Q1 2016 net profit up by 18 per cent to over AED 1 billion

Dubai Islamic Bank (DFM: DIB), the first Islamic bank in the world and the largest Islamic bank in the UAE by total assets, today announced its 1st quarter results for the period ended March 31, 2016.

1Q 2016 Results Highlights:

Higher revenue driven by core business growth:

- Group Net Profit increased to AED 1,001 million, up 18% compared with AED 850 million for the same period in 2015.

- Total Income increased to AED 2,105 million, up 22% compared with AED 1,728 million for the same period in 2015.

- Net Operating Revenue increased to AED 1, 693 million, up 11% compared with AED 1,520 million for the same period in 2015.

- Impairment losses declined to AED 118 million compared with AED 136 million for the same period in 2015.

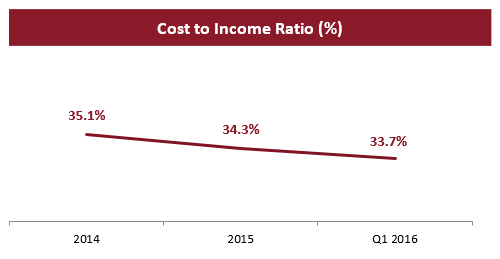

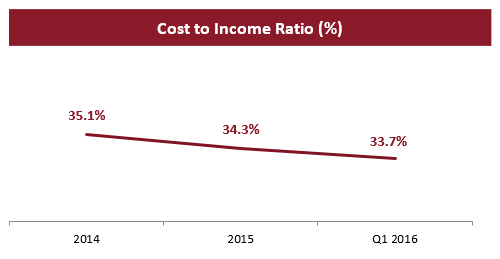

- Cost to income ratio improved to 33.7% compared with 34.8% for the same period in 2015.

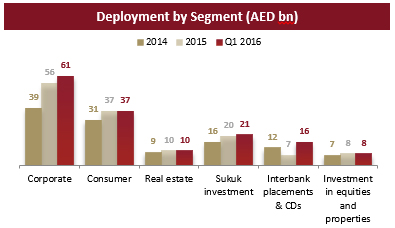

Steady growth in earning assets across all business segments

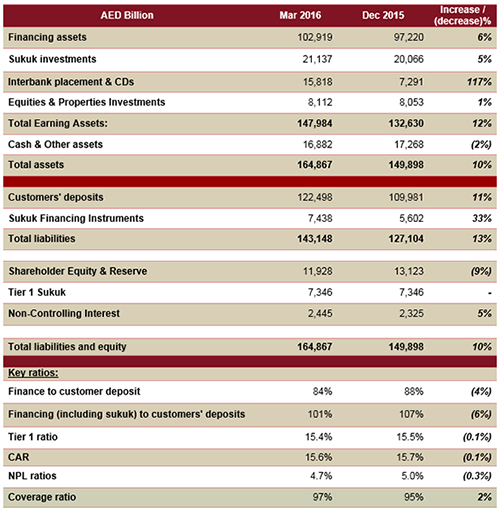

- Net financing assets at AED 102.9 billion up by 6%, compared to AED 97.2 billion at the end of 2015.

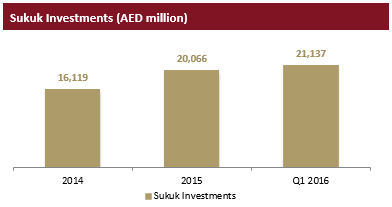

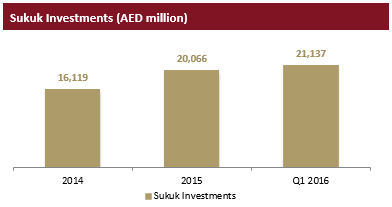

- Sukuk investments at AED 21.1 billion, an increase of 5%, compared to AED 20.1 billion at the end of 2015.

- Total Assets at AED 164.9 billion, an increase of 10%, compared to AED 149.9 billion at the end of 2015.

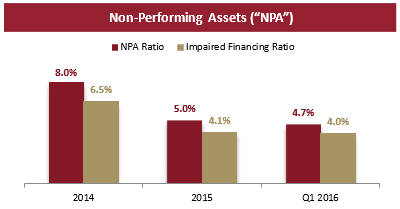

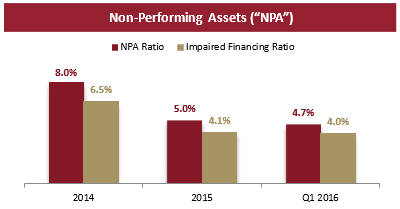

Loan impairments continue to trend downwards

- NPLs on a consistent decline with NPL ratio improving to 4.7%, compared to 5.0% at the end of 2015.

- Provision coverage ratio improved to 97%, compared to 95% at the end of 2015. Overall coverage including collateral at discounted value now stands at 152%, compared to 148% at the end of 2015.

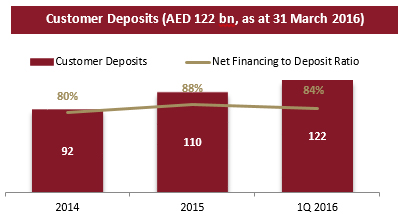

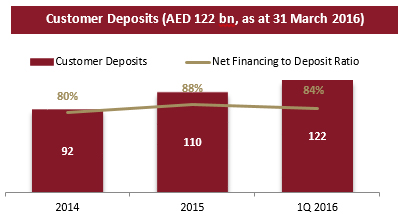

Growing customers’ deposits

- Customer deposits at AED 122.5 billion compared to AED 110.0 billion at the end of 2015, up by more than 11%.

- CASA book comprising 39% of total deposit base.

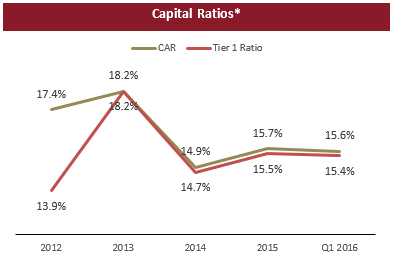

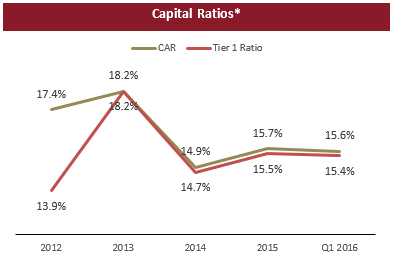

Strong Capitalization and liquidity position

- Capital adequacy ratio at 15.6% as of Mar 2016, as against 12% minimum required.

- Tier 1 CAR stood at 15.4% against minimum requirement of 8%.

- Financing to deposit ratio is at 84.0% highlighting significant liquidity.

Enhancing value for shareholders

- Earnings per share stood at AED 0.16 in Q1 2016.

- Return on assets reached 2.55% in Q1 2016.

- Return on equity stood 17.7% in Q1 2016.

Management’s comments on the financial performance of the financial period:

His Excellency Mohammed Ibrahim Al Shaibani, Director-General of His Highness The Ruler’s Court of Dubai and Chairman of Dubai Islamic Bank, said:

- The global markets entered 2016 with continued volatility in the commodities and equities sector. Despite this landscape, the UAE’s domestic banking sector has so far reported healthy results with DIB once again demonstrating its robust positioning

by delivering another strong earnings for the period.

- Earlier this year, the board also approved several initiatives to strengthen the bank’s capital in order to proactively support DIB’s growth ambitions in 2016.

- As markets stabilize over the coming months, I am confident that DIB will continue to be amongst the leading performers in the UAE financial sector.

Dubai Islamic Bank Managing Director, Abdulla Al Hamli, said:

- Continued focus on market penetration and cross sell has led to the bank delivering another solid set of results.

- DIB has also successfully received ISO 9001:2008 Human Resource Quality Management System certification demonstrating the robust nature of the bank’s policies, procedures and processes.

- Whilst playing a key role in supporting Emiratization strategy, DIB has positioned itself as one of the most sought after employers in the region.

Dubai Islamic Bank Group Chief Executive Officer, Dr. Adnan Chilwan, said:

- Last year, we achieved a major milestone by joining the USD $1 billion profit club in the banking sector in UAE. 2016 promises to be another strong one with DIB delivering more than AED 1 billion profit in the 1st quarter.

- Whilst we are cognizant of the challenges the markets pose today, the platform established over the last couple of years continues to create new business opportunities for the bank which were non-existent before. The diversified suite of products

and services has led to not just new-to-bank customers and sectors, but has also allowed for greater penetration and enhanced cross sell in existing business.

- As the year progresses, we are confident that the performance leadership demonstrated by DIB over the recent past will carry through the rest of 2016 as we culminate our carefully crafted and progressive 3 year growth strategy towards a strong conclusion.

Financial Review

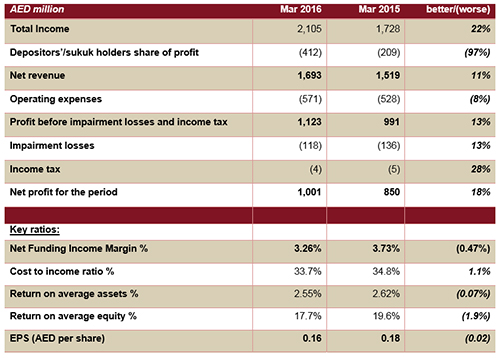

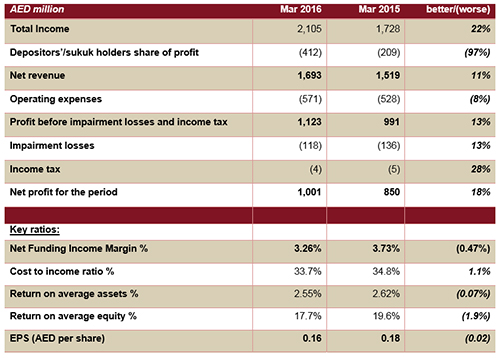

Income Statement highlights:

Total Income

Total income for the period ended March 31, 2016 increased to AED 2,105 million from AED 1,728 million for the same period in 2015, an increase of 22% driven by continuous growth in our core businesses. Income from Islamic financing and investing transactions

increased by 21% to AED 1,527 million from AED 1,259 million for the same period in 2015. Fees and commissions have increased by 37% to AED 418 million compared to AED 305 million for the same period in 2015.

Net revenue

Net revenue for the period ended March 31, 2016 amounted to AED 1,693 million, an increase of over 11% compared with AED 1,519 million in the same period of 2015. The increase is attributed to growth in funded income and fees and commissions.

Profit for the period

With strong growth in net revenue coupled with improved asset quality leading to declining impairment charges, net profit for the period ended March 31, 2016, increased to AED 1,001 million from AED 850 million in the same period in 2015, an increase

by 18%.

Operating expenses

Operating expenses marginally increased by 8.0% to AED 571 million for the period ended March 31, 2016, from AED 528 million in the same period in 2015.The increase is due to growth in operational expenses in line with increased business volume. Cost

to income ratio improved to 33.7% compared to 34.8% for the same period in 2015 driven by higher revenues and better operational efficiencies.

Impairment losses

Impairment losses declined to AED 118 million compared with AED 136 million for the same period in 2015, an improvement of 13%. Credit quality continues to improve during this quarter compared to the corresponding quarter last year resulting in lower

net impairment charges during the period.

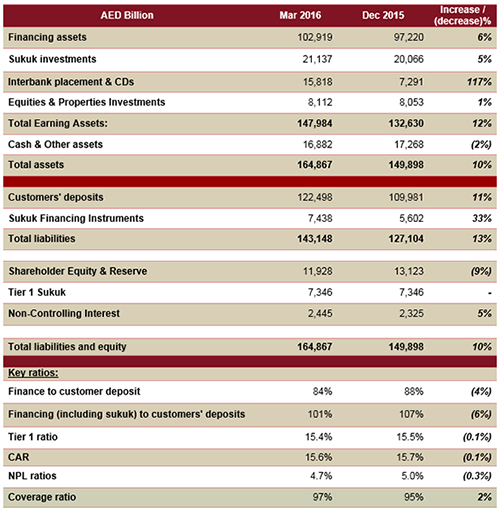

Statement of financial position highlights:

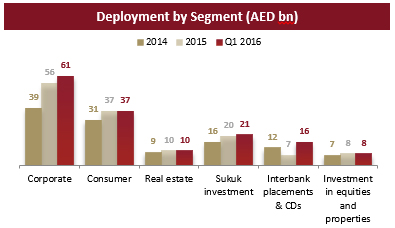

Financing portfolio

Net financing assets grew to AED 102.9 billion for the period ended March 31, 2016 from AED 97.2 billion as of end of 2015, an increase of 6%. Corporate banking gross finance grew to AED 70.7 billion (including real estate) for the period ended March

31, 2016, compared with AED 65.7 billion for the period ended 2015.

Asset Quality

Non-performing assets have shown a consistent decline with NPL ratio improving to 4.7% for the period ended March 31, 2016, compared with 5.0% at the end of 2015. Impaired financing ratio also improved to 4.0% for the period ended March 31, 2016 from

4.1% at the end of 2015. This is mainly due to reduction in absolute NPLs coupled with increase in overall performing assets. With continued provisions, cash coverage improved to 97% compared with 95% at end of 2015. Overall coverage ratio stood at

152% at the end of March 2016 compared to 148% at the end of December 2015.

Sukuk Investments

Sukuk investments increased by 5% for the period to AED 21.1 billion from AED 20.1 billion at end of 2015. The primarily dollar denominated portfolio consists of sovereigns and other top tier names many of which are rated.

Customer Deposits

Customer deposits for the period ended March 31, 2016 increased by 11% to AED 122 billion from AED 110 billion as of end of 2015. CASA book continues to be strong increasing by nearly 7% to AED 47.6 billion compared with AED 44.5 billion in 2015. Investment

deposits grew by 14.5% for the period ended March 31, 2016 to AED 74.8 billion from AED 65.4 billion as at end 2015. The increase in customer deposits has led to a financing to deposit ratio improving to 84% as of Q1 2016 compared to 88% at the end

of 2015.

Capital and capital adequacy

Capital adequacy ratio stands at 15.6% as of March 31, 2016, and T1 ratio at 15.4%, both ratios are well above regulatory requirement.

* Regulatory Capital Requirements CAR at 12% and Tier 1 at 8%

Key business highlights for the 1st quarter of 2016:

- Dubai Islamic Bank returned to the international debt capital markets with a very successful US$ 500 million 5Y Sukuk issue in March 2016. This deal was the first GCC bank issuance since November 2015 and essentially marked the reopening of the market

after a hiatus of 4+ months. The transaction is being hailed as a tremendous accomplishment in the current environment where the GCC has gone through a well-documented change in onshore liquidity conditions and witnessed multiple rating downgrades,

which have been mainly the result of the drop in oil prices.

- In March 2016, Moody’s retained the credit rating for the bank with issuer rating at ‘Baa1’ with a ‘Stable’ outlook. The ratings are driven by the bank’s solid profitability supported by a dominant and growing Islamic

franchise; solid capitalization metrics pressured by asset growth and solid liquidity with granular funding profile. In an environment where most banks are being subject to review for downgrade due to the macro-economic environment, DIB’s

strong credit rating and outlook evidences the confidence in the bank’s capabilities including the strong retail franchise in the UAE which gives the bank a competitive advantage.

- Following the conclusion of its Annual General Meeting (AGM), the shareholders approved DIB's capital increase by way of rights issue of 988,437,777 million new shares to raise the paid up capital from AED 3,953,751,107 to a maximum of AED 4,942,188,884.

The rights will be offered either once or through a series of issuances after obtaining the required approval from relevant regulatory authorities. Furthermore, approval was also, obtained for increasing the ceiling of non-convertible Shariah

compliant hybrid tier 1 capital instruments by USD 750 million for the purpose of strengthening the Bank's capital.

- Joint or lead managed nearly USD $4 billion in capital market transactions and nearly USD $5 billion of syndicated facilities. Key highlights of some of these transactions were the first sovereign sukuk in the international market in 2016, first international

sukuk issuance by a financial institution in 2016 as well as largest ever Asian USD sukuk transaction.

- DIB’s Human Resources Department achieved the ISO 9001:2008 certification for Quality Management System (QMS). This certification demonstrates the strength of DIB's robust policies and procedures designed to guide and govern the HR operations

across the Bank. The accreditation is a key milestone in the financial services industry and specifically, the Islamic banking sector, and will cement DIB's position as one of the most sought-after employers in the region.

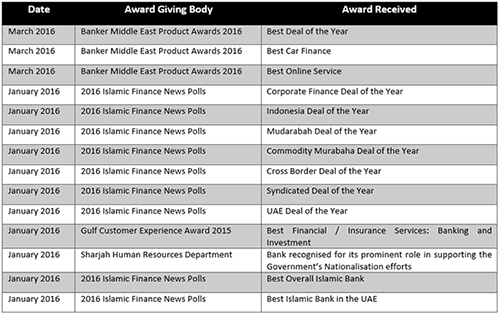

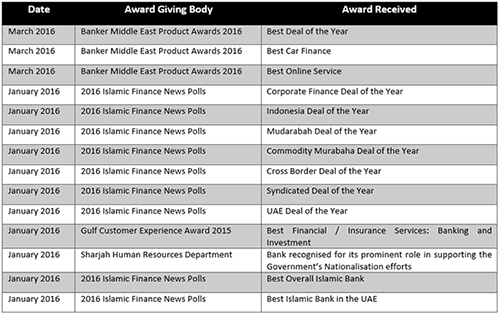

1st Quarter 2016 Awards: