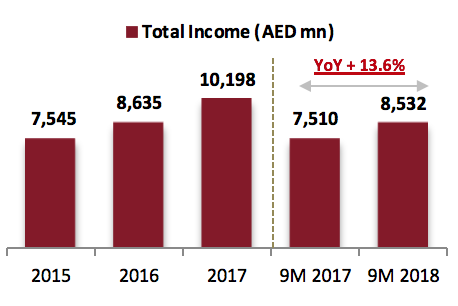

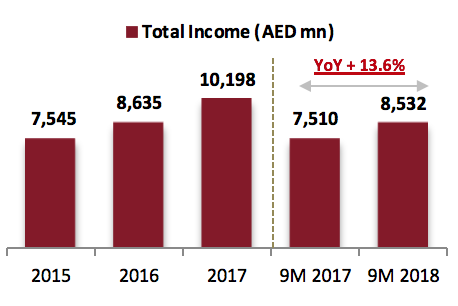

- Total Income reaches AED 8.5 billion, up by 13.6% YoY.

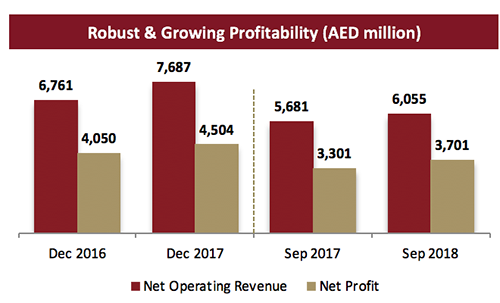

- Group Net Profit at AED 3.7 billion in the nine months of 2018, up 12.1% YoY.

- Balance sheet grows by 7.4% in the nine months of 2018 reaching AED 222.8 billion.

Dubai Islamic Bank (DFM: DIB), the first Islamic bank in the world and the largest Islamic bank in the UAE by total assets, today announced its results for the period ending September 30, 2018.

9M 2018 Results Highlights:

Sustained balance sheet growth and cost discipline driving strong operating performance

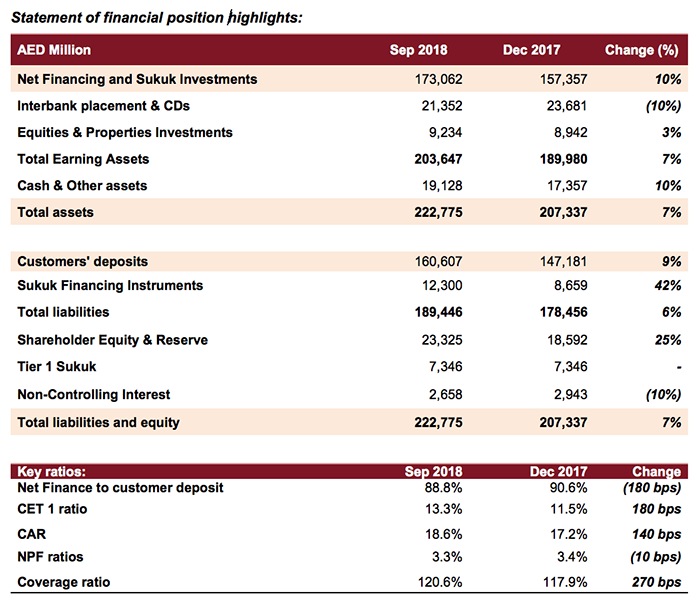

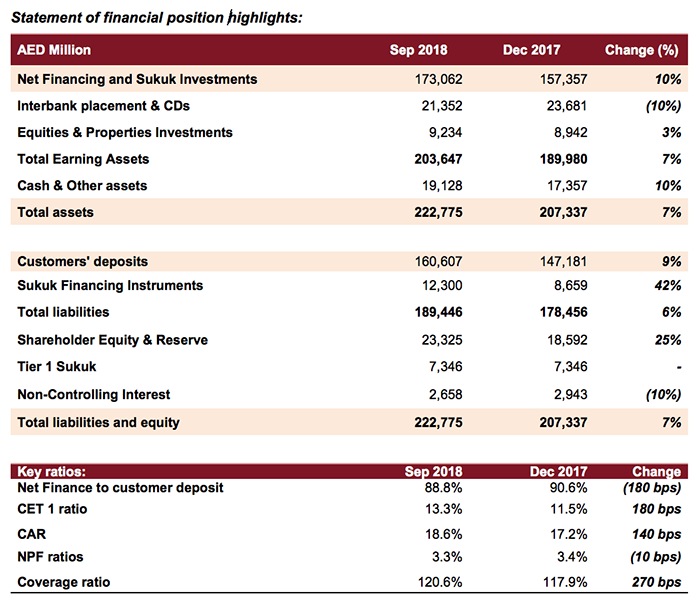

- Net financing & sukuk investments rose to AED 173.1 billion up by 10.0%, compared to AED 157.3 billion at the end of 2017.

- Total Assets now at AED 222.8 billion, up by 7.4%, versus AED 207.3 billion at the end of 2017.

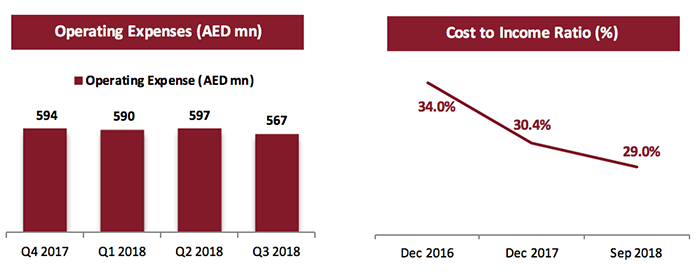

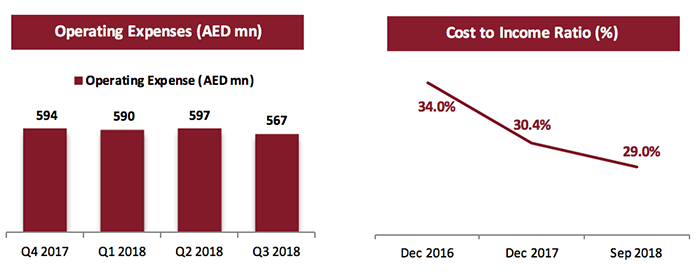

- Cost to Income ratio continuous its downward trend to 29.0% versus 30.7% in the same period of last year.

Robust top and bottom line growth

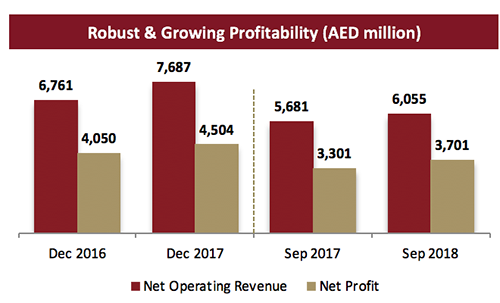

- Total income increased by 13.6% to AED 8,532 million, up from AED 7,510 million in the same period of last year.

- Net profits grew by 12.1% to reach AED 3,701 million, up from AED 3,301 million in the same period of last year.

- Net funded income margin to 3.15%, maintained at the higher end of the guidance for the year.

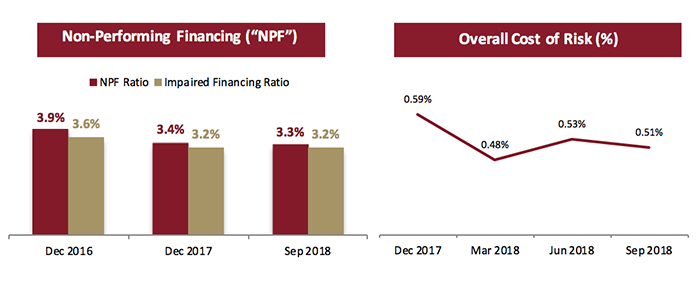

Strong asset quality indicators

- NPF ratio steady at 3.3%. Provision coverage ratio now up to 121%.

- Overall coverage, including collateral at discounted value, stands at 155%, indicating significant cushion in the balance sheet.

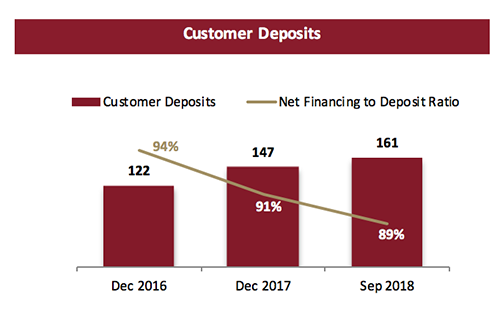

Strong stable funding

- Robust growth in customer deposits of 9.1% to reach to AED 160.6 billion from AED 147.2 billion in December 2017.

- CASA deposit maintained at around AED 52 billion as of September 30, 2018.

- Financing to deposit ratio stood at 88.8%.

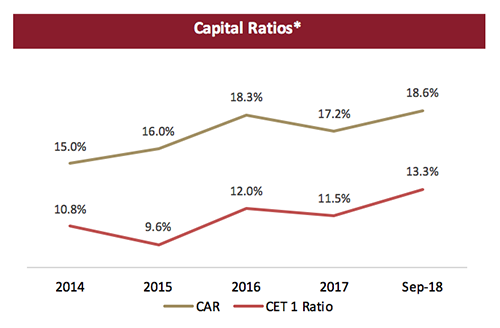

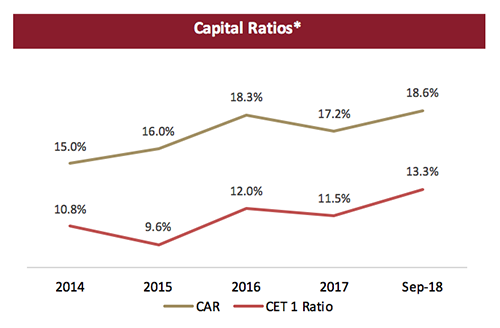

Stronger capital ratios under Basel III following successful rights issuance

- Capital adequacy ratio is at 18.6%, as against 12.75% minimum required.

- CET 1 is at 13.3%, as against minimum required of 9.25%, providing significant room for growth under the new Basel III regime.

- ROA at 2.31% and ROE at 18.2%, in line with guidance

Management’s comments for the period ending September 30, 2018:

His Excellency Mohammed Ibrahim Al Shaibani, Director-General of His Highness The Ruler’s Court of Dubai and Chairman of Dubai Islamic Bank, said:

- The UAE is on track to sustaining its growth following recovery in global oil prices, new reforms and government stimulus which includes initiatives in boosting the private sector to diversify sources of growth.

- The approved higher federal budget for 2019 will increase spending and development in key sectors which in turn benefits the banking sector as well as DIB given its strategic focus on these areas.

- DIB continues its strong balance sheet growth of 7.4% in the nine months of 2018 supported by a well-managed cost discipline leading to significant improvements in profitability.

Dubai Islamic Bank Managing Director, Abdulla Al Hamli, said:

- With a market cap of over AED 35 billion DIB today is amongst the fastest growing franchise in the region.

- DIB’s on-going investments in technology will provide the necessary infrastructure and platforms allowing the bank to sustain its growth in the coming years.

Dubai Islamic Bank Group Chief Executive Officer, Dr. Adnan Chilwan, said:

- The bank has constantly shown the ability to rapidly respond to changes in the economic environment leading to strong growth in profitability of 12% YoY crossing the USD 1 billion profit in the nine months of the year, a first in the bank’s history.

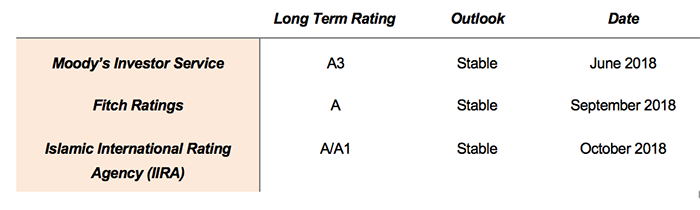

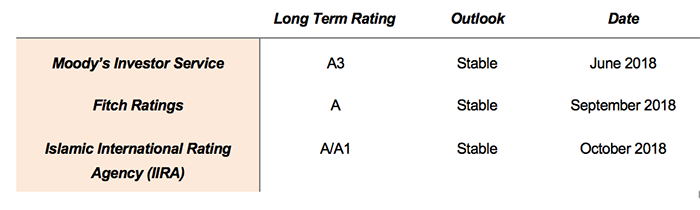

- With two credit rating reaffirmations during the quarter, the bank’s financial position remains solid with significant improvements in asset quality, liquidity and profitability.

- Optimal management of costs has further improved the cost income ratio to 29%, which is an incredibly efficient position for a large retail franchise based out of Dubai.

- Despite mobilizing longer term deposits which provides stable funding, the net profit margin remains at the higher end of the market at 3.15% ably assisted by a strong CASA book of around AED 52 billion.

- Capitalization remains strong with CET 1 at 13.3% and total CAR 18.6% well above the regulatory requirements including all buffers under BASEL III.

Financial Review

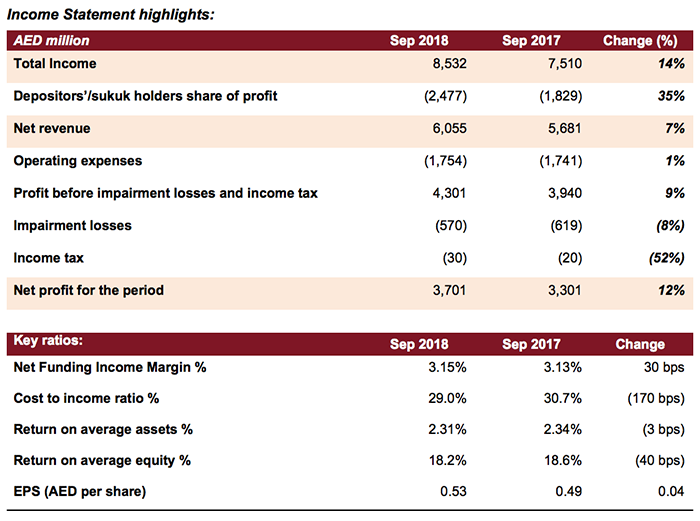

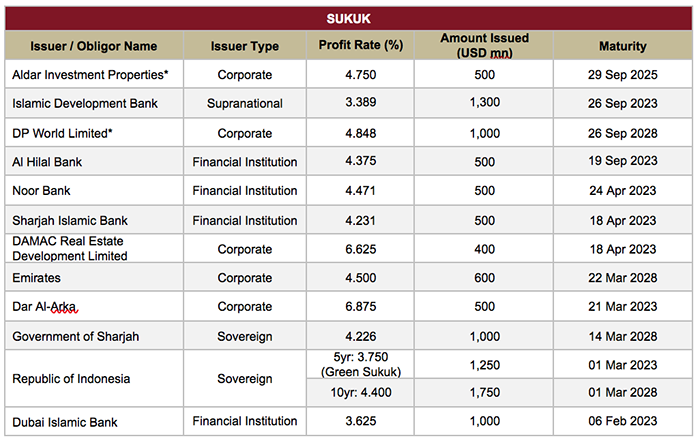

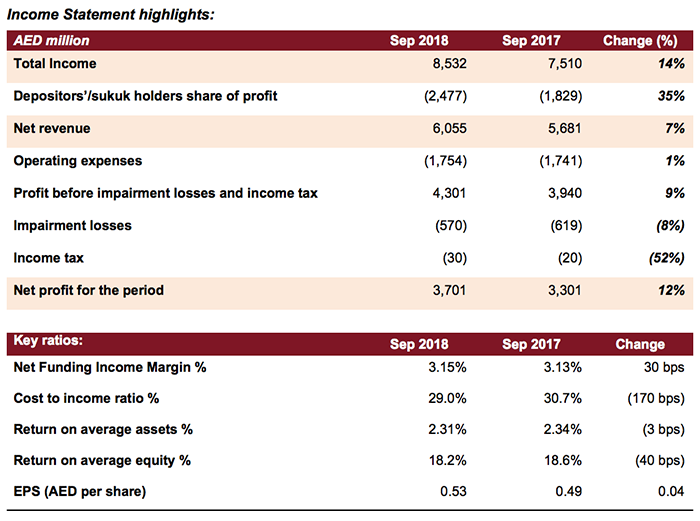

Income Statement highlights:

Total Income

Total income for the nine months of 2018 was AED 8,532 million, up 13.6% YoY, mainly driven by growth in income from Islamic financing which grew by 20.5% YoY to reach to AED 6,894 million from AED 5,722 million for the same period in 2017.

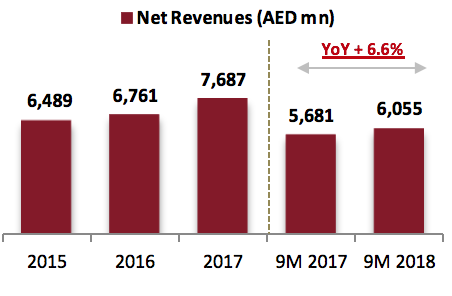

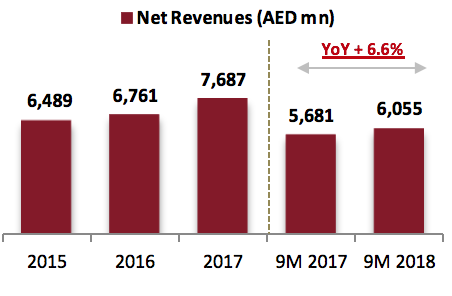

Net revenue

Net revenue for 9 months ended September 30, 2018 amounted to AED 6,055 million, an increase of 6.6% compared with AED 5,681 million in the same period of 2017. Commissions and fees increased by 8.3% during the nine months of 2018 reaching to AED 1,112 million.

Operating Expenses

Operating expenses for the 9 months ended September 30, 2018 remained stable at AED 1,754 million compared to AED 1,741 million in the same period in 2017. As a result, cost to income ratio significantly improved to 29.0% compared to 30.4% in December 2017.

Profit for the period

Net profits grew strongly by 12.1% to AED 3,701 million for the 9 months ending September 30, 2018 from AED 3,301 million September 30, 2017. Robust management in cost control have supported the strong net profit growth.

Statement of financial position highlights:

Financing portfolio

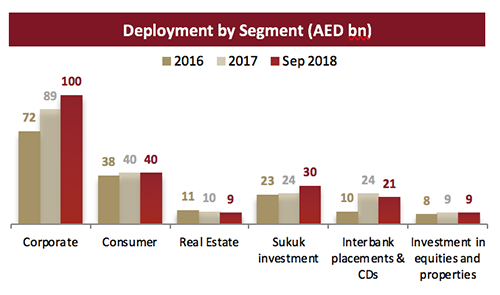

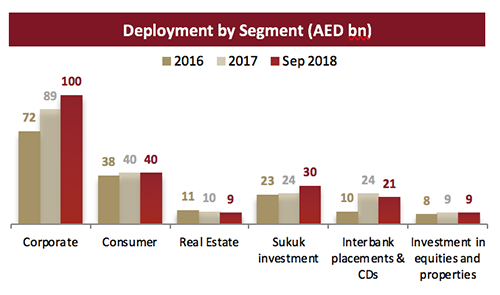

Net financing assets to customers increased to AED 142.6 billion as of September 30, 2018 from AED 133.3 billion at the end of 2017, an increase of 7% as the bank continues on its strong growth agenda. Corporate banking financing assets grew at nearly 11% reaching a milestone of AED 100 billion whilst consumer business remained steady at AED 40 billion, supported by new financing of over AED 2 billion. Commercial real estate concentration managed within guidance at around 19%.

Asset Quality

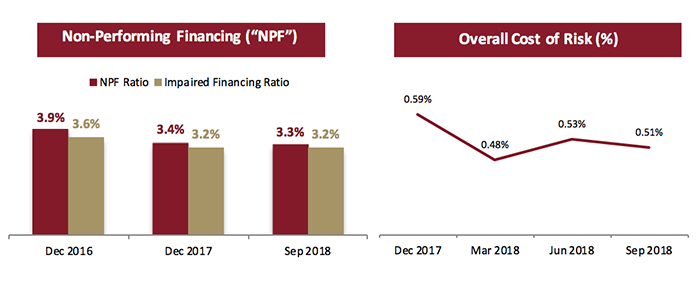

As at September 30, 2018, non-performing financing ratio and impaired financing ratio improved to 3.3% and 3.2%, respectively, as the buildup of quality assets continues. Cash coverage for the 9 months ended September 30, 2018 stood at 121% compared with 118% at the end of 2017. Overall coverage ratio including collateral at discounted value reached 155% with current cost of risk at 51 bps.

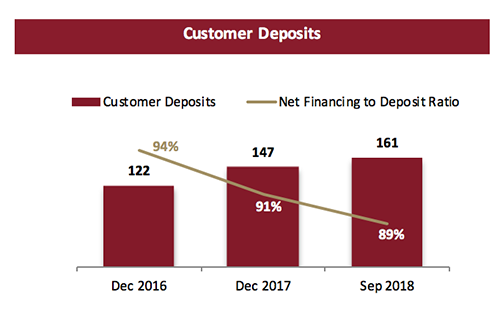

Customer Deposits

Customer deposits for the period ending September 30, 2018 increased by 9% to AED 160.6 billion from AED 147 billion as at end of 2017. CASA maintained component at around AED 52.0 billion and financing to deposit ratio stood at just under 89%, depicting strong liquidity.

Capital Adequacy

Capital adequacy ratios remained robust with overall CAR and CET 1 ratio growing by 30 bps for the third quarter of 2018 to 18.6% and 13.3% respectively. The successful rights issuance boosted the bank’s core capital metrics with the transaction generating massive interest across a highly diversified local and international investor base. DIB has been designated a Domestic Systemically Important Bank (D-SIB).

*Above graph reflects amended prior year values under the new Basel III regime

Ratings

- October 2018 – Islamic International Rating Agency (IIRA) has reaffirmed ratings on Dubai Islamic Bank with international scale ratings of A/A1. The strong ratings are driven by consistent improvement of asset quality indicators over time, continued growth in business assets and strong cost controls leading to robust profitability.

- September 2018 – Fitch Ratings has affirmed Dubai Islamic Bank (DIB) Long-Term Issuer Default Rating (IDR) at ‘A’ with a Stable Outlook and Viability Rating (VR) at ‘bb+’ reflecting strong domestic franchise, healthy profitability and sound liquidity.

- June 2018 – Moody’s publishes note on successful DIB rights issuance indicating that the capital increase is credit positive for the bank and will support the bank’s liquidity, solvency as well as maintain strong and stable capital buffers over the medium term.

Q3 2018 - Key business highlights:

- The bank has partnered with Emirates Skywards to launch the new Emirates Skywards DIB Credit Cards tailored specifically to offer exceptional value to the country's growing community of frequent flyers. The partnership brings together two of the UAE’s leading brands and offers a range of credit cards to earn Skywards Miles and receive other added benefits. The partnership aligns with DIB’s strategy to offer customers innovative and value added solutions.

- To continue its legacy in the Home Finance sector, DIB launched First Step as part of its MyHome solutions. ‘First Step’ address a very key customer need, early in the home buying journey by offering a self-service platform, completely free and easy, where the customer would be able to get a preapproval anytime and from anywhere, through any device instantly. It also provides a ‘Know Your Options’ guide for customer’s ready reference to assist in the home finance options. This adds a new dimension to DIB’s partnerships, as this enables the bank to be at various partner point of sales assisting their customers in the property buying decision. During Cityscape 2018, the bank partnered with 12 top developers and offered the MyHome First Step at the event, through smart devices installed in these partner stand.

- In line with the bank’s persistent efforts towards providing customers with a better experience, DIBs digital banking services has recently introduced the ‘DIB Chat Bot’. Enabled with AI (Artificial Intelligence) features, it can answer queries, provide information about products and services, as well as empower the customers to conduct financial transactions 24x7 such as account enquiries, credit card and bill payments.

- DIB’s new mobile banking app was recently launched in September 2018 bringing another innovation to help DIB customers manage their money on the go. From checking account balance to paying bills and transferring money overseas, DIB’s customers can bank anytime, anywhere and on any device.

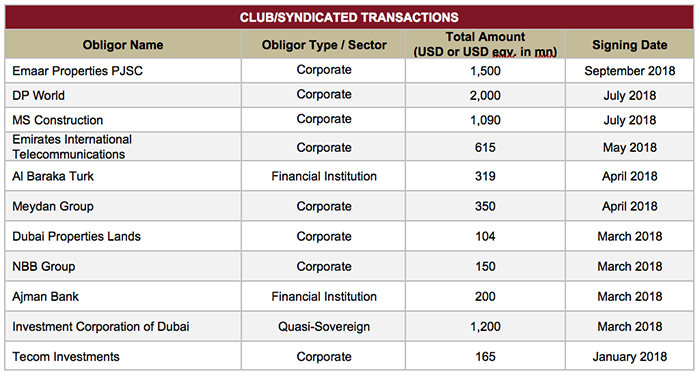

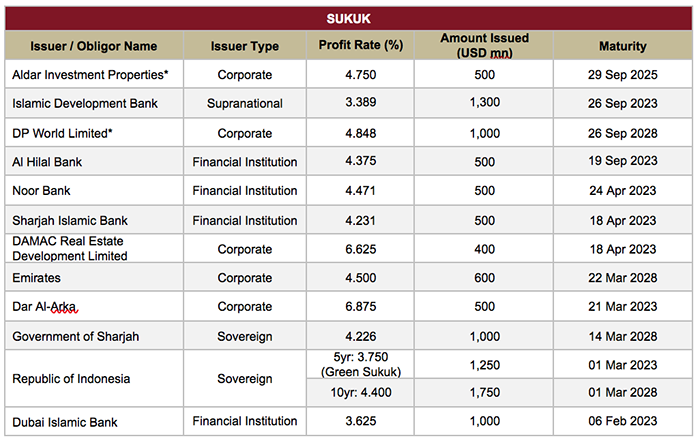

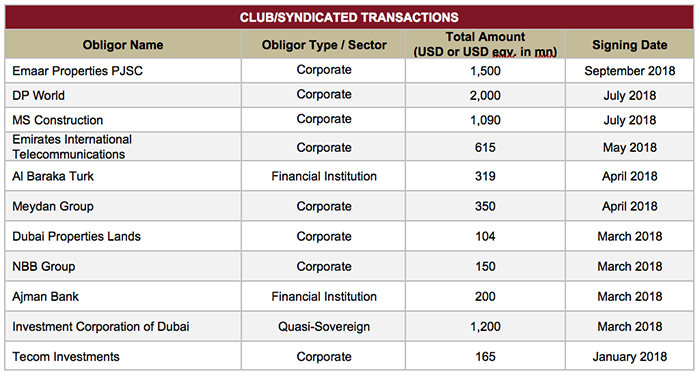

- DIB continues to be an active leader in the Islamic capital markets space with nearly USD 8 billion of sukuk and syndicated deals completed during the quarter for various issuers including corporates, financial institutions and supranational. During the quarter, the bank acted as JLM/Bookrunner on several sukuk issuances along with a Co-Dealer Manager role for the liability management exercises for corporates which were conducted concurrently with the new issuances. This demonstrates the robust capabilities of the bank as well as the strength of the brand franchise in dealing with complex benchmark sized transactions, extending beyond arranging and selling new issues.

Year to Date key deals

* (alongside a liability management exercise)

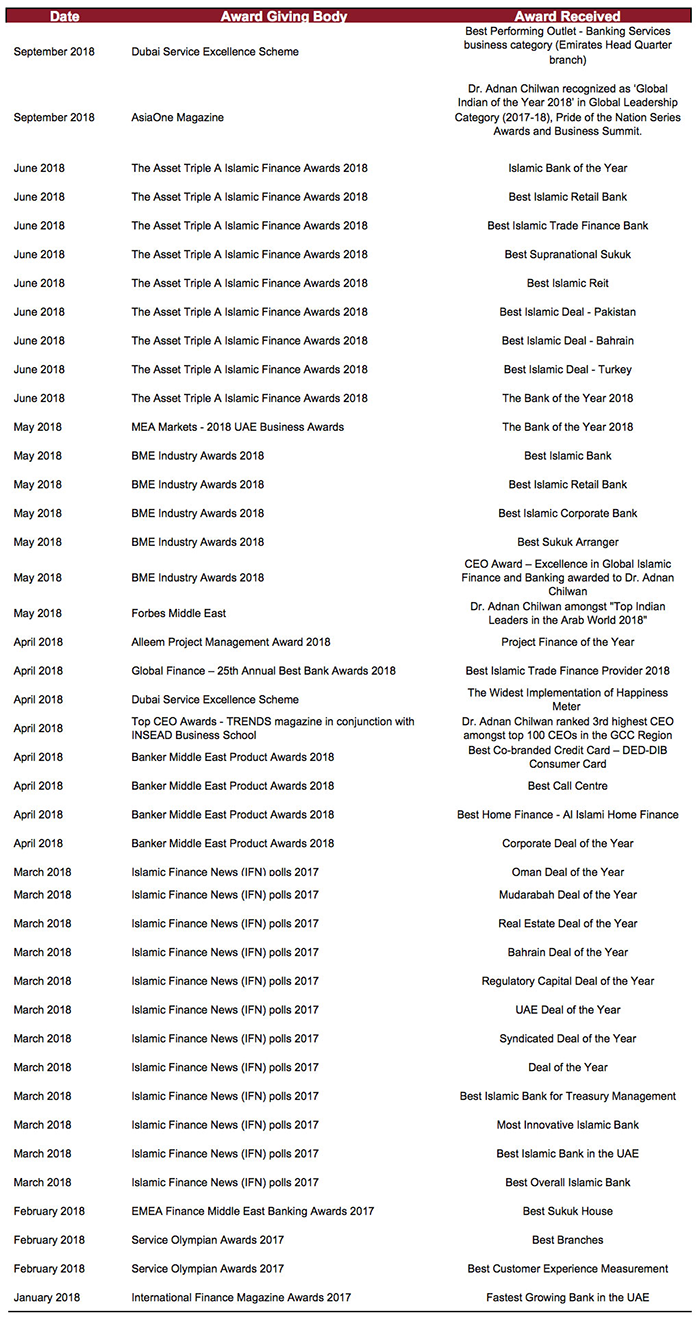

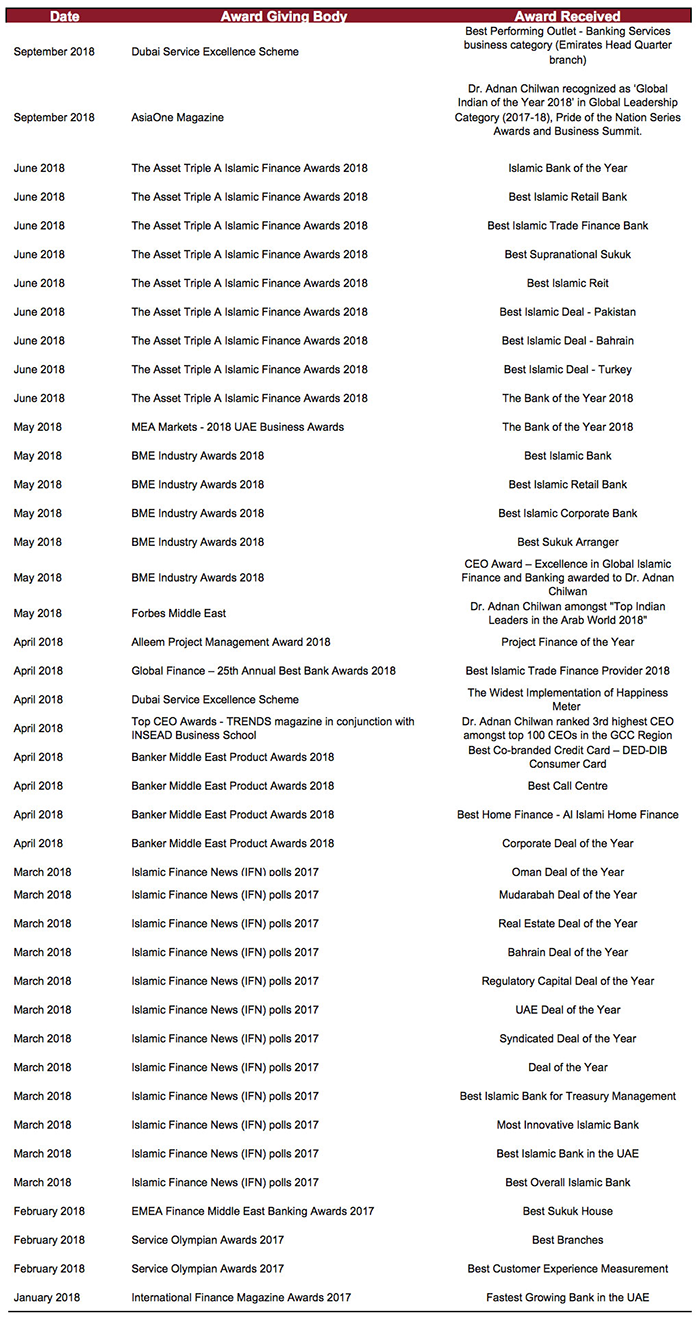

Year to Date 2018 Industry Awards