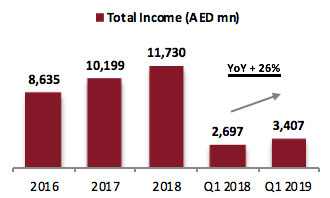

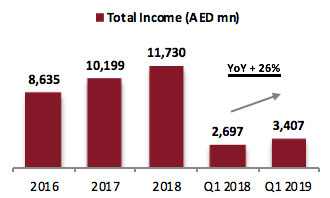

- Total income reaches AED 3.4 billion, up by 26% YoY.

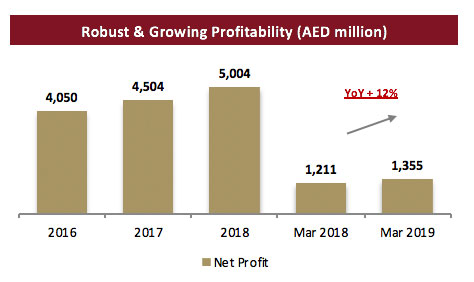

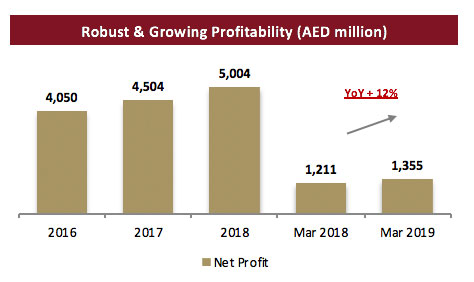

- Net Profit increases to AED 1.3 billion, up by 12% YoY.

Dubai Islamic Bank (DFM: DIB), the largest Islamic bank in the UAE, today announced its first quarter results for the period ending March 31, 2019.

Q1 2019 Highlights:

Sustained growth in profitability (Q1’ 19 vs Q1’ 18)

- Group Net Profit increased to AED 1,355 million, up 12% compared to AED 1,211 million.

- Total Income increased to AED 3,407 million, up by 26% compared to AED 2,697 million.

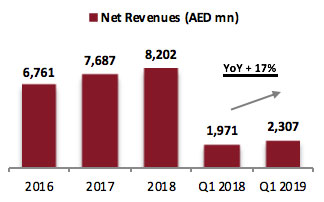

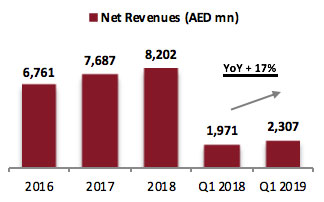

- Net Operating Revenue grew to AED 2,307 million, up 17% compared to AED 1,971 million.

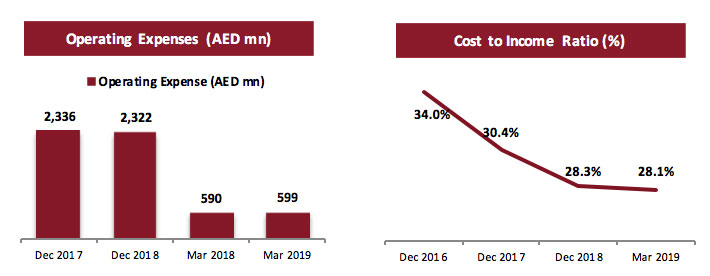

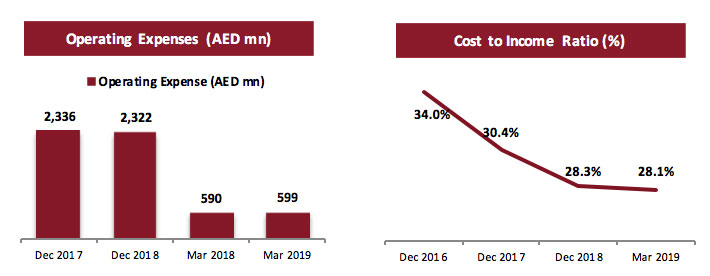

- Operating expenses stable at AED 599 million vs AED 590 million in Q1 of 2018.

- Net operating profit before impairment charges grew by 24% to AED 1,708 million.

- Cost to income ratio continues to improve at 28.1% compared to 28.3% at the end of 2018.

- Net Profit Margin grows to 3.19%, depicting profitability focused underwriting.

Expanding Core Business

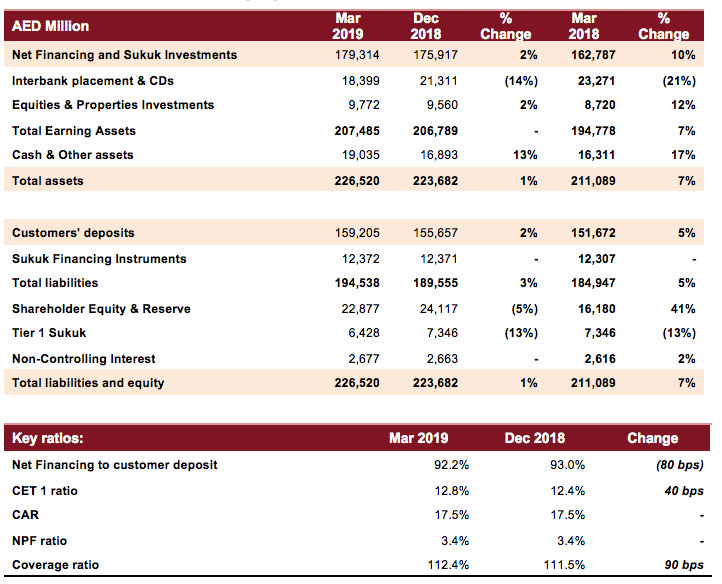

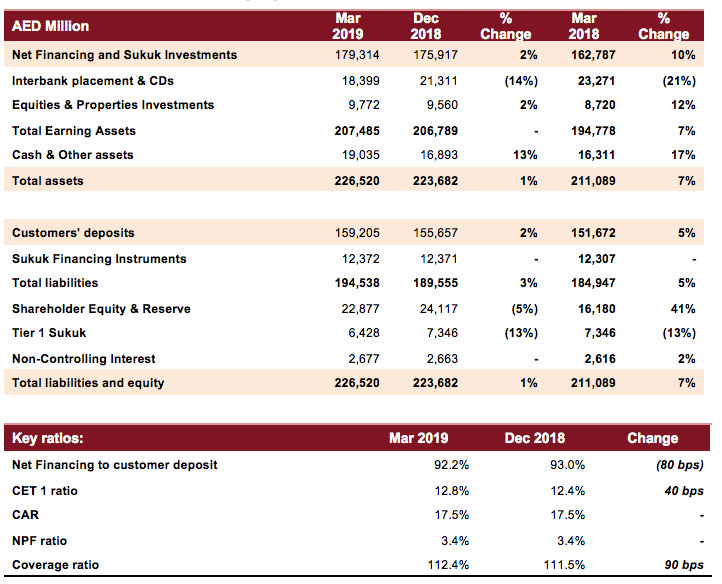

- Net Financing & Sukuk investments rose to AED 179.3 billion up by 2.0%, compared to AED 175.9 billion at the end of 2018.

- Total Assets stood at AED 226.5 billion, up by 1.3%, versus AED 223.7 billion at the end of 2018.

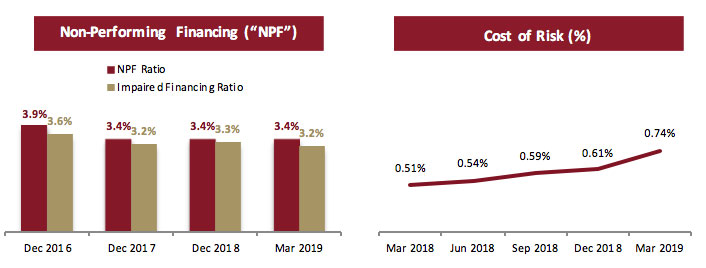

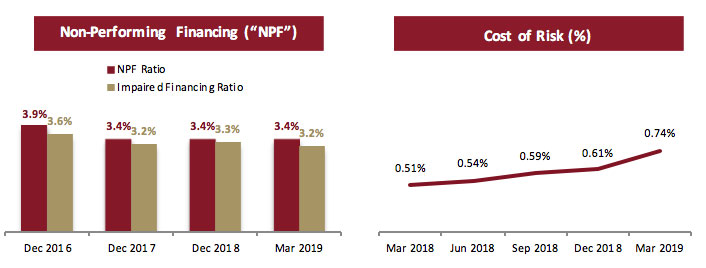

Asset quality remains a key strength

- NPF ratio stable at 3.4%. Provision coverage ratio is at 112%.

- Overall coverage, including collateral at discounted value, stands at 149%.

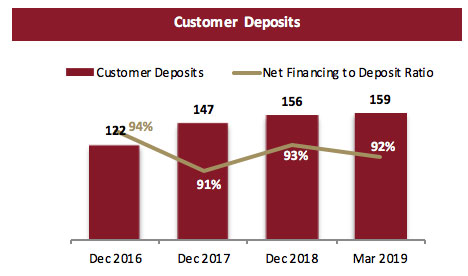

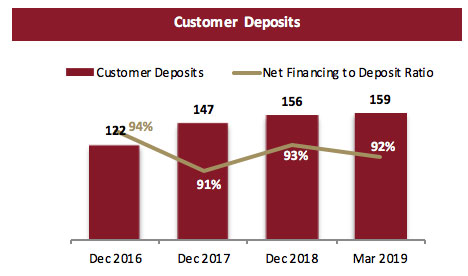

Robust Liquidity and Funding position

- Customer deposits rose by 2.3% to reach to AED 159.2 billion from AED 155.6 billion in end of 2018.

- CASA deposit stable at AED 53 billion as of Q1 2019.

- Financing to deposit ratio stood at 92%.

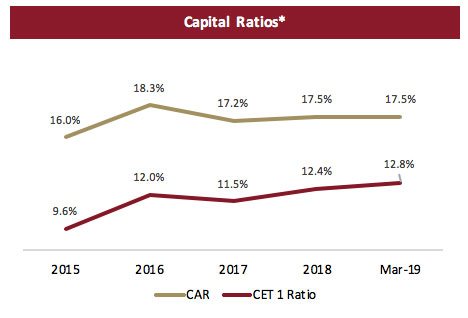

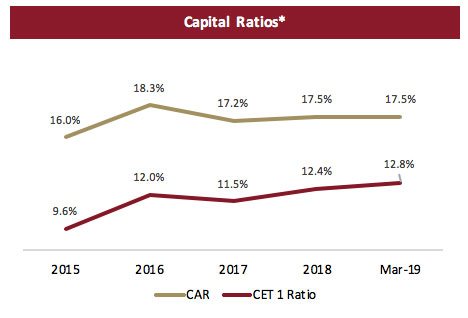

Capitalization ratios remain well above the regulatory thresholds

- Capital adequacy ratio is at 17.5%, as against 13.50% minimum required.

- CET 1 is at 12.8%, as against minimum required of 10.00%, providing significant room for growth under the new Basel III regime.

- ROA increased to 2.44% and ROE at 18.5%, in line with guidance.

Management’s comments for the quarter ending March 31, 2019:

His Excellency Mohammed Ibrahim Al Shaibani, Director-General of His Highness The Ruler’s Court of Dubai and Chairman of Dubai Islamic Bank, said:

- The UAE’s GDP continues to grow crossing USD $400 billion following successful structural reforms, strengthening of fiscal policies as well as growth in the non-oil sectors. The implementation of various initiatives set out to attract investors and businesses are paving the way for sustained growth in the UAE in the years to come.

- The banking sector remains resilient with strong capitalization and rising profitability. DIB continues to progress with robust set of first quarter results with total income growing by 26% to reach to AED 3.4 billion driven by consistent strong growth across our businesses.

- Global market optimism is returning as reflected by the positive index performances as well as increasing trade volumes in the UAE financial markets since the start of the year.

Dubai Islamic Bank Managing Director, Abdulla Al Hamli, said:

- Global oil prices continue its upward trend since the start of the year. This, together with stimulus initiatives being put in place, will boost economic activity within the UAE and promote public spending as well as heightened private and public sector confidence.

- As digital technology and innovation makes further inroads into the financial industry, DIB ensures that the bank is at the forefront of these events with the launch of a digital lab, which will be the home of digital innovation and advancement for the bank.

Dubai Islamic Bank Group Chief Executive Officer, Dr. Adnan Chilwan, said:

- DIB’s growth is synonymous with that of UAE. We have proven that year-on-year, quarter-on-quarter. Our latest, 1st Quarter net profit has grown by 12%, reaching AED 1.3 billion. DIB continues to deliver on all fronts by constantly evolving it’s business model based on the needs of its flourishing customer base.

- Steady growth in deposits supported by robust capital has ensured the balance sheet crosses AED 226 billion. Efficiencies continue to strengthen our P&L with cost income ratio now at 28.1%.

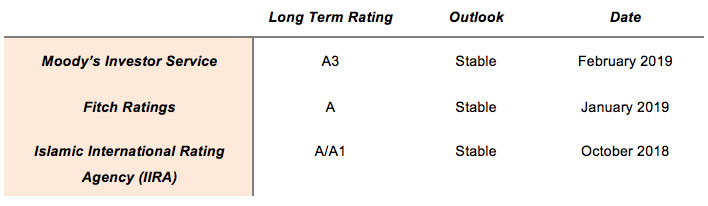

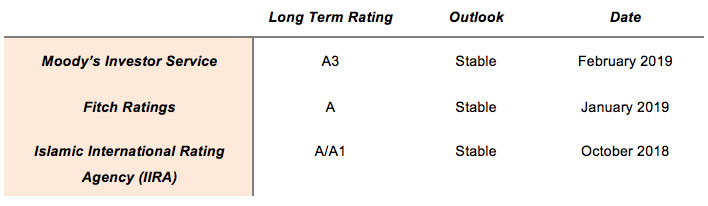

- The reaffirmed credit ratings with a stable outlook reiterate the bank's strong balance sheet positioning. ever-growing profitability, and it’s financial standing as a leading player in the region.

- What is encouraging is the support and confidence that investors are extending towards DIB. The successful AT1 Basel llI-compliant sukuk issuance earlier this year shows that our engagement strategy with our investors is clearly helping to further boost the market confidence in the institution.

- Efficiency and returns remain a key part of our growth plans evidenced by Net Profit Margin climbing to 3.19%.

- We are making steady inroads in digitisation and innovation. Our aspirations to be an always-on financial institution are well under way with the successful unveiling of a hub for digital innovation, the DIB Digital Lab.

Financial Review

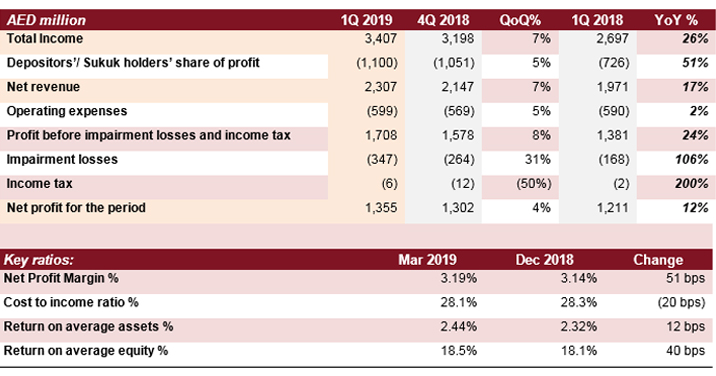

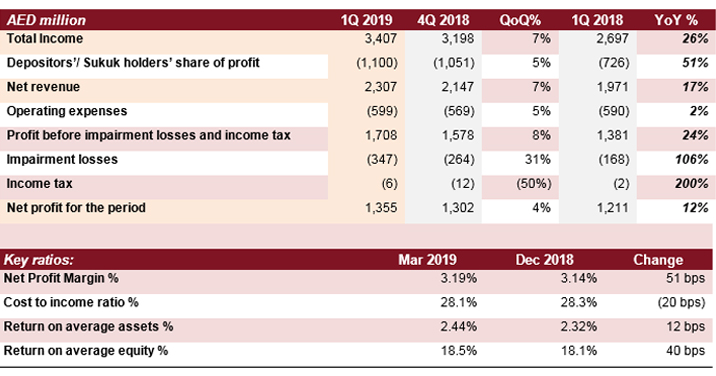

Income Statement highlights:

Total Income

Total income for the period ended 31 March 2019 was AED 3,407 million, up 26% YoY, mainly driven by growth in income from Islamic financing and sukuk investments at 28% and supported by commissions and fees which increased by 6%.

Net revenue

Net revenue for the period ended 31 March 2019 amounted to AED 2,307 million, an increase of 17% compared with AED 1,971 million in Q1 of 2018.

Operating Expenses

Operating expenses for the period ended 31 March 2019 is at AED 599 million compared to AED 590 million in Q1 of 2018. Cost to income ratio continuous to improve to 28.1% compared to 28.3% in December 2018.

Net Profit

Net profits grew strongly by 12% to AED 1,355 million for the period ended 31 March 2019 from AED 1,211 million in Q1 of 2018. The continued rise in profitability is attributed to the bank’s consistent top line income growth and improved efficiencies.

Statement of financial position highlights:

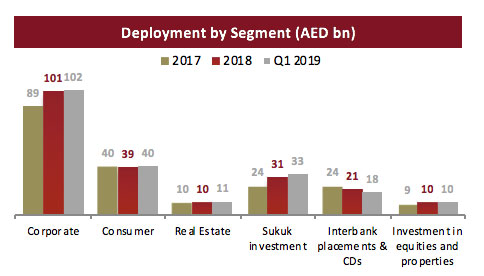

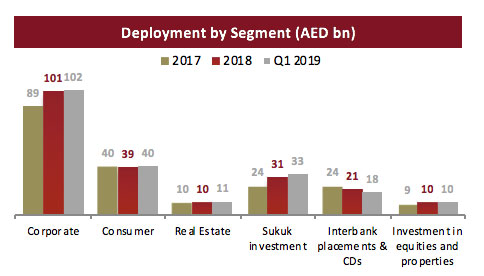

Financing and Sukuk portfolio

Net financing & sukuk investments increased to AED 179.3 billion for the period ended 31 March 2019 from AED 175.9 billion in Q1 of 2018, an increase of 2%, primarily driven by continued core business growth. Corporate banking financing assets currently stands at AED 102 billion whilst the consumer financing assets stood at AED 40 billion, supported by new financing of nearly AED 3.5 billion. Commercial real estate concentration managed within guidance at around 19%.

Asset Quality

For the period ended 31 March 2019, non-performing financing ratio and impaired financing ratio stood at 3.4% and 3.2% respectively. Cash coverage stood at 112% and overall coverage ratio including collateral at discounted value reached 149% with cost of risk (on gross financing assets) at 74 bps.

Customer Deposits

Customer deposits for the period ended 31 March 2019 increased by 2% to AED 159 billion from AED 156 billion in end of 2018. CASA deposit remained stable at AED 53 billion and net financing to deposit ratio stood at 92%.

Capital Adequacy

Capital adequacy ratios remained robust with overall CAR and CET 1 ratio deposits for the period ended 31 March 2019 standing at 17.5% and 12.8% respectively. DIB has been designated a Domestic Systemically Important Bank (D-SIB) by the regulator, which signifies the importance of the franchise to the financial sector in the country.

* Above graph reflects amended prior year values under the new Basel III regime

Ratings:

- February 2019 – Moody’s publishes DIB credit opinion update re affirming the bank’s long term issuer rating scale ‘A3’ carrying a ‘Stable’ outlook supported by healthy profitability, stable asset quality with sound capital and liquidity.

- January 2019 - Fitch Ratings has re-affirmed Dubai Islamic Bank (DIB) Long-Term Issuer Default Rating (IDR) at ‘A’ with a Stable Outlook and Viability Rating (VR) at ‘bb+’ reflecting strong domestic franchise, healthy profitability and sound liquidity.

- October 2018 – Islamic International Rating Agency (IIRA) has reaffirmed ratings on Dubai Islamic Bank with international scale ratings of A/A1. The strong ratings are driven by consistent improvement of asset quality indicators over time, continued growth in business assets and strong cost controls leading to robust profitability.

Q1 2019 - Key business highlights:

- In January 2019, the bank successfully closed a USD 750 million Additional Tier 1 (AT1) Perpetual Non-Call 6yrs Sukuk with a profit rate of 6.25% per annum. The transaction, was only the second AT1 Sukuk under the new Basel III capital guidelines issued by the Central Bank of UAE (“CBUAE”) in 2018. This was also the first hybrid capital issuance from the GCC in 2019.

The success of this transaction came on the back of an extensive marketing strategy aimed at updating international and regional investors with DIB’s strategy and continued strong financial performance. As a result, DIB achieved one of the largest and high quality orderbook for a GCC bank in over a year at USD 3.7bn from more than 160 investors, representing nearly 5x oversubscription. The investor base was well diversified with 62% of the Sukuk allocated to Middle East investors, 19% to UK/Europe, 18% to Asia and 1% to US offshore.

- The Business banking product suite has been revamped to include a robust range of products for DIB customers. Two new deposit products – Business Saver Account and Cashflow Deposit have been designed to cater to the diverse requirements of the changing customer needs.

In addition a whole new exclusive benefits for Wajaha, Aayan and Mummayaz customers was also launched providing additional offerings and benefits for dining, hotels as well as entertainment.

- As part of the digital strategy, the bank launched the DIB Digital Lab, a hub where digital ideas come to life, with customer experience as its central focus. The hub covers all aspects of the digital journey – from idea creation and development to delivery and training.

In addition, digital customer journeys were also launched during the quarter for pre-approved credit cards and personal financing providing seamless and simplistic journey with a customer centric approach. This service significantly enhances application process from end to end involving zero paperwork.

Happiness meters were also implemented across all DIB Dubai branches and covering main branches of Abu Dhabi and Northern Emirates. The initiative is in line with Dubai’s strategic ‘Smart City’ ambitions.

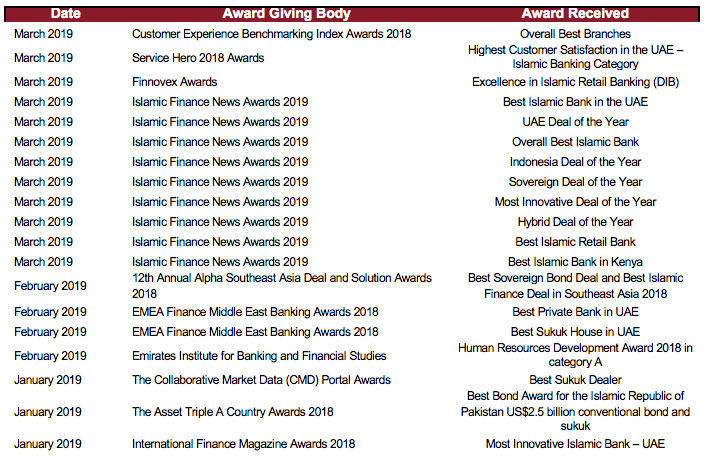

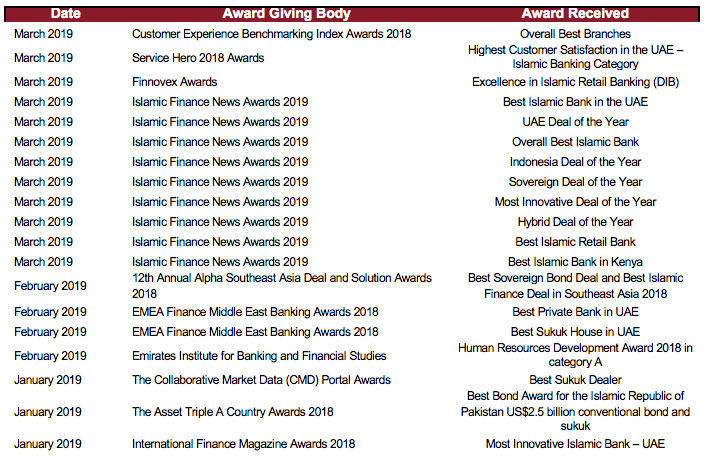

Industry Awards (Q1 – 2019)