- Total income surpasses AED 10.2 billion, up by 20% YoY.

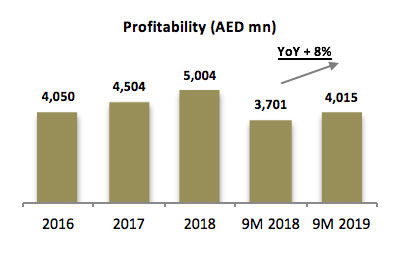

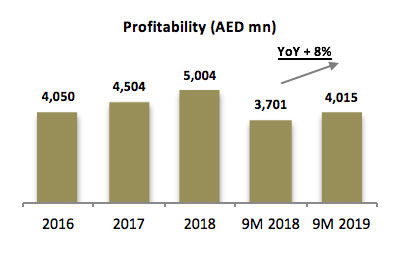

- Net Profit crosses AED 4.0 billion, up by 8% YoY.

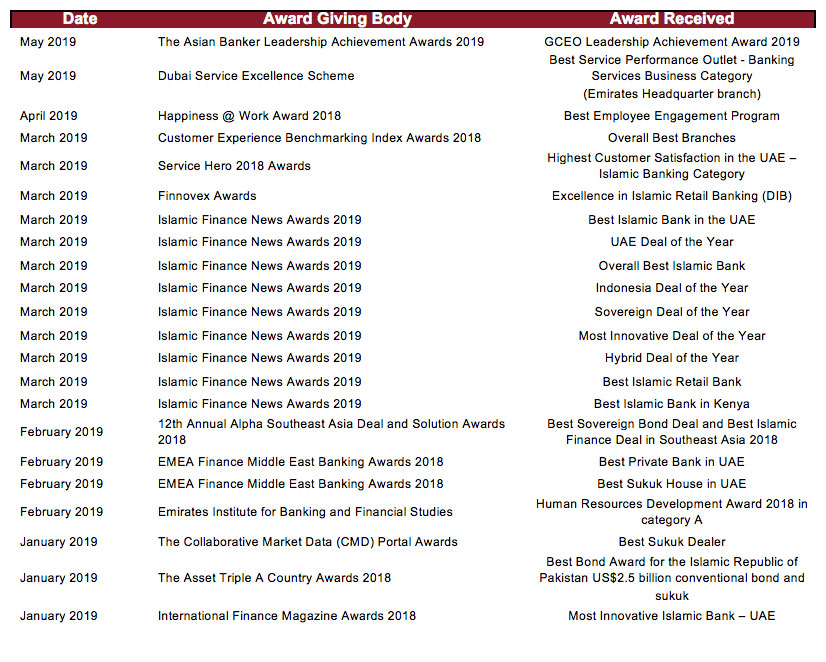

- ROA rises by 5 bps YoY to 2.36%, ROE is now at 17.6%.

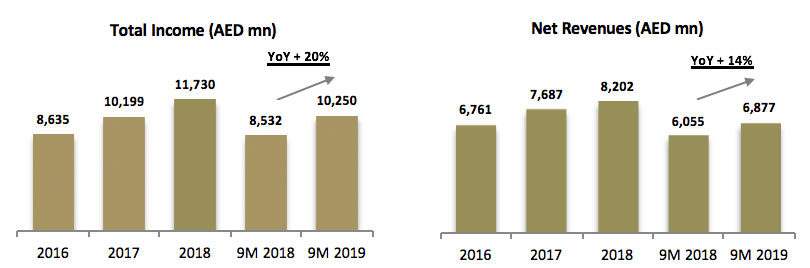

- Cost income ratio at 27.9%, amongst the best in the market.

Dubai Islamic Bank (DFM: DIB), the largest Islamic bank in the UAE, today announced its results for the period ending September 30, 2019.

9M 2019 key highlights:

Profitability consistently on the rise (9M ‘19 vs 9M’ 18)

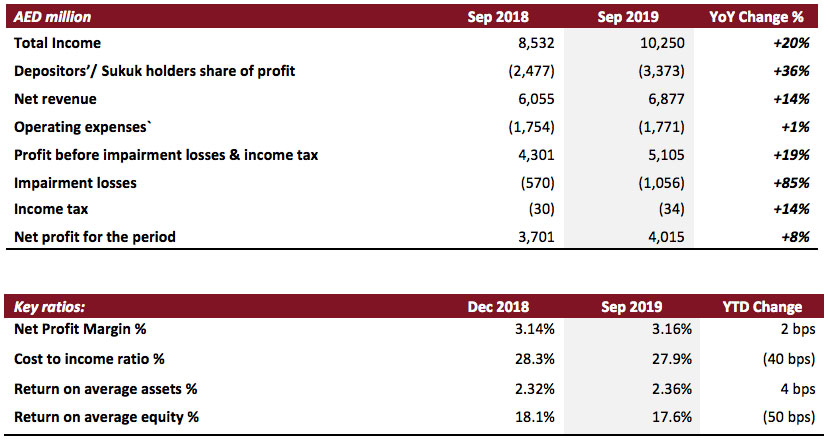

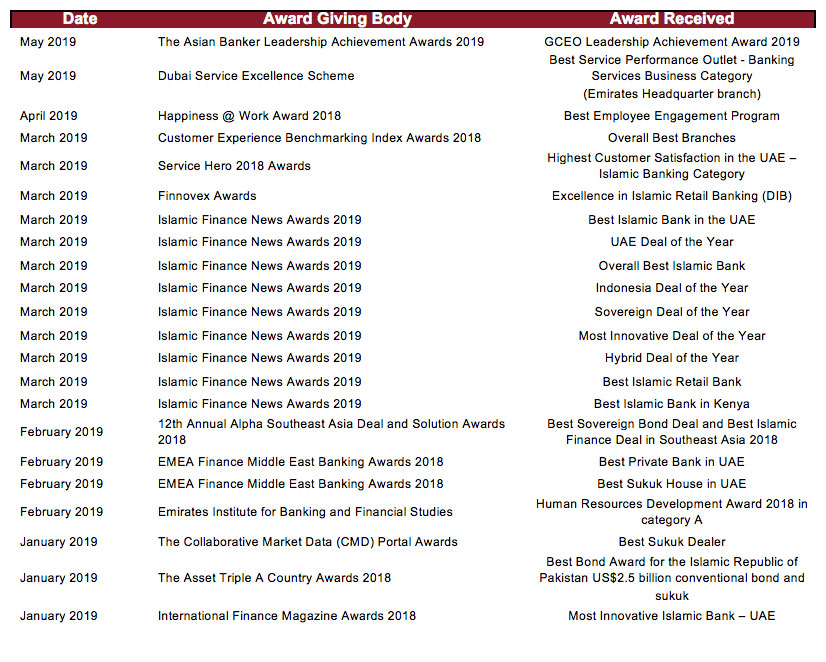

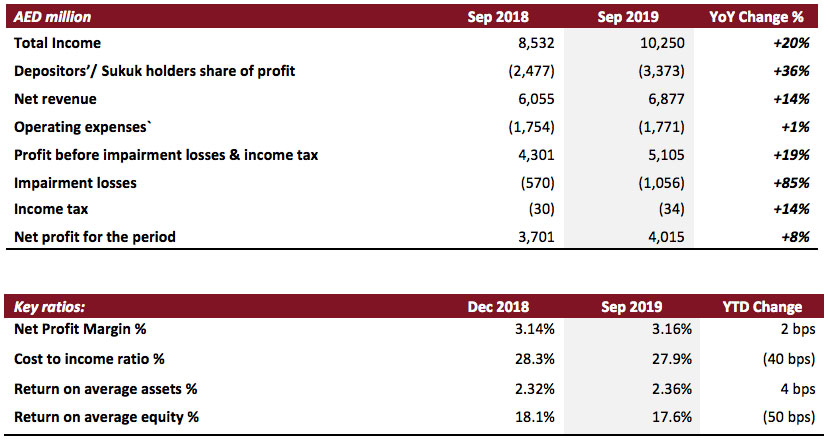

- Total Income reaches to AED 10,250 million, up by 20% YoY compared to AED 8,532 million.

- Group Net Profit increased to AED 4,015 million, up 8% YoY compared to AED 3,701 million.

- Net Operating Revenue grew to AED 6,877 million, up 14% YoY compared to AED 6,055 million.

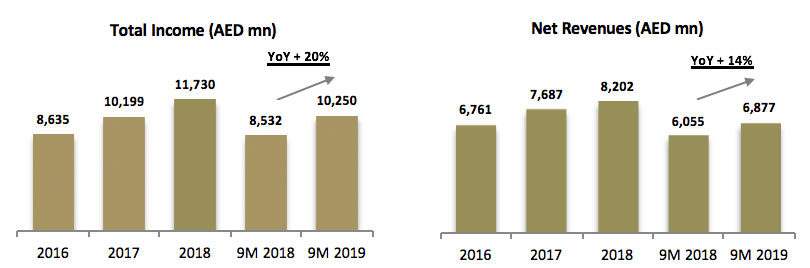

- Operating expenses stable at AED 1,771 million vs AED 1,754 million in 9M 2018.

- Net operating profit before impairment charges grew by 19% YoY to AED 5,105 million.

- Cost to income ratio continues to improve now at 27.9% compared to 28.3% at the end of 2018.

- Net Profit Margin at 3.16% in line with guidance for the year.

- ROA increased to 2.36% and ROE at 17.6%, both in line with guidance.

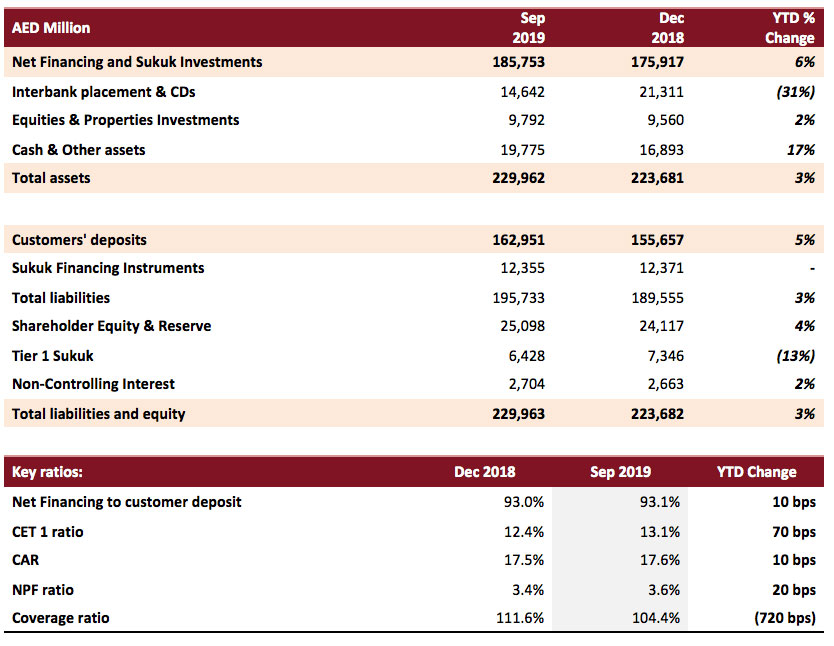

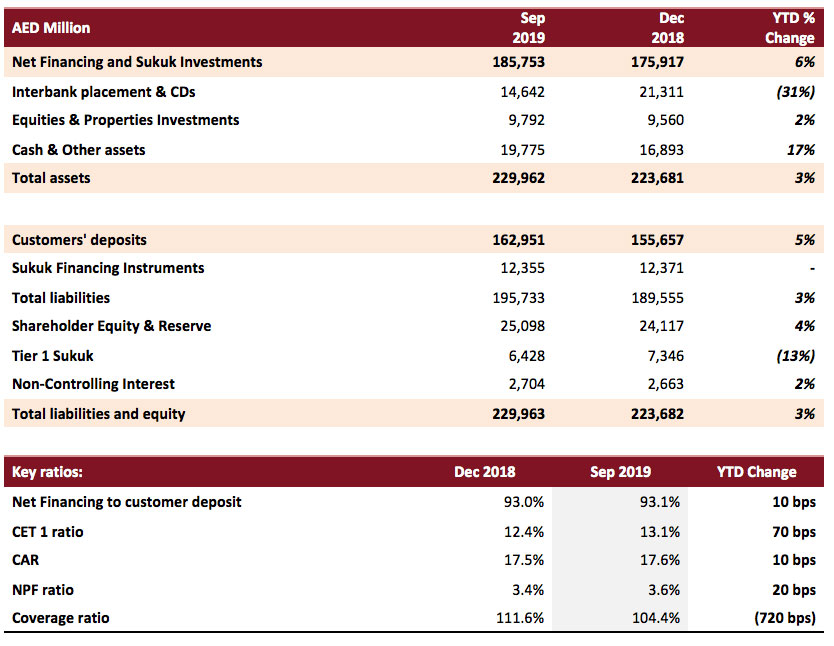

Strong balance sheet growth

- Net Financing & Sukuk investments rose to AED 185.7 billion up by 6% YTD.

- Total Assets stood at AED 229.9 billion, up by 3% YTD.

- Customer deposits increased to AED 162.9 billion up by 5% YTD.

- CASA deposits stands at AED 50.7 billion as of 9M 2019 representing 31% of customer deposits.

- Financing to deposit ratio stood at 93%.

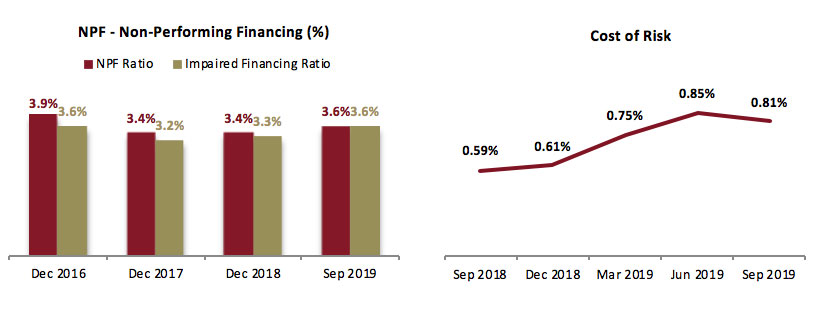

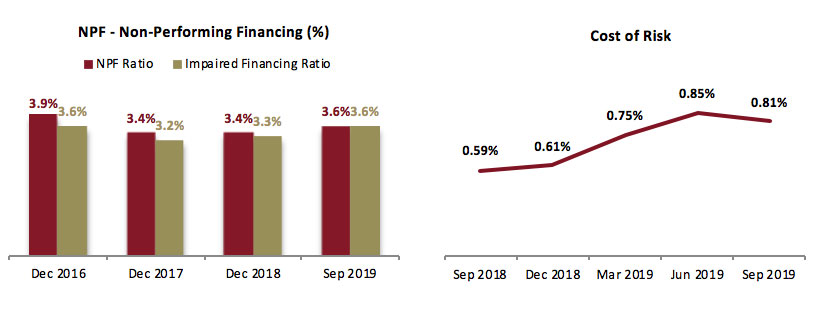

- NPF ratio is at 3.6% with cash coverage ratio is at 104%.

- Overall coverage, including collateral at discounted value, stands at 136%.

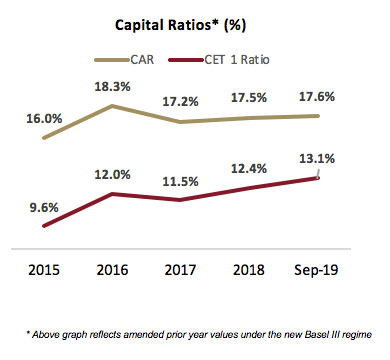

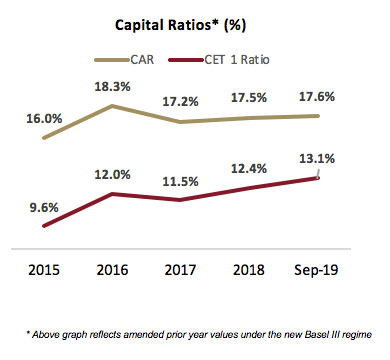

Capital ratios remain strong

- Capital adequacy ratio is at 17.6%, as against 13.50% minimum required.

- CET 1 has increased to 13.1% vs 12.4% in end of 2018 and as against minimum required of 10.00%.

Management’s comments for the period ending September 30, 2019:

His Excellency Mohammed Ibrahim Al Shaibani, Director-General of His Highness The Ruler’s Court of Dubai and Chairman of Dubai Islamic Bank, said:

- Amidst a subdued global environment, the UAE banking sector continues to demonstrate strength and resilience with total assets of more than USD $700 bn, growth of 9% YoY. The sector today has the largest share of total listed banking assets in the GCC at more than 30%.

- The on-going economic reforms particularly in strengthening the private sector has boosted the non-oil portion of the economy on the back of an expansionary budget and supportive fiscal policies.

- The UAE has continued to emphasize its position as a global business hub, by leading the Arab World in the recent World Economic Forum 2019 Global Competitiveness Index. The country’s current position amongst the top 25 in the world has been largely driven by several innovative measures by the government to ensure the presence of an environment that is attractive to both local and global investors alike.

Dubai Islamic Bank Managing Director, Abdulla Al Hamli, said:

- In line with the national Emiratization agenda, DIB remains committed in developing talent and leadership skills within the bank with Emiratisation ratio now reaching close to half of the workforce. This has been a key element of the bank’s heritage and strategy which aims to grow and develop future leaders to support the global ambitions of the UAE.

- The Islamic banking sector in the UAE continue to remain robust with assets crossing AED 560 billion and a healthy 23% domestic market share. DIB continues to be the market leader in UAE and remains committed to accelerate the penetration of the sector in the wider economy.

Dubai Islamic Bank Group Chief Executive Officer, Dr. Adnan Chilwan, said:

- DIB’s fundamentals remain strong with profitability reaching AED 4.0bn, up by 8% YoY whilst focus on delivering strong returns to our shareholders continues with ROE at 17.6%.

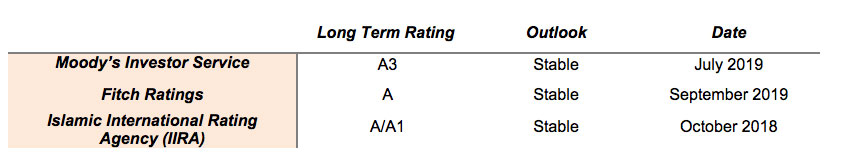

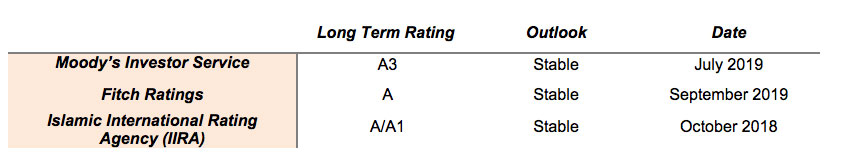

- The quarter saw both Moody’s and Fitch re-affirm the bank’s credit ratings with a ‘stable’ outlook signifying the strength of the franchise to navigate through the current global economic environment and sustain profitable growth.

- Focus on quality growth has seen a double digit rise in the top line income of 20% which combined with efficient cost management has translated into cost to income ratio being stable at 27.9%, amongst the best in the market. Given the bank’s future plans around digitalization, we expect to remain around these levels going forward.

- Net profit margin at 3.16% has now surpassed the highest end of the guidance and remains amongst the top in the domestic banking sector.

- DIB continues to be very well capitalized, with both CAR and CET1 at 17.6% and 13.1%, well above the regulatory requirements of 13.5% and 10% respectively.

Financial Review

Income Statement highlights:

Income and Revenue

Total income for the 9-month period reached AED 10,250 million, up 20% YoY. Income from financing and investments in sukuk continues to be a key driver for the growth. New businesses from the consumer and wholesale supported the strong income growth. Net revenue for the 9-month period amounted to AED 6,877 million, an increase of 14% compared with AED 6,055 million in 9M 2018.

Costs

Operating expenses for the 9-month period remained broadly stable at AED 1,771 million compared to AED 1,754 million in 9M 2018. Cost to income ratio continuous to improve now at 27.9% compared to 28.3% at the end of 2018. Building efficiencies across the bank’s operations as well as strict cost discipline have enabled the bank to maintain one of the best cost income ratios in the sector.

Net Profit

Profitability remains robust with net profit growing by 8% to AED 4,015 million for the 9-month period from AED 3,701 million in 9M 2018. Strong growth in core income for the period supported by cost management focus has attributed to the healthy growth in profitability. The bank continues to benefit from efficiency building exercise through focus on promoting digital channels and optimizing the branch network.

Statement of financial position highlights:

Financing and Sukuk portfolio

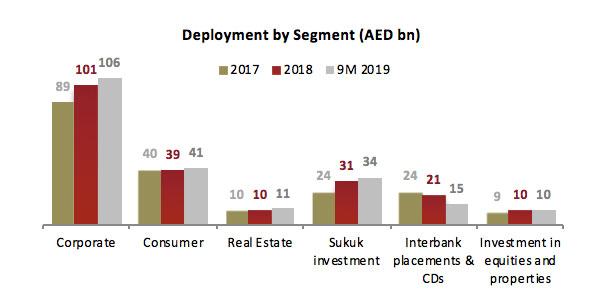

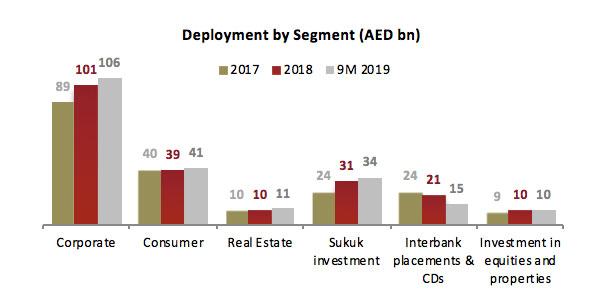

Net financing & sukuk investments increased to AED 185.7 billion during the 9 month period from AED 175.9 billion at the end of 2018, an increase of over 6%. Corporate banking financing assets currently stand at AED 106 billion whilst the consumer financing assets stood at AED 41 billion. New gross financing for the consumer book has now crossed AED 10 billion year to date driven by key products of auto, personal as well as home finance. Commercial real estate concentration managed within guidance at around 20%.

In addition to the sustained growth of the core businesses, the bank’s high margin sukuk portfolio has also grown strongly now reaching AED 34 billion vs AED 31 billion at the end of 2018. The portfolio primarily consists of rated sovereign institutions in domestic and strategic growth markets making DIB one of the most active financial institutions in the Islamic capital markets space. The bank’s total assets now stand at nearly AED 230 billion, a growth of 3% year to date.

Asset Quality

For the period ended 30 Sep 2019, non-performing financing ratio and impaired financing ratio stood at 3.64% and 3.57% respectively. Cash coverage stood at 104% and overall coverage ratio including collateral at discounted value reached 136% with cost of risk (on gross Islamic & financing assets) at 81 bps.

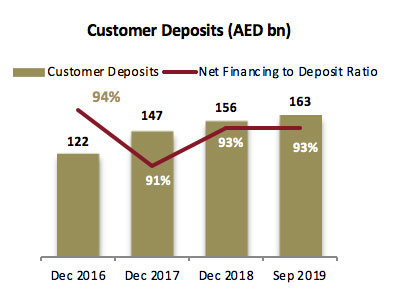

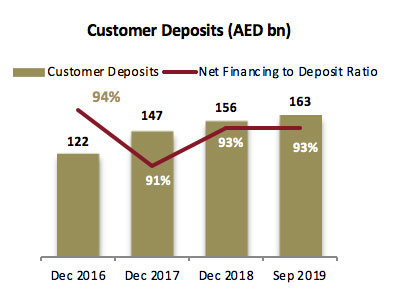

Customer Deposits

Customer deposits during the 9 month period reached to AED 163 billion from AED 156 billion in end of 2018. CASA deposits is now at AED 50.7 billion as of 30 September 2019 representing 31% of customer deposits. Net financing to deposit ratio stood at 93%.

Capital Adequacy

Capital adequacy ratios remained robust with overall CAR and CET 1 ratio as at 30 September 2019 stand at 17.6%, (against minimum CAR requirement of 13.5%), and 13.1%, (against minimum CET1 requirement of 10%), respectively. DIB has been designated a Domestic Systemically Important Bank (D-SIB) by the regulator, which signifies the importance of the franchise to the financial sector in the country.

Ratings:

- July 2019 – Moody’s publishes DIB credit opinion update re affirming the bank’s long term issuer rating scale ‘A3’ carrying a ‘Stable’ outlook supported by strong retail franchise in the UAE, solid profitability, sound liquidity and stable asset quality.

- September 2019 - Fitch Ratings has re-affirmed Dubai Islamic Bank (DIB) Long-Term Issuer Default Rating (IDR) at ‘A’ with a Stable Outlook and Viability Rating (VR) at ‘bb+’ reflecting strong domestic franchise, healthy profitability, sound funding & liquidity and adequate capital ratios.

- October 2018 – Islamic International Rating Agency (IIRA) has reaffirmed ratings on Dubai Islamic Bank with international scale ratings of A/A1. The strong ratings are driven by consistent improvement of asset quality indicators over time, continued growth in business assets and strong cost controls leading to robust profitability.

Q3 2019 - Key business highlights:

- DIB continues to support the nation’s Emiratization agenda as part of its ongoing commitment to develop the leadership skills of Emiratis within the bank. DIB has achieved 100% Emiratisation at branch managerial level, while maintaining best Emiratization scores as per UAE Central Bank requirements. The bank also remains fully aligned with the UAE’s National Agenda 2021, and its goal to increase Emiratis working in the public and private sector by a factor of ten.

- During the 3rd quarter, DIB received its re affirmed credit ratings with 2 international agencies (Fitch Ratings and Moodys) demonstrating the strength and resilience of the bank across key indicators such as profitability, asset quality, liquidity and capital ratios. The bank continues to have sound capital buffers and growth performance remain solid. Both agencies gave a ‘stable’ outlook for the bank.

- Short term financing product for Consumer Banking was recently launched providing customers with flexible solutions for their immediate financing needs. The service is available with Personal Finance and Credit Cards and customers can now choose the product and repayment option that suits them best.

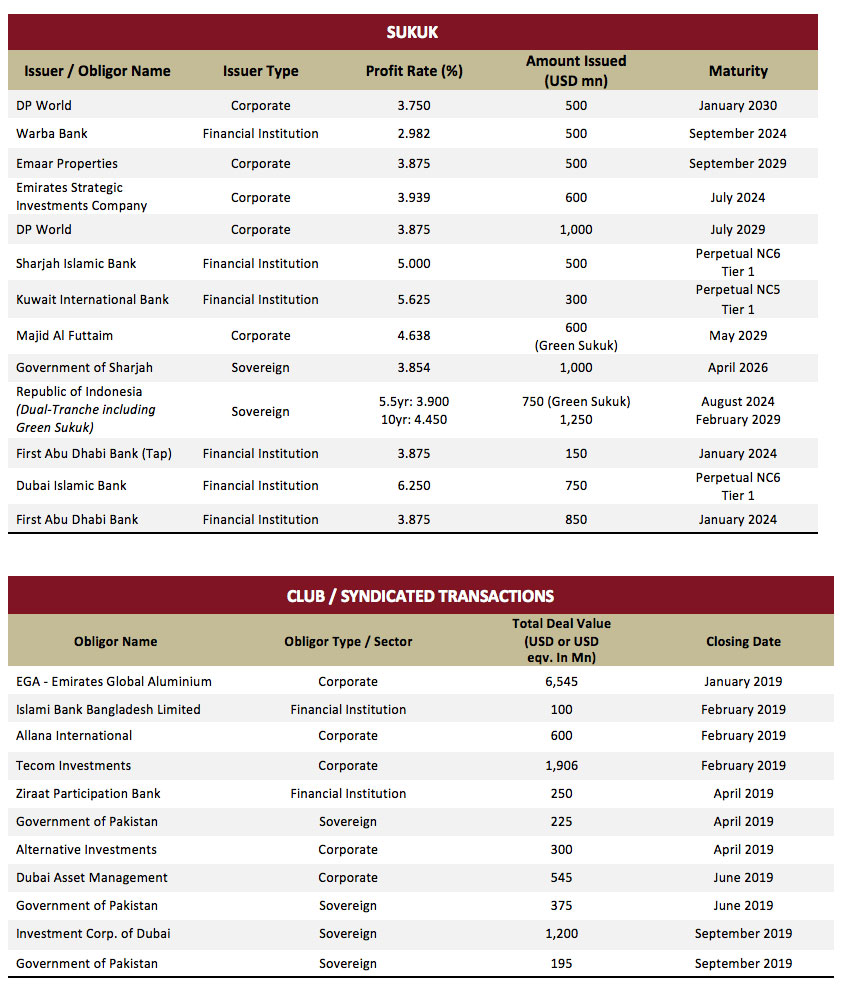

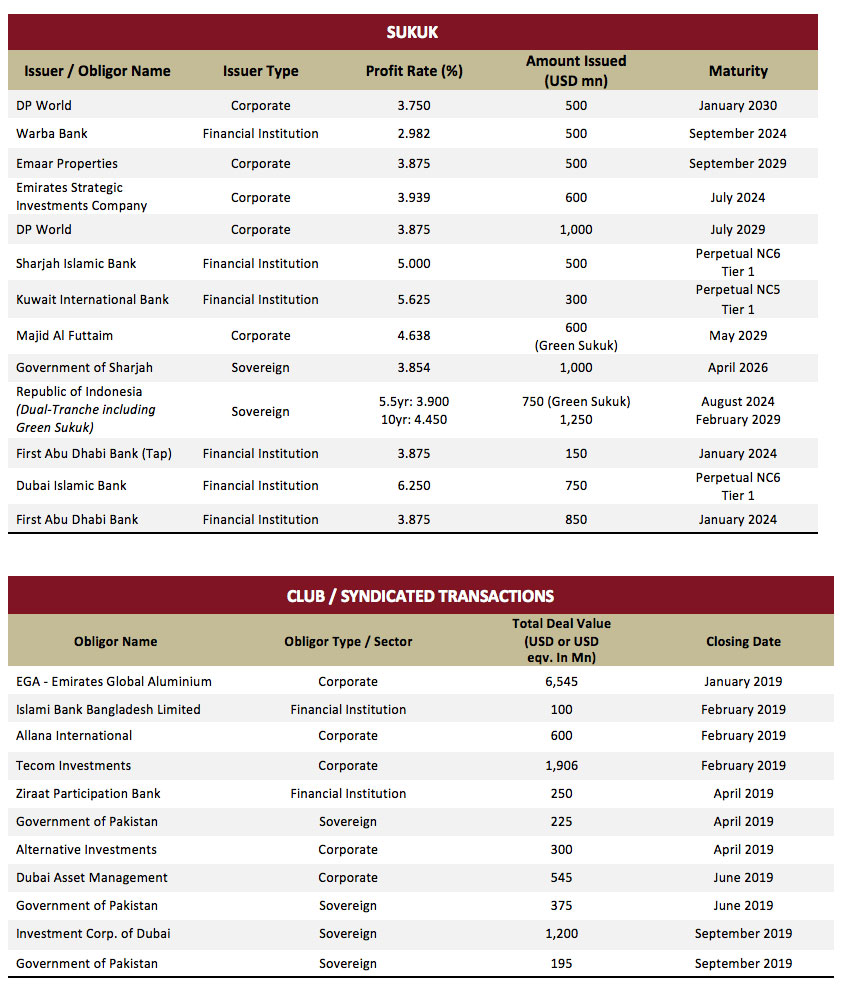

YTD 2019 Syndications and Deals

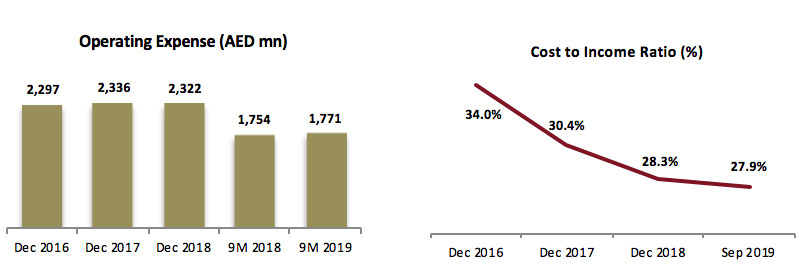

Industry Awards (Year to Date 2019)