- Net Profit reaches AED 1.211 billion, up by 16%

- Top line revenue rose by 13% to AED 2.7 billion

Dubai Islamic Bank (DFM: DIB), the first Islamic bank in the world and the largest Islamic bank in the UAE by total assets, today announced its first quarter results for the period ending March 31, 2018.

1st Quarter Results Highlights:

Resilient profitability as core business growth continues

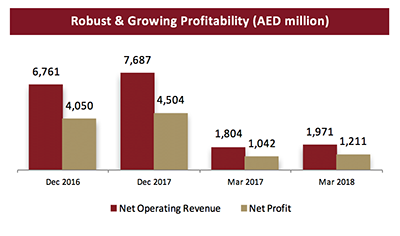

- Group Net Profit increased to AED 1,211 million, up 16% compared with AED 1,042 million for the same period in 2017.

- Total income increased to AED 2,697 million, up 13% compared with AED 2,378 million for the same period in 2017.

- Net Operating Revenue increased to AED 1,971 million, up 9% compared with AED 1,804 million for the same period in 2017.

- Impairment losses stood at AED 168 million.

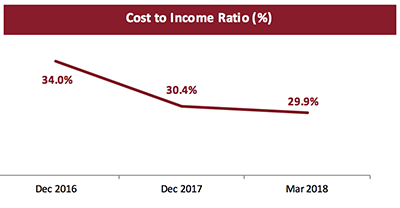

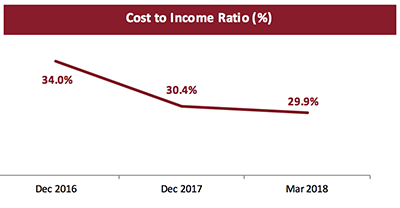

- Costs held flat, with cost to income ratio declining to 29.9% compared with 32.8% for the same period in 2017, depicting continued focus on creating efficiencies across the organization.

- Net funded income margin stood at 3.03%, still amongst the top end of the market.

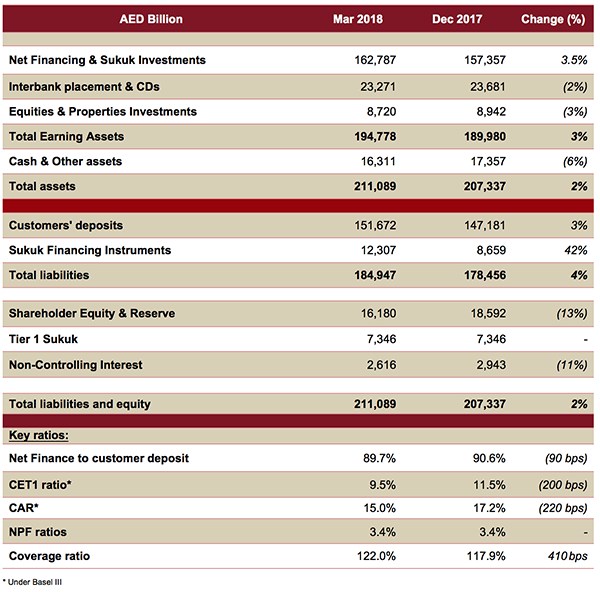

Balance sheet key metrics continue to impress

- Net financing & sukuk investments rose to AED 162.7 billion up by nearly 3.5%, compared to AED 157.3 billion at the end of 2017.

- Total Assets stood at AED 211.1 billion at the end of first quarter 2018.

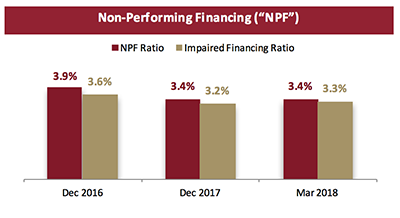

Asset Quality remained robust

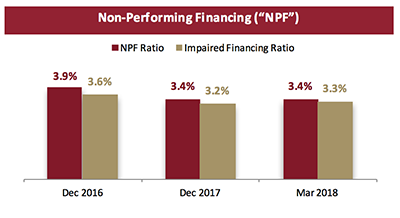

- NPF ratio steady at improved to 3.4%.

- Provision coverage ratio improved to 122%, compared to 118% at the end of 2017.

- Overall coverage including collateral at discounted value now stands at 158.4%, compared to 156.5% at the end of 2017.

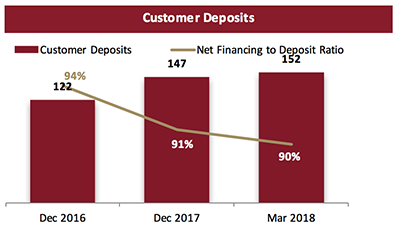

Strong liquidity supporting growth

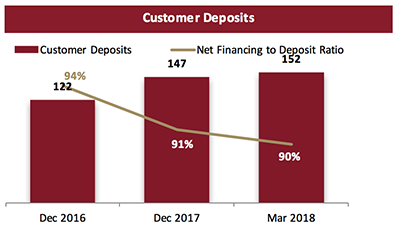

- Customer deposits stood at AED 151.7 billion at the end of first quarter 2018.

- Significant CASA proportion constituting 34% of total deposit base.

- Financing to deposit ratio stood at a healthy level of 90%.

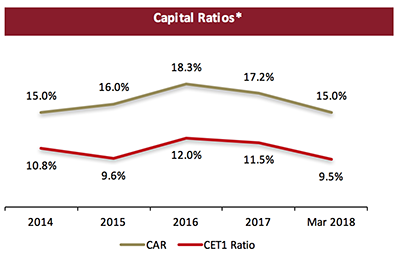

Capitalization at optimum levels to support growth

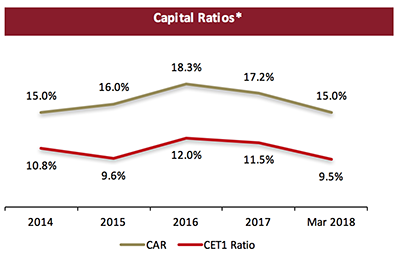

- Capital adequacy ratio remained strong standing at 15.0%, as against 12% minimum required.

- Planned capital raising to boost CET1 (currently at 9.5% under BASEL III) to support growth.

- DIB has been designated a Domestic Systemically Important Bank (D-SIB) – additional capital buffer of 0.5% required by January 1st, 2019.

Robust shareholder returns while delivering strong dividends

- Earnings per share further improved to AED 0.19 in Q1 2018 compared to AED 0.16 in the same period.

- Return on assets increased to 2.35% in Q1 2018.

- Return on equity rose to 19.2% in Q1 2018.

Management’s comments on the financial performance for the period ending March 31, 2018:

His Excellency Mohammed Ibrahim Al Shaibani, Director-General of His Highness The Ruler’s Court of Dubai and Chairman of Dubai Islamic Bank, said: :

- The overall macroeconomic environment continues to recover, with bright prospects on the horizon for 2018, based on further improvement in global oil prices and pick up in investment activity, as a result of mega projects leading up to the Expo 2020.

- DIB carries on its growth aspirations in the coming years following recent approvals from our shareholders to increase its capital and deploying it towards growing and expanding the business franchise.

- The quarter saw improving financial metrics across the industry following the implementation of new economic and banking regulations such as Basel III, IFRS 9 as well as VAT as the market continues to strengthen its domestic policies.

Dubai Islamic Bank Managing Director, Abdulla Al Hamli, said:

- Once again, the bank has given a robust performance across all major financial KPIs as the growth agenda continues.

- The significant growth in profitability over the years has enabled the bank to continue to distribute strong dividends to shareholders whilst optimizing internal generation of capital.

- As Islamic banking activities continuing to pick up pace in the country, DIB remains a key player in the financial sector with a growing market share year on year.

Dubai Islamic Bank Group Chief Executive Officer, Dr. Adnan Chilwan, said:

- 2018 is a critical year as it effectively marks the culmination of the 10-year master plan that has seen the bank transform into a financial powerhouse in the UAE banking space. Whilst we continue on our expansionary agenda, this year is primarily about striking a balance between growth and profitability.

- The market beating growth over the last few years has been the result of an extremely pointed and comprehensive strategic agenda built around positioning the bank to take advantage of both visible and seemingly invisible market opportunities.

- One critical component that has helped to get us where we are today is our ability to pre-emptively create capacity, both with regards to liquidity and capitalization. This has been a key differentiator that has allowed us to profitably grow over the years whilst ensuring that shareholder returns remain robust year on year

- The year has once again started on a strong note with 16% profitability growth clearly signifying that the plans put in place continue to yield strong returns. A key component of the success witnessed by the bank has been the shareholders’ support over the years, particularly in building capacity when needed to remain on our growth path.

- Additionally, the last few years has shown that the bank’s growing profitability has been the leading factor in the strong shareholders’ returns and we are confident that this trend will continue as DIB moves forward in its expansionary plans in the coming years.

Financial Review

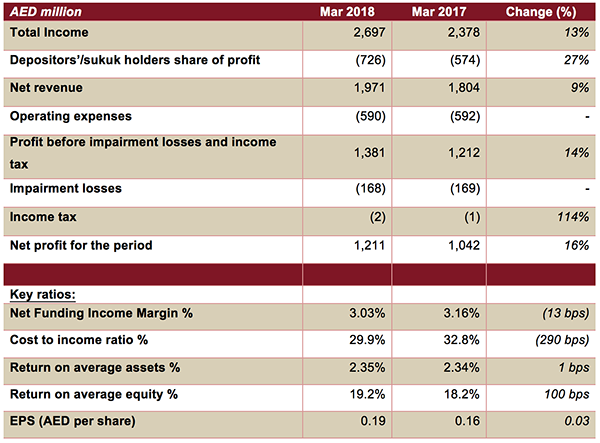

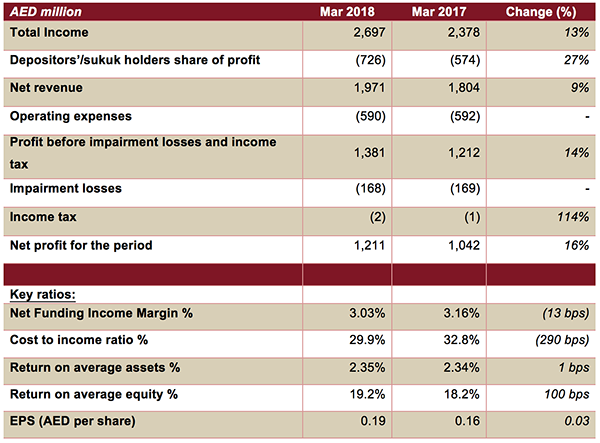

Income Statement highlights:

Total Income

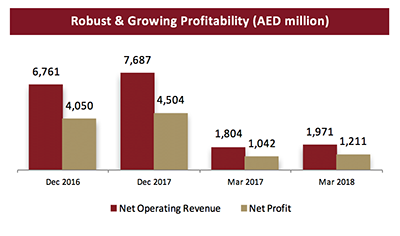

Profitability continues its northbound trajectory with total income increasing to AED 2,697 million compared to AED 2,378 million for the same period in 2017. The rise of 13% was driven primarily by sustained growth in core businesses, as income from Islamic financing and investing transactions increased by 16% to AED 2,094 million from AED 1,805 million for the same period in 2017.

Net revenue

Net revenue for the period ending March 31, 2018 amounted to AED 1,971 million, an increase of 9% compared with AED 1,804 million in the same period of 2017. Whilst the robust growth in core business continued to support revenues, strong rise in fees and commissions of 15.5% gave an additional boost to rising profitability.

Operating expenses

Operating expenses declined to AED 590 million for the period ending March 31, 2018 compared to AED 592 million in the same period in 2017 as focus on creating efficiencies within the business continues. As a result, cost to income ratio significantly improved to 29.9% compared to 32.8% for the same period in 2017.

Profit for the period

Net profit for the period ending March 31, 2018, rose to AED 1,211 million from AED 1,042 million in the same period in 2017, an increase of 16%. The profitability increase came on the back of a strategy focus on building a quality financing portfolio while simultaneously managing costs.

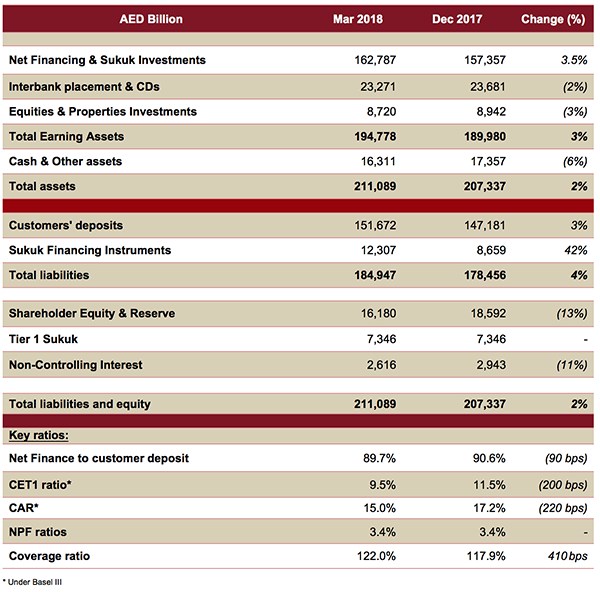

Statement of financial position highlights::

Financing portfolio

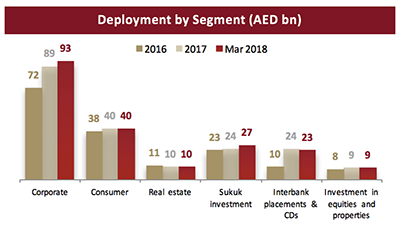

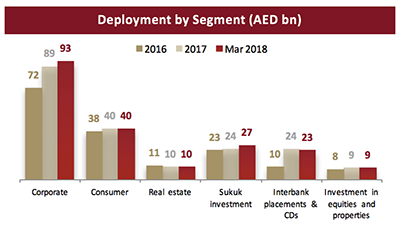

Net financing and sukuk investments grew to AED 162.7 billion from AED 157.3 billion as of end of 2017, an increase of nearly 3.5% as the bank continued to use its inherent capacity to further penetrate and increase its market share. Corporate banking financing assets grew at around 4% to AED 93 billion whilst consumer business remained steady at AED 40 billion supported by new financing of close to AED 500 million. Commercial real estate concentration remained low at around 19% and in line with guidance.

Asset Quality

Non-performing financing ratio and impaired financing ratio remains steady at 3.4% and 3.3% respectively depicting the high quality of credits. Buildup of provisions increased cash coverage to 122% for the period ending March 31, 2018 compared with 118% at the end of 2017. Overall coverage ratio including collateral at discounted value stood at 158% compared to 157% at the end of 2017.

Customer Deposits

Customer deposits for the period ending March 31, 2018 increased by 3% to AED 152 billion from AED 147 billion as at end of 2017. CASA component stood at AED 51.7 billion as of March 31, 2018 denoting a significant portion of low cost deposits. Financing to deposit ratio stood at 90% as of March 31, 2018 signifying ample capacity to grow.

Capital Adequacy

Capital adequacy ratios remained robust with overall CAR at 15.0% as of March 31, 2018 and CET1 ratio at 9.5%. The announced capital raising plan will be a key factor to ensure compliance under the new Basel III regime while simultaneously allowing the bank to continue its strong growth agenda focused on enhancing profitability and in turn shareholder returns.

*Above graph reflects amended prior year values under the new Basel III regime

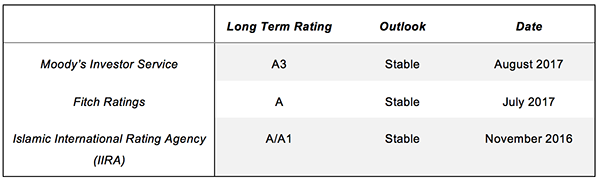

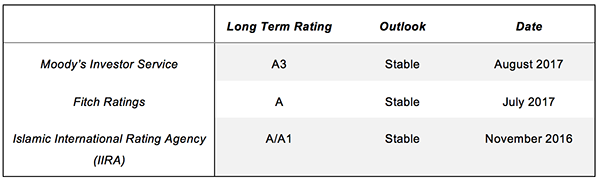

Ratings:

- Aug 2017 – Moody’s upgraded DIBs long-term issuer ratings to ‘A3’ from Baa1; outlook ‘Stable’.

- Jul 2017 - Fitch has upgraded the bank’s standalone VR to ‘bb+’' from ‘bb’ citing robust and continuous improvement across the major key metrics including profitability and asset quality.

- The moves clearly point towards not just the financial strength of the existing franchise but the confidence the stakeholders have in its ability to sustain the performance in the foreseeable future.

Q1 2018 - Key business highlights:

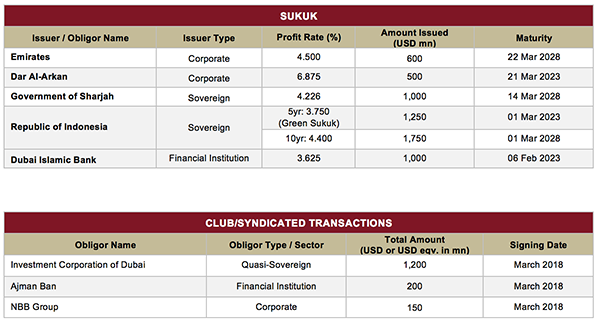

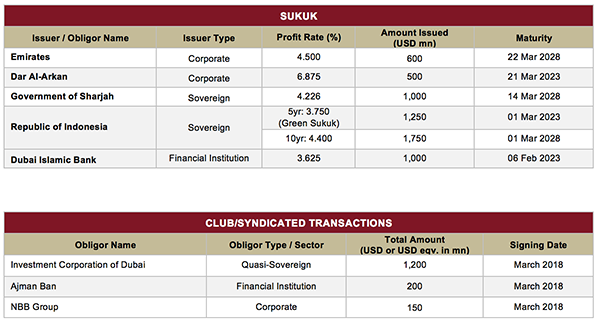

- In January, Dubai Islamic Bank successfully priced a US$ 1 Billion Sukuk that was issued with a 5 year tenor, maturing on 6th February 2023. The issuance emanating from DIB’s USD 5 billion Sukuk Programme carried a profit rate of 3.625 % and was the first US$ benchmark Sukuk transaction from the GCC in 2018. The deal came on the back of strong demand for DIB’s credit highlighting the confidence of global investors in the UAE’s largest Islamic bank.

- Following the conclusion of its Annual General Meeting (AGM), the bank announced that the assembly had approved the distribution of 45 fils per share as cash dividend for 2017, closing another year with strong returns to shareholders since the bank embarked on a growth agenda four years ago.

- The AGM also approved DIB's capital increase by way of rights issue to further bolster the bank's CET1 and facilitate credit expansion in 2018. In addition, the board also approved the increase of the ceiling of non-convertible Sharia compliant additional Tier 1 capital instruments.

- The bank launched a new home finance product, “My Home”, which offers customers with greater choice and flexibility in meeting their home finance related needs. This ‘one stop shop’ provides simplicity and provides solutions to customers at every step of the home ownership journey.

- The bank participated in the 20th National Career Exhibition supported by the Sharjah Chamber of Commerce & Industry and Emirates Institute for Banking & Financial Studies. The bank continues to place importance in developing and expanding the skills of the talent at the bank shifting towards a more Human Capital concept rather than Human Resource.

Year to Date key deals

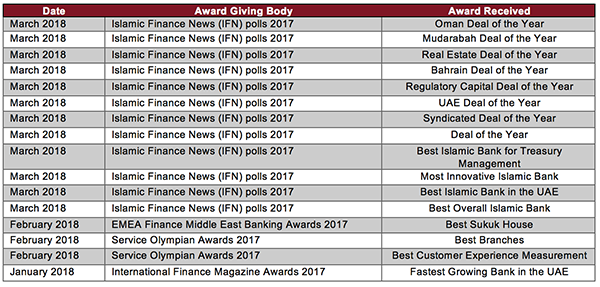

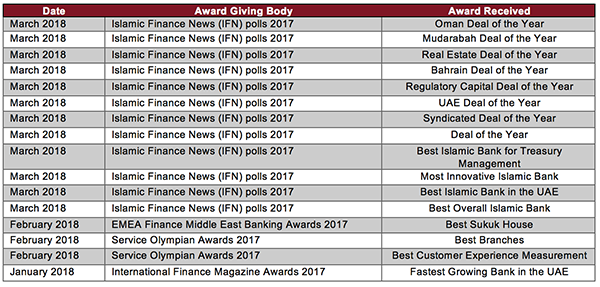

2018 Industry Awards: