- Total assets at nearly AED 300 billion, an increase of 29% YTD.

- Total income of around AED 9.9 billion supported by significant increase in fee income of 19%.

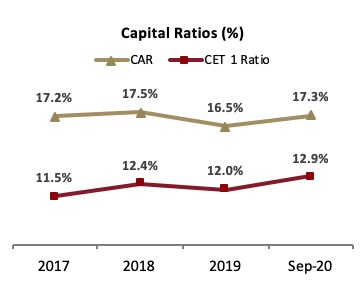

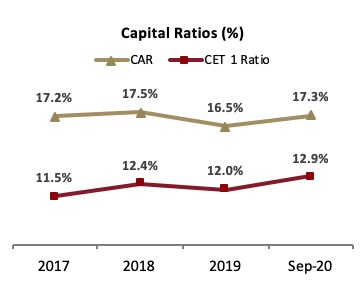

- Capital ratios and liquidity remain robust despite significant growth in earning assets

- Relief measures of nearly AED 8 billion extended to support customers under TESS program.

Dubai Islamic Bank (DFM: DIB), the largest Islamic bank in the UAE, today announced its results for the period ending September 30, 2020.

9M 2020 results highlights:

- Group Net Profit reached to AED 3,124 million during the first nine months of the year.

- Net financing and Sukuk investments rose to AED 234.5 billion vs AED 184.2 billion in 2019, up by 27% YTD.

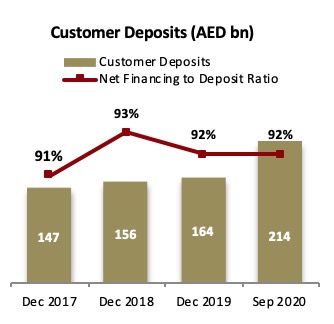

- Customer deposits increased to AED 214.6 billion up by 31% YTD.

- CASA component increased to 39% from 33% when compared to YE2019.

- Cost to income ratio stable at 29.4%.

- ROA stood at 1.70% and ROE at 14.0%.

- Financing to deposit ratio stood at 92%, signifying ample liquidity.

- NPF ratio at 4.8%, remains robust given the current market conditions.

- Overall coverage, including collateral at discounted value, stands at 114%.

- Capital adequacy (CAR) and CET 1 ratios improved to 17.3% and 12.9% respectively, despite growth and conservative provisioning.

Management’s comments for the period ending 30 September 2020:

His Excellency Mohammed Ibrahim Al Shaibani, Director-General of His Highness The Ruler’s Court of Dubai and Chairman of Dubai Islamic Bank, said:

- The global environment remains uncertain with geographies around the world yet to fully recover. At home, the UAE remains committed towards economic development with a strong focus on precautionary safety measures as we witness the gradual recovery of trade and business services. In addition, the proactive fiscal policies of the UAE government have supported the domestic banks to continue to operate profitably whilst simultaneously assisting and servicing customers during these trying times.

- The on-going consolidation of the banking sector in the GCC region is expected to continue with constrained growth opportunities and lower oil prices. DIB’s strategic acquisition of Noor remains on target for completion by year end. The anticipated synergies have already started to materialize which will pave the way for robust growth and greater returns for our shareholders in the years to come.

Dubai Islamic Bank Managing Director, Abdulla Al Hamli, said:

- The UAE’s strong international economic relations, stable government and advanced technology infrastructure will further support the recently announced government initiatives such as the retirement and remote working programs. DIB’s robust consumer business coupled with digital offerings remains aligned towards supporting immediate on-boarding of new customers as well as continuing to service and engage with them on the same.

- During these unprecedented times, our business continuity and crisis management plans were immediately engaged. This has enabled our highly dedicated and capable employees to continue on with their duties and be able to service our customers with minimal disruptions supported by technology enablers and extreme precautionary and safety measures.

Dubai Islamic Bank Group Chief Executive Officer, Dr. Adnan Chilwan, said:

- Even with the continued economic uncertainties and market volatilities over the past few months, the bank’s total income for the nine months of 2020 remained stable at nearly AED 10 bln, a significant achievement during these unprecedented times. Our diversified revenue streams continue to sustain the bank’s healthy profitability levels during the period as we see the net operating revenue actually increase to over AED 6.9 bln despite the pandemic.

- Focusing on low risk segments, the bank remains at the top in the market from earning assets growth perspective with nine months increase of 27% supported by gross new financing of around AED 42 billion. Despite the growth, liquidity remained strong at 92%.

- Notwithstanding significant growth, and substantial provisioning and impairments due to the conservative approach adopted, the strong profitability has pushed the capitalization ratios upwards with CET1 rising by 90 bps to circa 13% and overall CAR 17.3%, depicting a robust capital position.

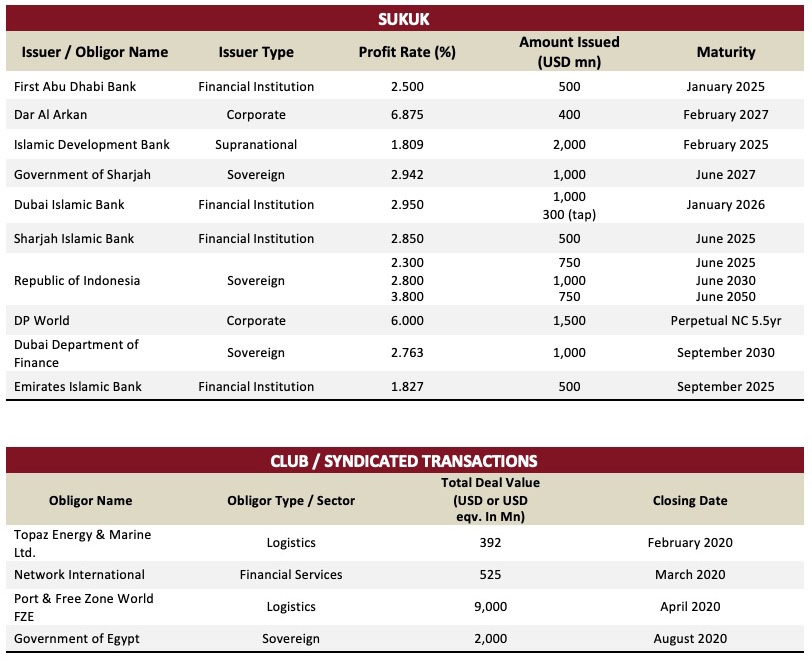

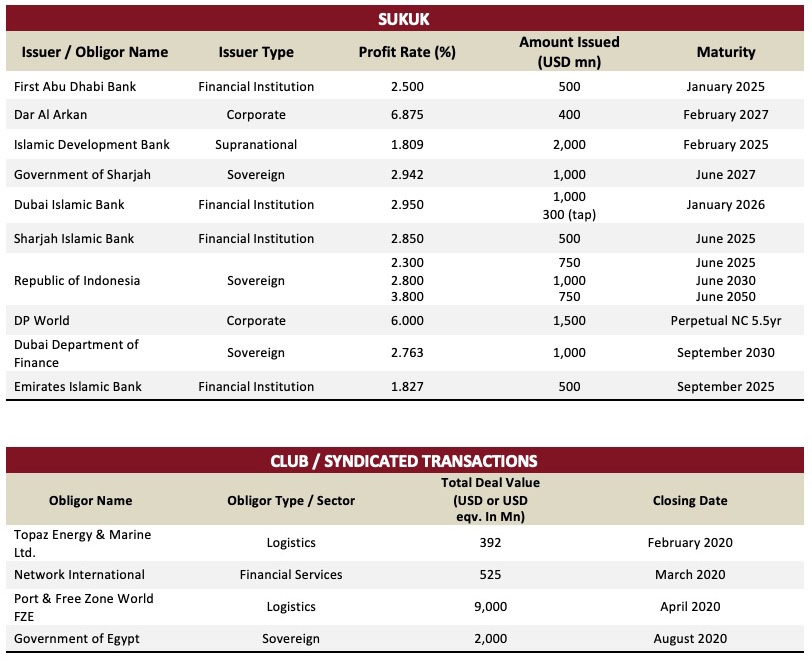

- As a leading player in the capital markets space, more than USD 20 bln of sukuk and syndicated transactions were executed to support the market. Furthermore, vital support was also provided to over 50,000 corporate and retail customers with nearly AED 8 bln in relief measures under the UAE CB’s TESS program.

- The Noor Bank acquisition remains on target for completion within the year. As synergies start to unfold, this key transaction will facilitate the acceleration of our business and strategic ambitions to sustain our leading position in the industry, now and in the post-covid future.

Financial Review:

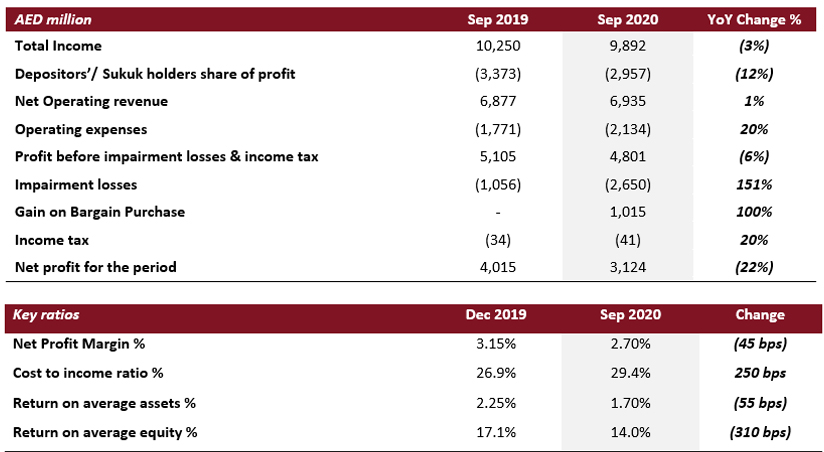

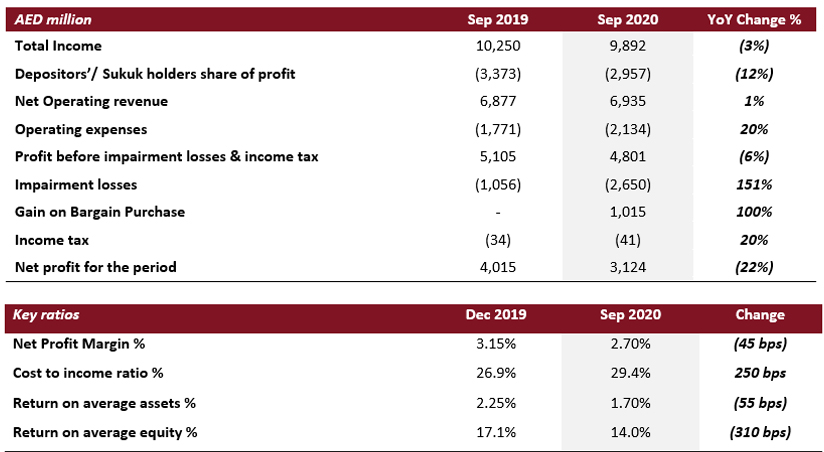

Income Statement highlights:

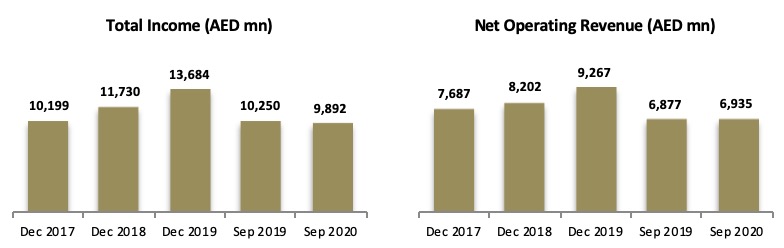

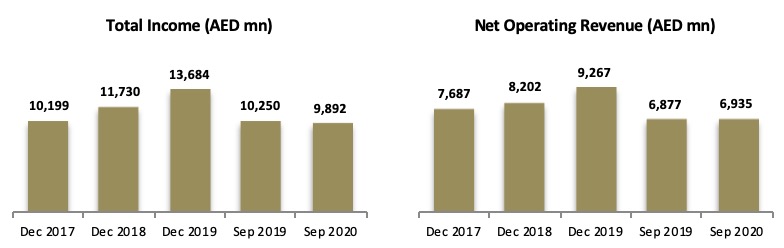

Income and Net Revenues

The bank’s total income reached nearly AED 9.9 billion for the nine months of 2020 whilst net operating revenue grew to AED 6.9 billion supported by core business growth as well as robust fees & commissions and FX income of AED 1.32 billion, an increase of 19% YoY.

Costs

Operating expenses reached AED 2,134 million in the first nine months of 2020 against AED 1,771 million during the same period last year. The rise in costs primarily stems from consolidation impact of Noor Bank as well as integration expenses in 1Q 2020. Cost to income ratio stood at 29.4% as of Q3 2020, and is expected to steadily improve as synergies materialize.

Net Profits

The net profits of the bank during the nine months of 2020 reached to AED 3,124 million. Despite the challenges in the global economy, the bank continues to demonstrate franchise strength and remain profitable during the on-going global crisis. The near completion of the Noor integration exercise is expected to bring further positive contributions towards the bank’s overall profitability.

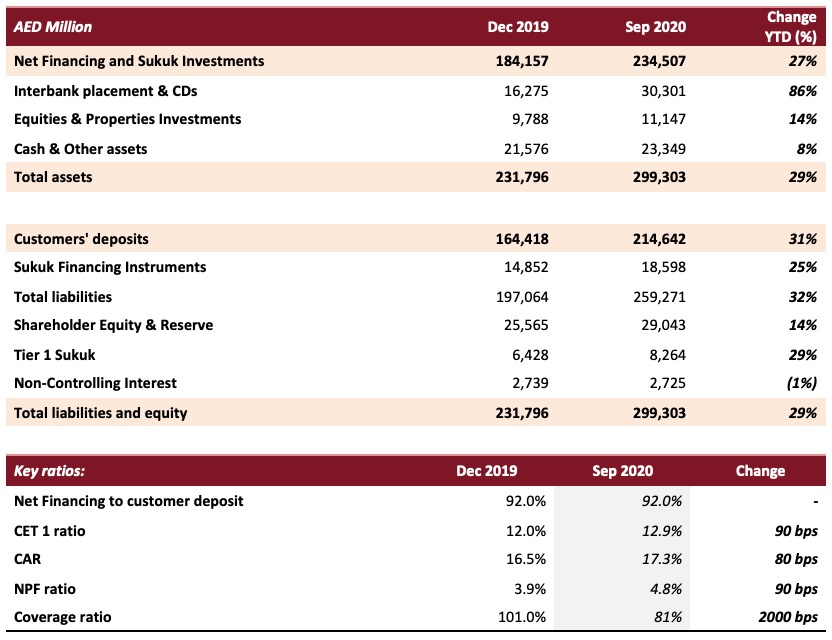

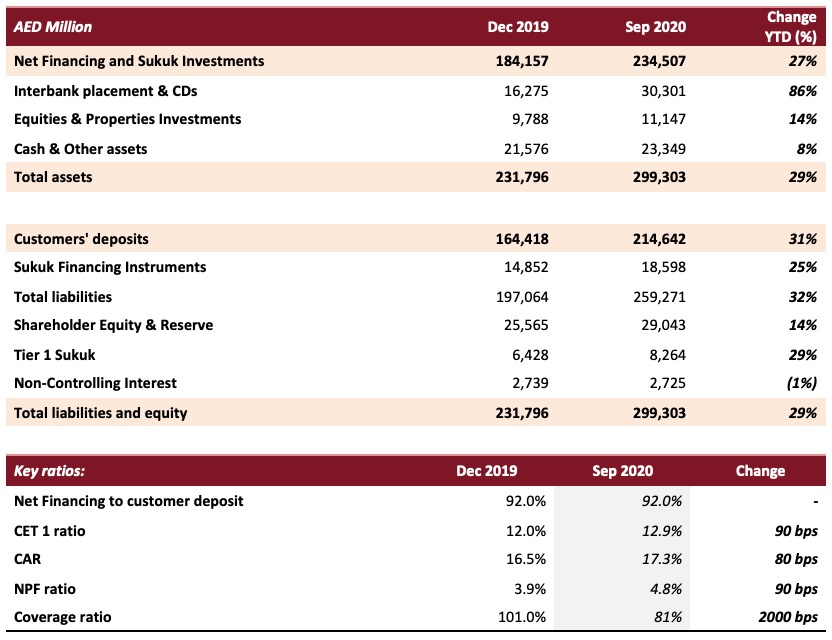

Statement of financial position highlights:

Financing and Sukuk portfolio

The net financing & Sukuk investments grew to AED 234.5 billion during the nine months of 2020 from AED 184.2 billion at the end of 2019, a robust rise of 27%. Nearly AED 42 billion were deployed in gross new financing growth driven by the realignment of strategy focusing on lower risk sectors, particularly sovereigns, and includes gross new consumer financing amounting to AED 9.5 bn to date.

Asset Quality

Non-performing financing (NPF) ratio and impaired financing ratio stood at 4.8% and 4.6% respectively. Cash coverage and overall coverage ratio, including collateral at discounted value stood at 81% and 114% respectively. Normalized cost of risk for the period was 99 bps (excluding one-off charges).

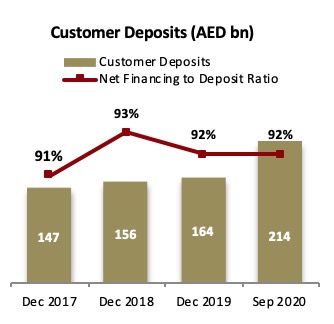

Customer Deposits

Customer deposits grew to AED 214.6 billion from AED 164.4 billion at year-end 2019 reflecting significant rise of 31% YTD.

CASA rose strongly by 52% YTD to AED 82.9 billion, growing from AED 54.6 billion in year-end 2019. This currently represents about 39% of customer deposits. Net financing to deposit ratio stood at 92%, signifying ample liquidity despite material growth in financing book.

Capital Adequacy

Capital adequacy and CET 1 ratios improved to 17.3% (+80 bps YTD) and 12.9% (+90 bps YTD) respectively. Despite strong growth during the year, capital levels remain intact and well above the minimum regulatory requirement.

Q3 2020 - Key business highlights:

- To support and mitigate the impact of the pandemic in the domestic economy, the UAE Central Bank announced a comprehensive TESS program providing all banks with Zero Cost Facility (ZCF). As at 30 September 2020, the bank’s customers benefited from nearly AED 8 billion which included relief to the customers from the payment of instalments on outstanding facilities for affected private sector and retail banking customers who approached the bank.

- Noor bank integration remains on track with key deliverables on policies and operating models completed. The bank continues to progress in terms of its technology platforms integration and end-to-end product and process harmonization, with minimal impact for customers. Targeted completion time will be during Q4 2020.

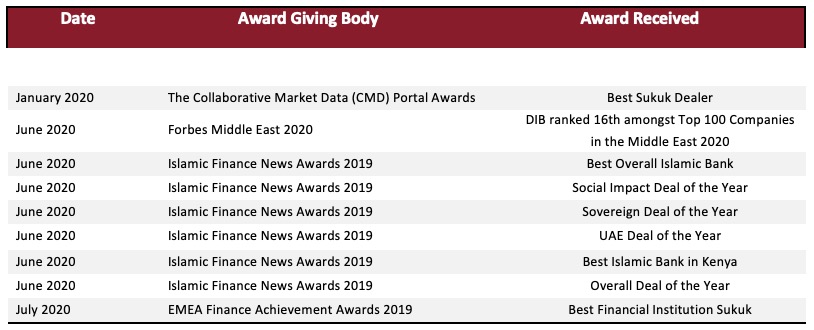

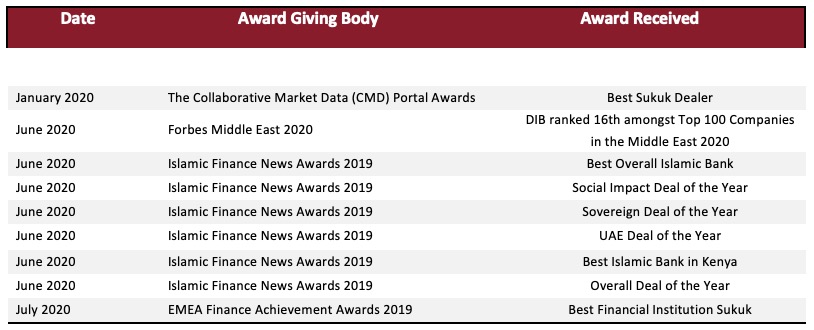

- During the annual Islamic Finance News (IFN) awards 2020, DIB’s contributions to the Islamic finance industry was acknowledged with 6 prestigious awards. DIB also landed the “Best Overall Islamic Bank”, “Social Impact Deal of the Year” in the UAE, the “Sovereign Deal of the Year”, the “UAE Deal of the Year”, and the “Overall Deal of the Year” awards. DIB Kenya picked up the “Best Islamic Bank” award in Kenya for the second time, a testimony to the bank’s achievements in the short tenure thus far in the country. The sheer diversity of accolades received clearly evidences the bank’s commitment, dedication and support to the progression and development of the Islamic finance industry worldwide.

9M 2020 DCM and Syndication Deals

Year to Date Industry Awards (2020)