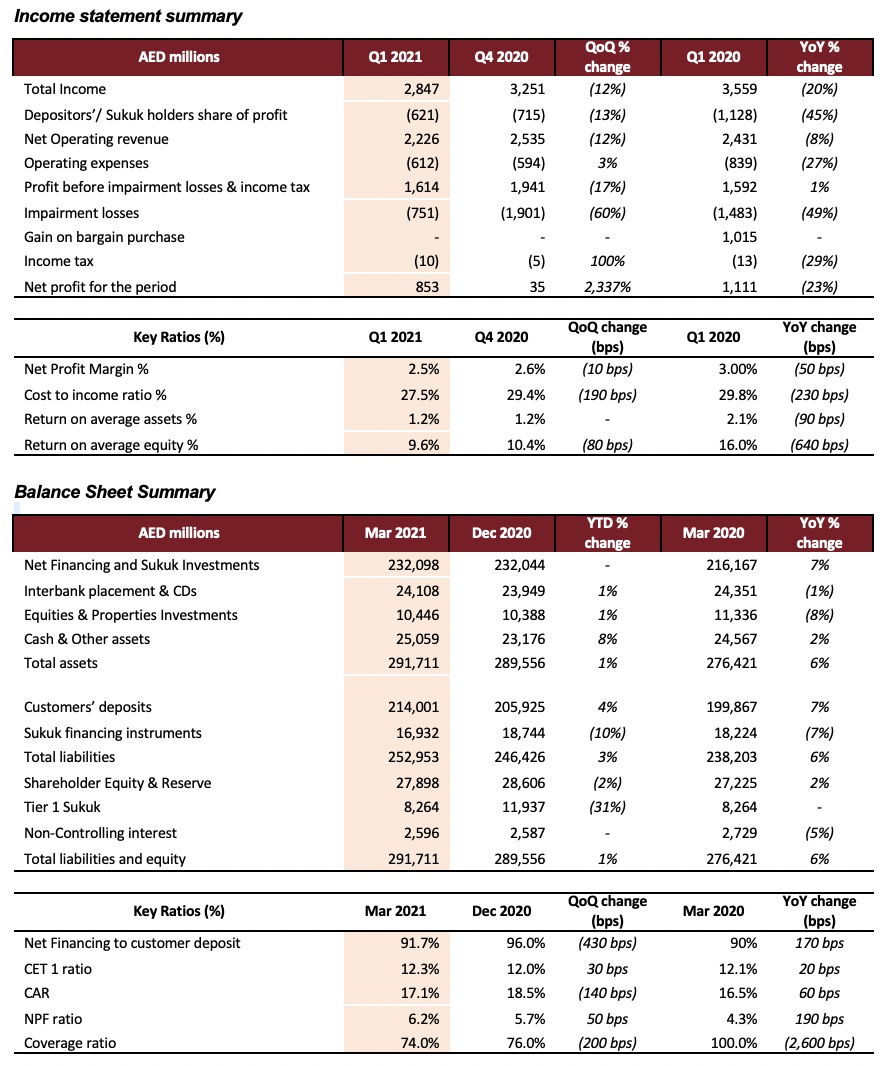

Financial Review:

Operating Performance

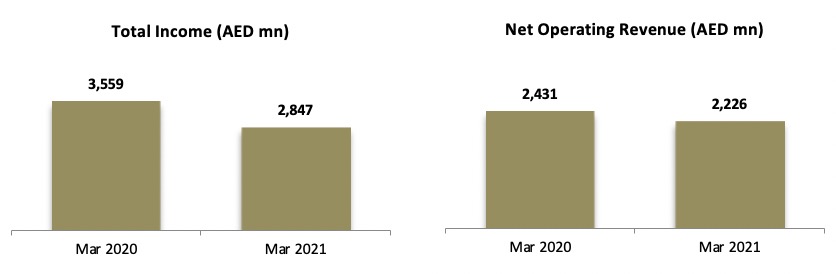

The bank’s total income in the first quarter of 2021 reached AED 2,847 million, compared to AED 3,559 million in the same period last year, lower by 20% reflecting softer operating environment and muted domestic retail activity, in relation to the pre-covid quarter last year.

Net operating revenue during the quarter reached to AED 2,226 million supported by lower cost of fund during the period. Commission and fees continue to support income growth, rising by 3% to reach AED 425 million in the first quarter. Profit before net impairment charges increased YoY to AED 1,614 million from AED 1,592 million in 1Q 2020. The net profit of the bank for the first quarter of 2021 reached to AED 853 million, only marginally lower despite significant one-off gain of over AED 1 billion in the comparable quarter last year.

Net profit margin stands largely stable at 2.5% despite the low-rate environment.

Operating expenses declined to AED 612 million compared to AED 839 million in the same period of last year, an improvement of over 27%. The reduction in operating expenses is attributed to the integration synergies achieved as well as overall focus on cost management. The lower expenses have led to an improvement in cost to income ratio by nearly 2%, which now stands at 27.5% vs 29.4% at YE2020. This is expected to steadily improve, as synergies continue to materialize. Impairment charges were lower at AED 751 million, reflecting the bank’s prudent approach to underwriting risk given the current market conditions.

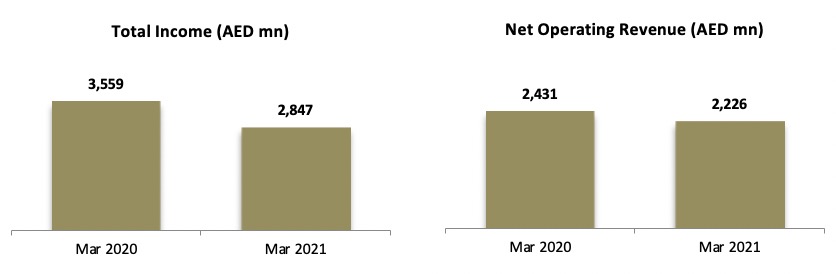

Balance Sheet Trends

Net financing & Sukuk investments remained stable at AED 232.0 billion for the first quarter of 2021, following some early repayments. Gross new consumer financing of nearly AED 3.3 billion achieved driven by a healthy growth in the mortgage and personal financing portfolio.

Customer deposits climbed strongly to AED 214.0 billion in the first quarter of 2021, from AED 205.9 billion at year-end 2020 reflecting a robust rise of 7% YoY and 4% YTD. CASA now stands at AED 84.9 billion representing about 40% of customer deposits. Net financing to deposit ratio stood at 92%, signifying ample liquidity whilst liquidity coverage ratio (LCR) remains comfortable at 127%, well above the minimum requirement set by the UAE Central Bank of 70%, as part of the TESS program.

Non-performing financing (NPF) ratio stood at 6.2%, with impaired financing at AED 12.9 billion vs AED 12.0 billion in end of 2020. Total provisions against financing assets were AED 8.8 billion with provision coverage including collateral at 102% as of March 2021. Cost of risk for the period was 101 bps.

Capital adequacy ratio stands at 17.1% and CET 1 ratio is stable at 12.3% during the first quarter of 2021.

Key business highlights:

- DIB successfully priced a landmark USD 500 million Perpetual Non-Call 5.5yrs Additional Tier 1 Sukuk with a profit rate of 3.375% per annum. This transaction represents the lowest ever pricing achieved by a GCC bank (both conventional and Islamic) on an Additional Tier 1 instrument and the lowest ever on a USD AT1 Sukuk globally. Despite the volatility witnessed in credit markets during the past month on account of US Treasury rates, achieving this landmark success in the current scenario is testament to the bank’s strong credit profile and standing with international and regional investors.

- DIB acted as an arranger and bookrunner for the UK as it issued its second Sukuk for £500 million with a 5-year maturity. The issuance attracted strong demand from investors in the Middle East, Asia and the UK. The issuance served to bolster UK’s reputation as an open international financial centre. The transaction achieved the objectives of Her Majesty’s Treasury by more than doubling the issuance size of the debut 2014 Sukuk issuance and providing critical liquidity in the Islamic financial market. The issuance was sold to high-quality institutional investors around the world.