- Total income reaches AED 13.7 billion, up by 17% YoY

- Net Income grew to AED 9,267 million, up 13% YoY

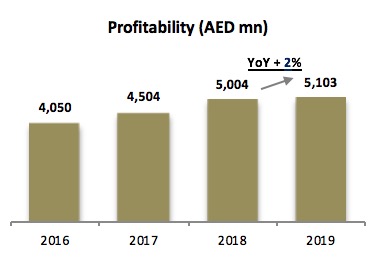

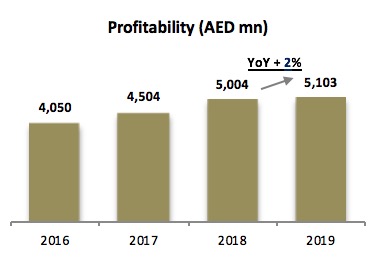

- Net Profit at AED 5.1 billion, up by 2% YoY

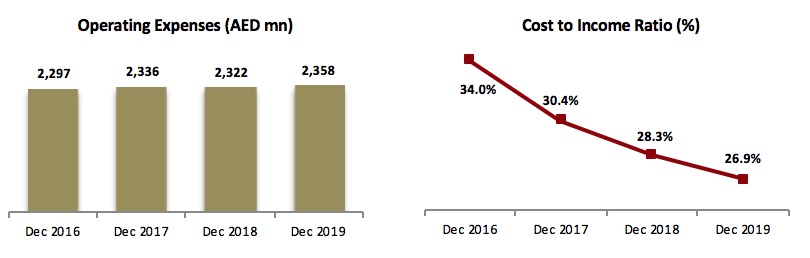

- Cost to income ratio now at 26.9%, amongst the best in the market

- Noor Bank acquisition complete, with integration underway to realize the synergies and boost returns

- DIB Board has recommended an increase in Foreign Ownership Limit to 40%, subject to regulatory and corporate approvals

Dubai Islamic Bank (DFM: DIB), the largest Islamic bank in the UAE, today announced its results for the period ending December 31, 2019.

Full Year 2019 Results Highlights:

Sustained Performance

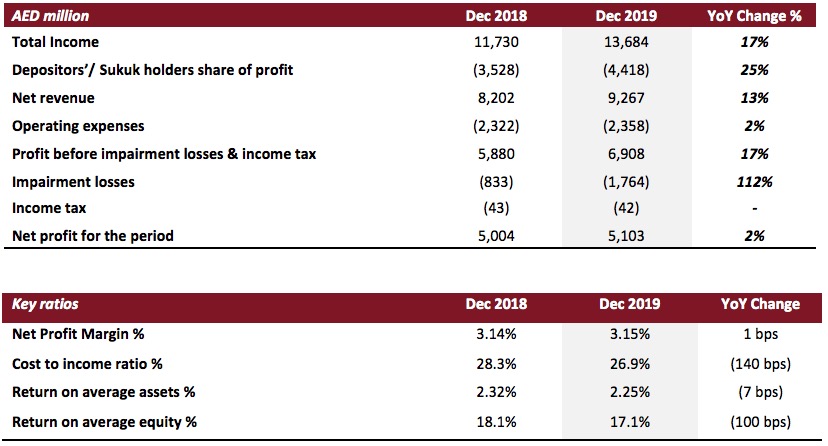

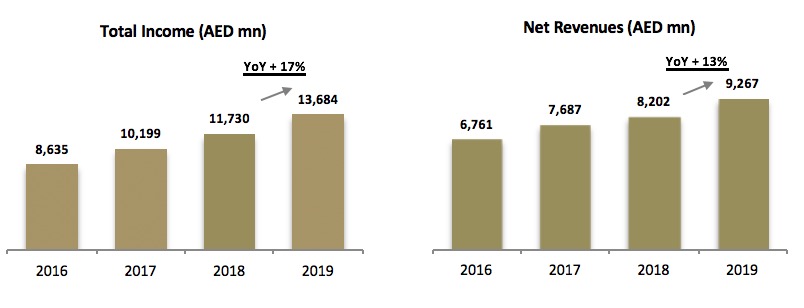

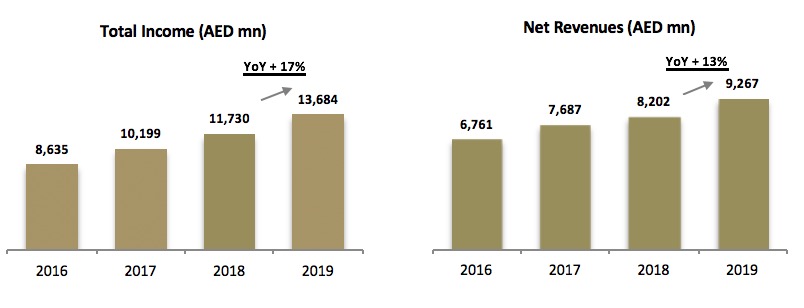

- Total Income reached AED 13,684 million, up by 17% YoY compared to AED 11,730 million.

- Group Net Profit increased to AED 5,103 million, up 2% YoY compared to AED 5,004 million.

- Net Income grew to AED 9,267 million, up 13% YoY compared to AED 8,202 million.

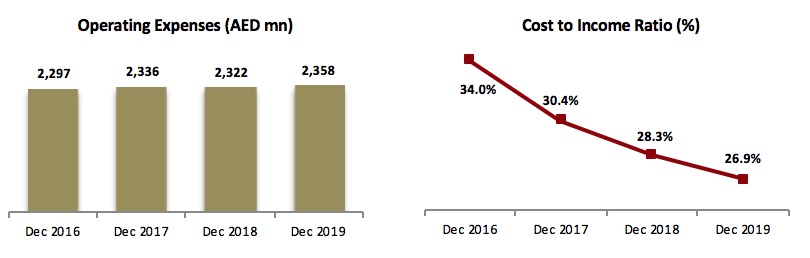

- Operating expenses continue to be stable at AED 2,358 million vs AED 2,322 million in 2018.

- Net operating profit before impairment charges grew by 17% YoY to AED 6,908 million.

- Cost to income ratio continues to improve now at 26.9% compared to 28.3% at the end of 2018.

- Net Profit Margin at 3.15%, is at the higher end of the guidance for the year.

- ROA is at 2.25% and ROE is at 17.1% for the year.

Managed Expansion, focused on profitable growth

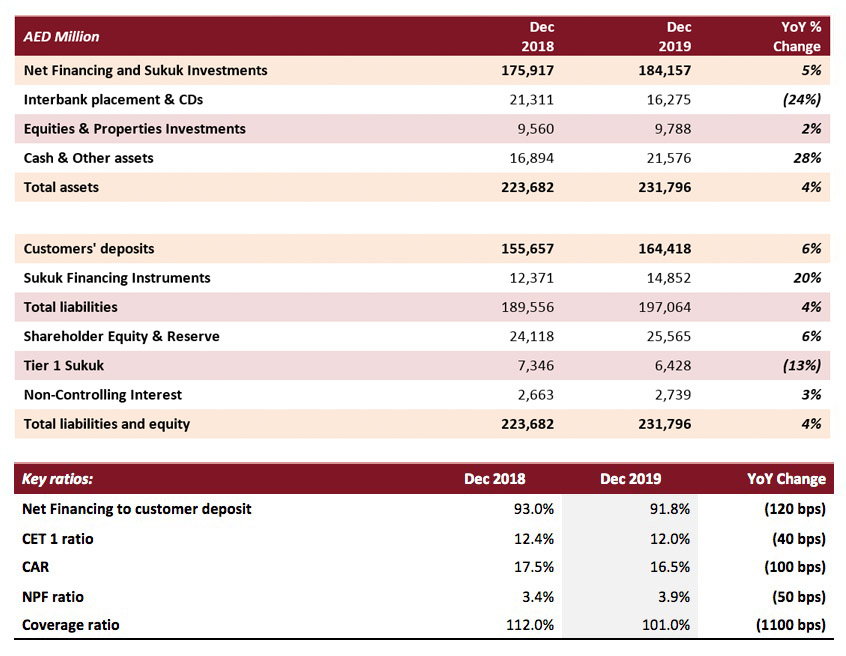

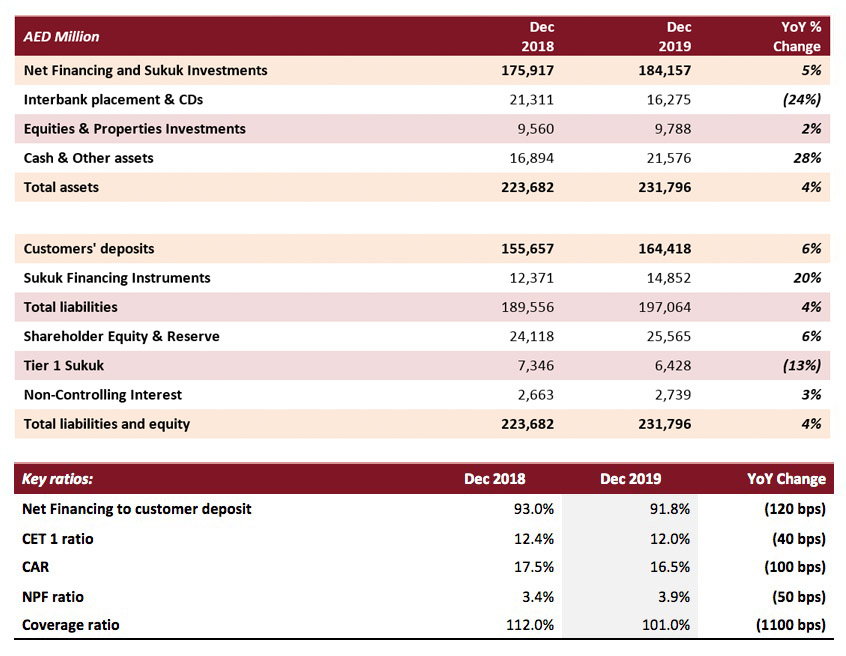

- Net Financing & Sukuk investments rose to AED 184.2 billion up by 5% YoY.

- Total Assets stood at AED 231.8 billion, up by 4% YoY.

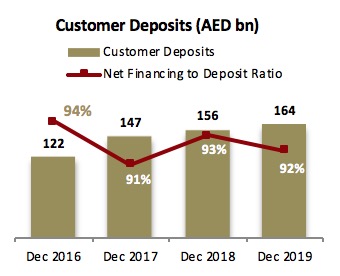

- Customer deposits increased to AED 164.4 billion up by 6% YoY.

- CASA deposits stand at AED 54.6 billion in 2019, representing 33% of customer deposits.

- Financing to deposit ratio stood at 92%.

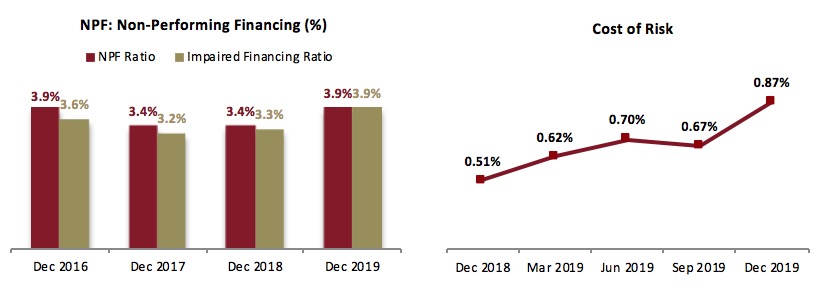

- NPF ratio is at 3.9%, with cash coverage ratio at 101%.

- Overall coverage, including collateral at discounted value, stands at 135%.

Robust capital ratios

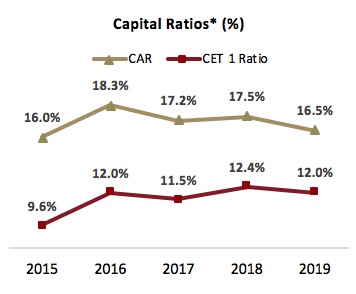

- Capital adequacy ratio is at 16.5%, as against 13.50% minimum requirement.

- CET 1 is at 12.0% as against minimum requirement of 10.00%.

- DIB’s Board of Directors recommends the distribution of a cash dividend of 35%, subject to AGM approval.

Management’s comments for the period ending December 31, 2019:

His Excellency Mohammed Ibrahim Al Shaibani, Director-General of His Highness The Ruler’s Court of Dubai and Chairman of Dubai Islamic Bank, said:

- Over the past decade, the UAE has witnessed various regulatory advancements, aiding economic progress, including higher investment flows and rising visitor numbers. As we prepare to embark on the biggest national strategy towards the future of the nation, DIB is firmly positioned towards achieving these great opportunities within local as well as international markets.

- The UAE banking system and financial markets remain strong, with sound capitalization, whereby Dubai Financial Market (DFM) was amongst the top 3 performing markets in the region in 2019. This clearly demonstrates the government’s sound reforms and investment policies, ensuring Dubai’s position as the leading financial hub in the region.

- The bank’s growth performance over the years has resulted in a balance sheet expansion to more than AED 230 bn, with a market cap crossing USD 10 billion. With the much anticipated 2020 major economic events, DIB’s strategic focus remains solid towards growing our customer base and maximizing the value for our shareholders.

Dubai Islamic Bank Managing Director, Abdulla Al Hamli, said:

- Dubai is on its way to stronger economic growth, with a rising GDP and higher non-oil trade volumes, driven by positive economic reforms, which serve to continuously attract investments into the emirate. DIB remains committed to develop the key sectors driving the growth, thus ensuring Dubai’s market competitiveness on the global map.

- In 2019, we have set the foundations towards enhancing the digital journey of our customers, and the year saw major milestones, such as the launch of our digital lab and academy. The future is bright for financial institutions embracing technological advancements, and we at DIB, will continue to be at the forefront in providing our customers with premium and enhanced services and experiences.

Dubai Islamic Bank Group Chief Executive Officer, Dr. Adnan Chilwan, said:

- We have and will continue to redefine the Islamic Banking landscape. Our aim is to make DIB the source of innovation for the industry as a whole. This is what is driving us today to deliver the promise of digital with agility, the positive impacts of which are already being experienced by our customers. Our recently launched services under the “Banking in Minutes” theme has seen new to bank customers opening relationships with DIB from the comfort of their homes and offices, without the need for paper, branch visits, or interaction with a person – everything is simply done through our growing suite of services offered on the DIB mobile app, and perhaps more importantly, in a matter of minutes. The mobile banking experience will get richer and richer as we progress this year for both existing and potential customers.

- Whilst our organic growth has been well above the market over the last five years, CAGR of 13% (assets ’14-’19), we are always on the lookout on how to accelerate this further. Noor Bank acquisition is a prime example of the same, and with the transaction completed, we are now fully geared to push forward with the integration in the shortest possible timeframe, and realize the extensive synergies expected from this deal.

- DIB has continued to challenge the norms and prove its resilience year on year, despite global and regional growth constraints. Our sustained earnings, with profitability of over AED 5bn, is a clear manifestation of the strategic direction we have set in place, in order to provide only the best and most innovative services to our ever-growing customer base.

- We remain focused on managing the growth and risk of our balance sheet, aligned to the vulnerabilities of the current operating environment and broader market conditions, whilst retaining our capital and liquidity strength indicated by strong overall capitalization of 16.5% and LDR of 92%. Efficiency building continues, thus resulting in an industry leading cost to income ratio of 26.9%.

- With quality business at the top of the agenda, our revenues continue to rise, with significant growth in total income of 17% YoY. Prudent risk management practices remain at the core of this growth, in line with our strategies to mitigate risks and build cushions to insulate against any event in today’s ever changing economic landscape. Our persistent efforts to strengthen asset quality have led to NPF ratio declining from 11% in 2013 to under 4% in 2019.

- As the UAE enters a new phase of economic growth, DIB’s unwavering commitment towards aligning with trends shaping the global economy, strengthening the relationship with our customers and investing in our business, will continue to drive our long-term sustainable growth agenda.

Financial Review

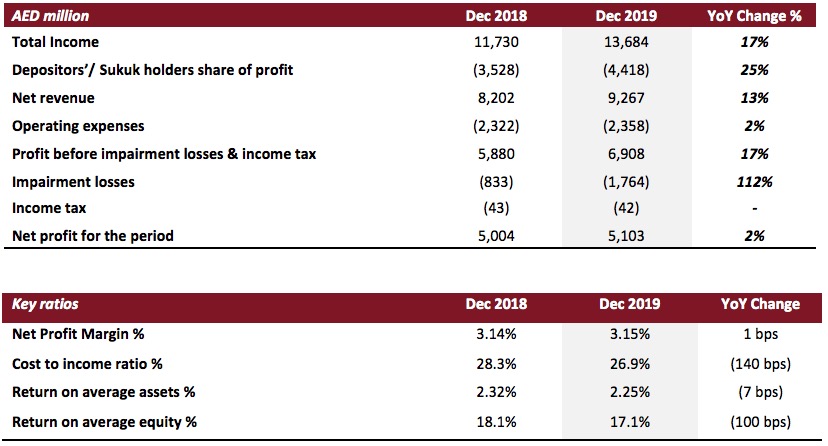

Income Statement highlights:

Income and Revenue

The bank continued its strong performance with a double digit rise in total income of 17% YoY, now reaching AED 13,684 million for the year ending 2019. Focus on quality business has led to robust growth in core income, with net revenue amounting to AED 9,267 million, an increase of 13% compared with AED 8,202 million in 2018.

Costs

Operating expenses for the year ending 2019 remained broadly stable at AED 2,358 million compared to AED 2,322 million in 2018. Cost to income ratio continued its healthy trend, now at 26.9% compared to 28.3% at the end of 2018. Managing costs continues to be a key strength of the bank, as the C/I ratio remains amongst the strongest in the sector.

Revenue

On the back of double digit rise in total income of 17%, and a 13% rise in net revenue, supported by optimal cost management, earnings momentum continued in 2019. Management remains focused on quality asset growth built around prudent risk management practices leading to net profit growing to AED 5,103 million.

Statement of financial position highlights:

Financing and Sukuk portfolio

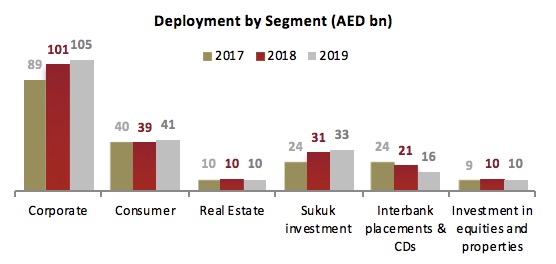

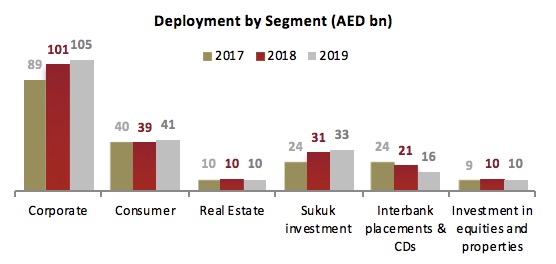

Net financing & Sukuk investments increased to AED 184.2 billion for the year ending 2019 from AED 175.9 billion at the end of 2018, a rise of nearly 5%. Corporate banking financing assets currently stand at AED 105 billion, whilst consumer financing assets stood at AED 41 billion. New gross financing for the consumer book has been higher in 2019 and has crossed AED 14 billion, compared to AED 13 billion in 2018. The growth is driven not just by quality business expansion, but also via a focus on optimizing the bank’s delivery channels, including mobile platforms. Commercial real estate concentration is within guidance, at around 21%.

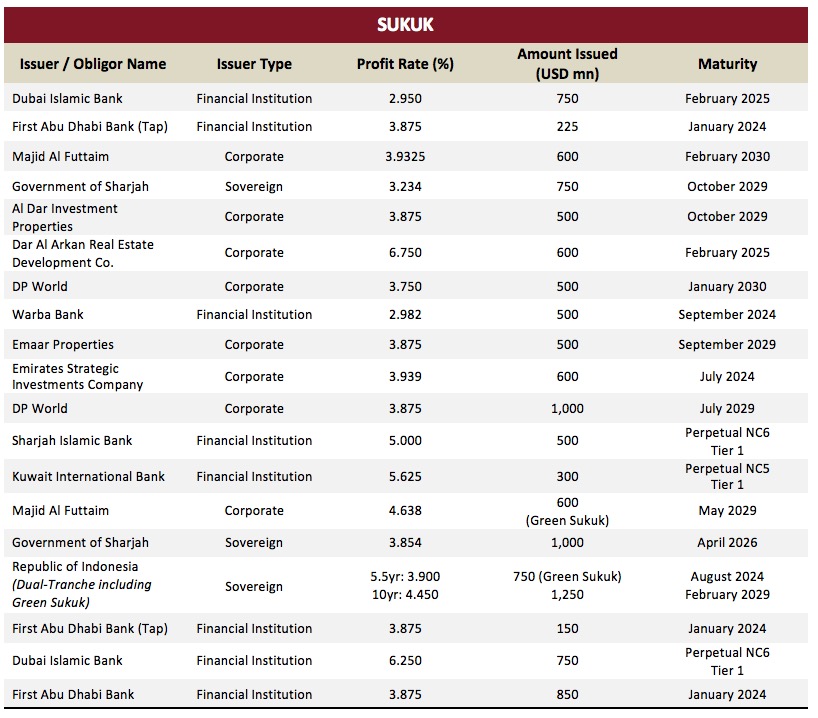

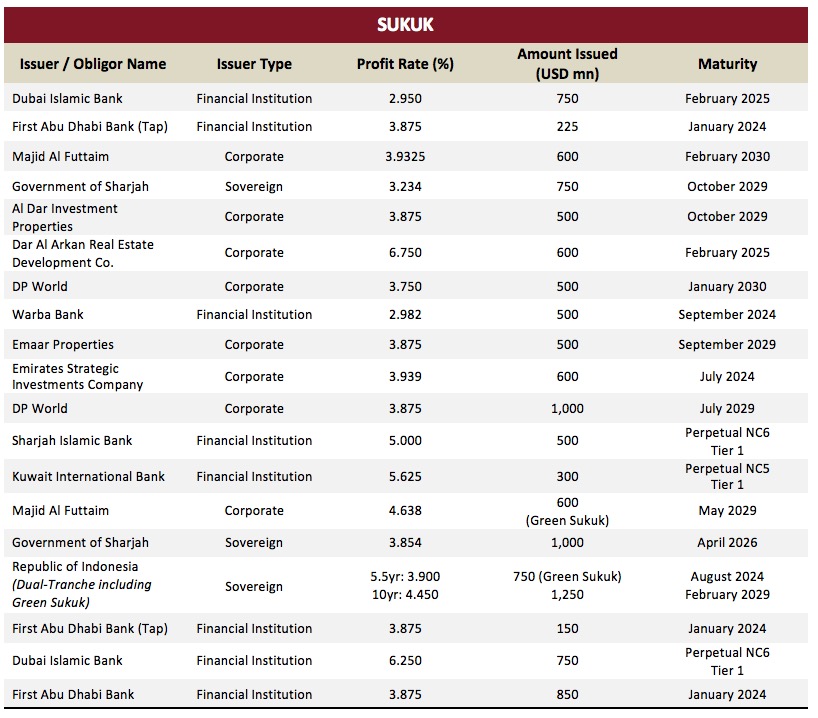

The bank’s high margin Sukuk portfolio reached AED 33 billion in the year ending 2019 vs AED 31 billion in 2018. The portfolio primarily consists of rated sovereign institutions in domestic and strategic growth markets, making DIB one of the most active financial institutions in the Islamic capital markets space. The bank’s total assets now stand at AED 232 billion, a growth of 4% YoY.

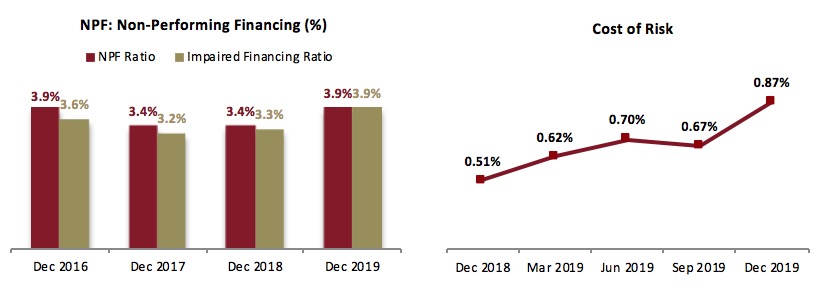

Asset Quality

For the year ending 2019, non-performing financing ratio and impaired financing ratio stood at 3.94% and 3.89%, respectively. Cash coverage stood at 101%, and overall coverage ratio, including collateral at discounted value reached 135%, with cost of risk (on gross Islamic & financing assets) at 87 bps.

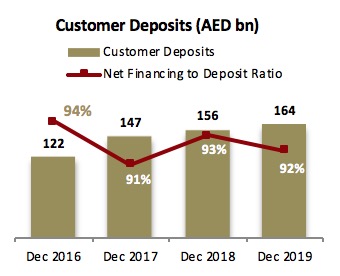

Customer Deposits

Customer deposits for the year ending 2019 reached AED 164 billion from AED 156 billion at the end of 2018. CASA deposits now stand at AED 54.6 billion, up from AED 53.9 billion in 2018. This currently represents 33% of customer deposits. Net financing to deposit ratio stood at 92%.

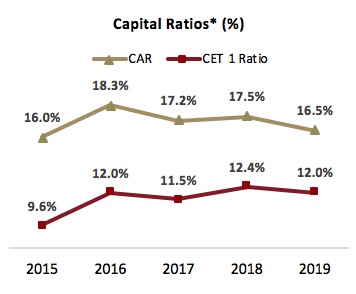

Capital Adequacy

Capital adequacy ratios remained robust with overall CAR and CET 1 ratio for the year 2019, standing at 16.5%, (against minimum CAR requirement of 13.5%), and 12.0%, (against minimum CET1 requirement of 10%), respectively. DIB has been designated as a Domestic Systemically Important Bank (D-SIB) by the regulator, which signifies the importance of the franchise to the financial sector in the country.

* * Above graph reflects amended prior year values under the new Basel III regime

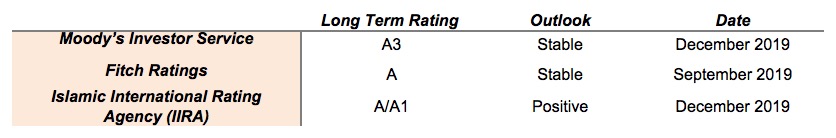

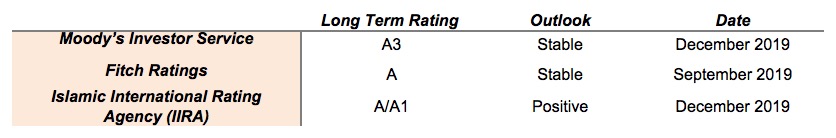

Ratings:

- December 2019 – Moody’s published a DIB credit opinion update reaffirming the bank’s long term issuer rating of ‘A3’ along with a “Stable” outlook, reflecting the bank’s strong retail franchise in the UAE, solid profitability & liquidity and stable asset quality & improved coverage levels.

- September 2019 - Fitch Ratings has also reaffirmed Dubai Islamic Bank’s (DIB) Long-Term Issuer Default Rating (IDR) at ‘A’ with a “Stable” outlook, reflecting strong domestic franchise, healthy profitability, sound funding & liquidity and adequate capital ratios.

- December 2019 – Islamic International Rating Agency (IIRA) has reaffirmed ratings on Dubai Islamic Bank with international scale ratings of A/A1 with a revised outlook on the national scale ratings to ‘Positive’ from ‘Stable’. The re-affirmed ratings from IIRA is a reflection of the bank’s superior performance over the last few years supported by strong balance sheet and sustained high income generation.

Q4 2019 - Key business highlights:

- Shareholders of DIB approved the acquisition of Noor Bank, the operations of which will be fully integrated into DIB. With the acquisition, DIB is set to position itself as one of the largest Islamic banks in the world, with total assets exceeding AED 275 billion (USD ~75 billion). The acquisition will strengthen Dubai’s position as a global centre for Islamic finance and will offer opportunities for DIB to further develop its successful growth strategy.

- Dubai Islamic Bank successfully closed a USD 750 million 5-year Sukuk with a profit rate of 2.950% per annum. The transaction is DIB's second foray into the international capital markets in 2019, the first being a USD 750mn Additional Tier 1 Sukuk instrument priced earlier this year. The Sukuk's profit rate of 2.95% is the tightest achieved by an FI Sukuk in 2019. The Sukuk was issued as a drawdown under DIB's USD 7.5 billion Trust Certificate Issuance Programme, which is listed on Euronext Dublin and NASDAQ Dubai.

- The final quarter of 2019 saw reaffirmations from (2) ratings agencies (Moody’s and IIRA), both re-affirming the bank’s ratings, driven by healthy profitability, stable asset quality and strong capital ratios. IIRA revised the bank’s outlook on the national scale ratings to ‘Positive’ from ‘Stable’.

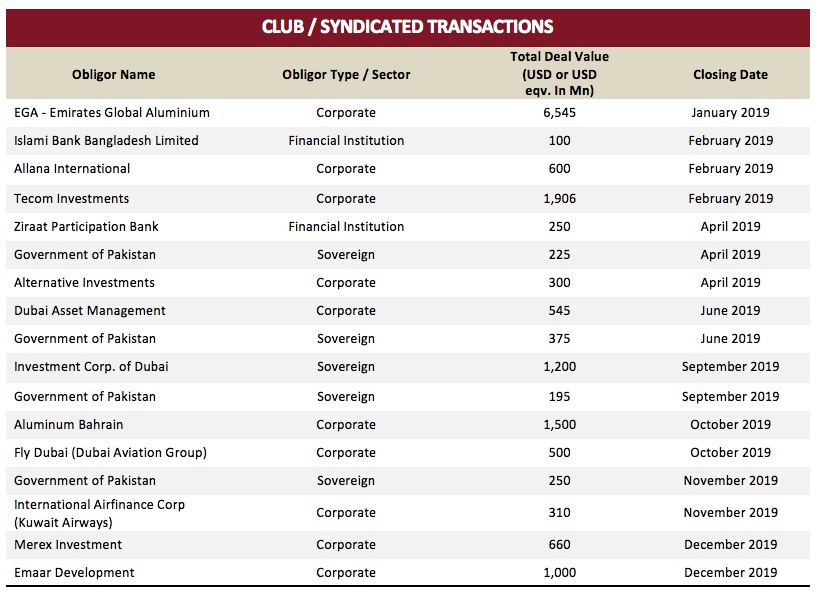

- In 2019, DIB continued to be at the forefront of the Islamic financing and capital markets space having completed over 30 transactions valued at a total of USD 30bn. DIB executed high profile deals for a range of clients from sovereigns, supranationals, quasi-sovereigns, large corporates to financial institutions. This strong performance has led to DIB capturing the top spot in both the 2019 EMEA Islamic Financing Mandated Lead Arranger and Bookrunner League Tables by Bloomberg. In terms of the Islamic capital markets, DIB remained the Middle East Leader in the 2019 International Sukuk League Table by Bloomberg, holding the 3rd position globally.

- DIB introduced “Banking in Minutes,” entering the new decade as a “Digitally Intelligent Bank.” In line with the country's digitization efforts, the bank has, for many years, been active in championing the use of technology as a means of empowering its customers and simplifying their banking experience. With ‘Banking in Minutes’, DIB drives unprecedented enhancements to customer experience with "tech that helps," thus demonstrating the bank’s utmost focus on what the customer really wants. In addition, new non-DIB customers can now also establish a relationship electronically and benefit from a seamless, hassle-free, convenient and on-the-go approach to financial services.

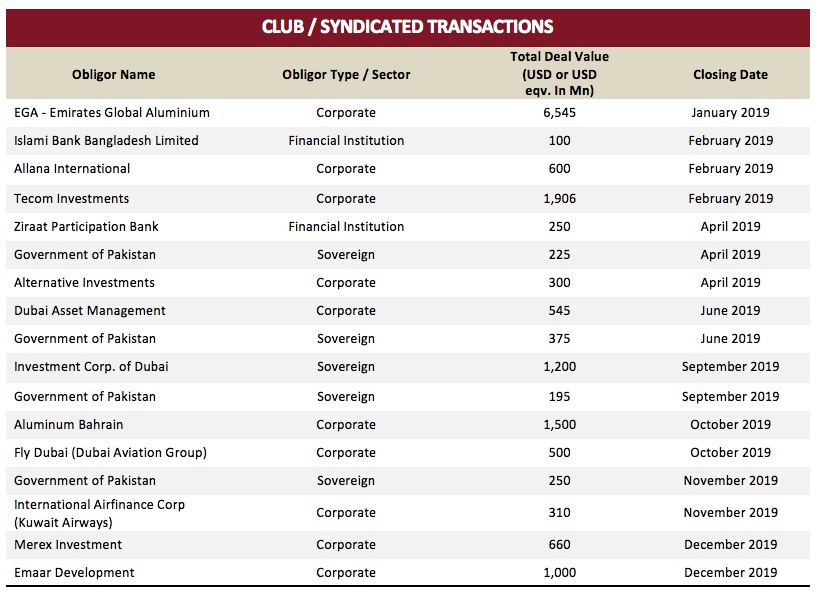

2019 Syndications and Deals

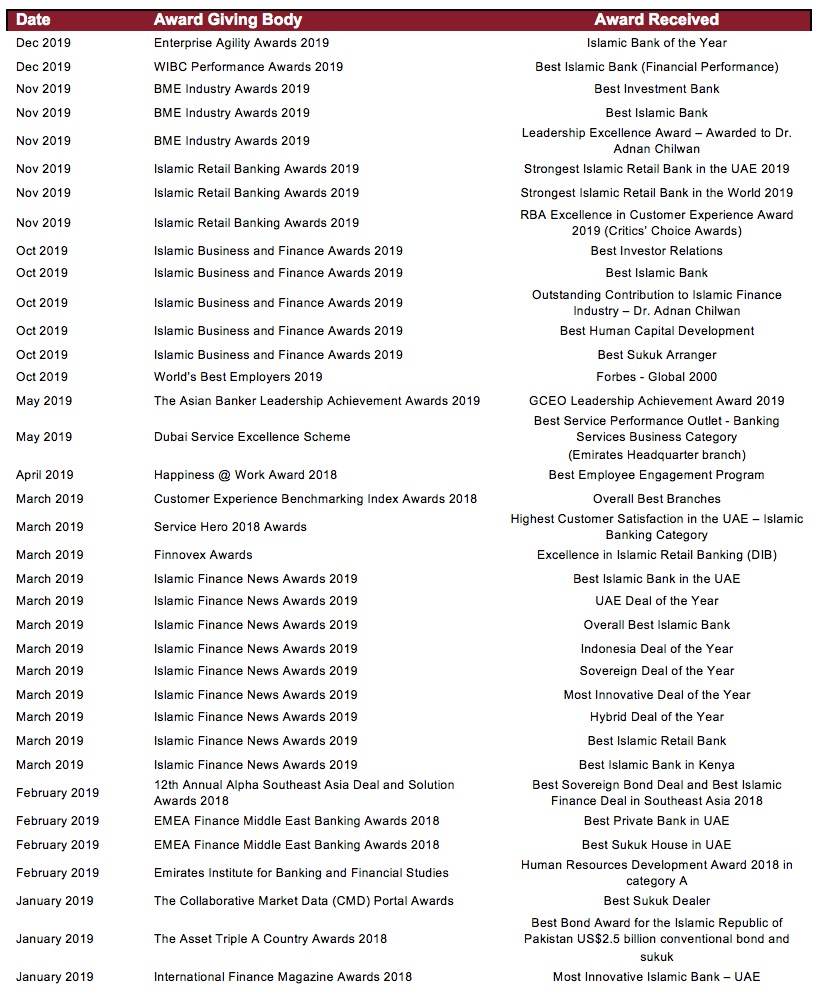

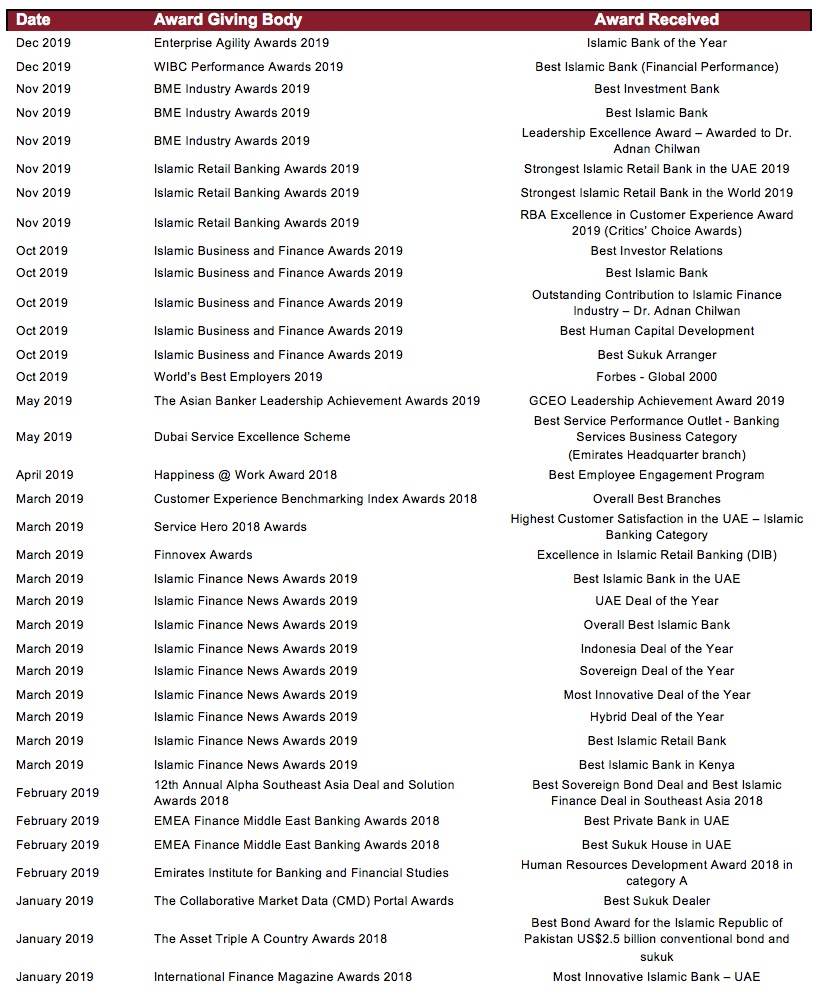

Industry Awards (2019)