Net profit surpasses AED 5.0 billion, up by 11%

- Total Income crosses AED 11.7 billion, up by 15% YoY

- Financing & Sukuk investments grew by nearly 12% to AED 175.9 bln

- Total assets grew by nearly 8% to reach AED 223.7 billion

- Successful rights issuance in 2018 strengthens capital, positioning the bank for sustained growth

Dubai Islamic Bank (DFM: DIB), the first Islamic bank in the world and the largest Islamic bank in the UAE by total assets, today announced its results for the year ended December 31, 2018.

Full Year 2018 Results Highlights:

Growth momentum with profitability focus continues

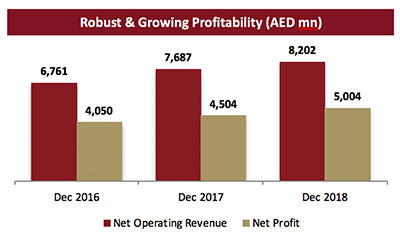

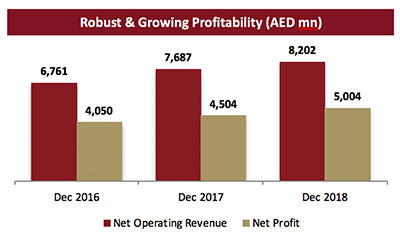

- Group Net Profit increased to AED 5,004 million, up 11% compared to AED 4,504 million for 2017.

- Total Income increase to AED 11,730 million, up by 15% compared to AED 10,199 million for 2017.

- Net Operating Revenue grew to AED 8,202 million, up 7% compared to AED 7,687 million for 2017.

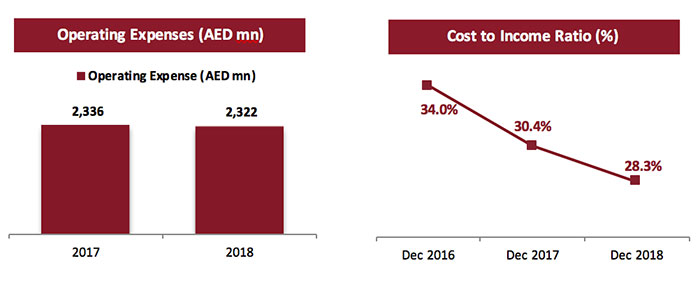

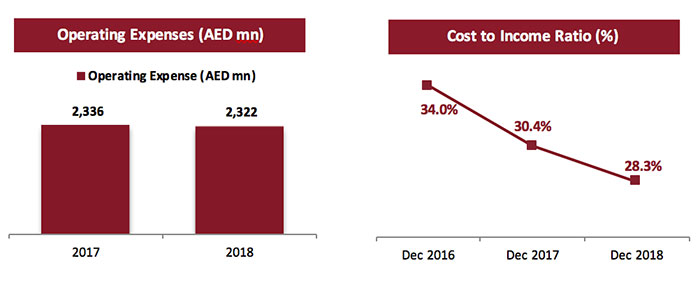

- Operating expenses reduced to AED 2,322 million compared to AED 2,336 million for 2017.

- Net operating income before impairment charges grew by 10% YoY to AED 5,880 million.

- Cost to income ratio for the year ended 2018 is at 28.3% compared to 30.4% at the end of 2017.

Core business remains the underlying driver for balance sheet growth

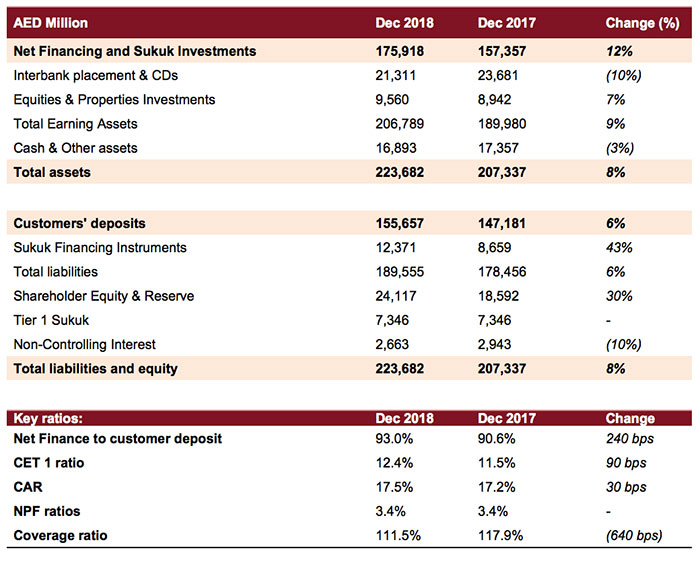

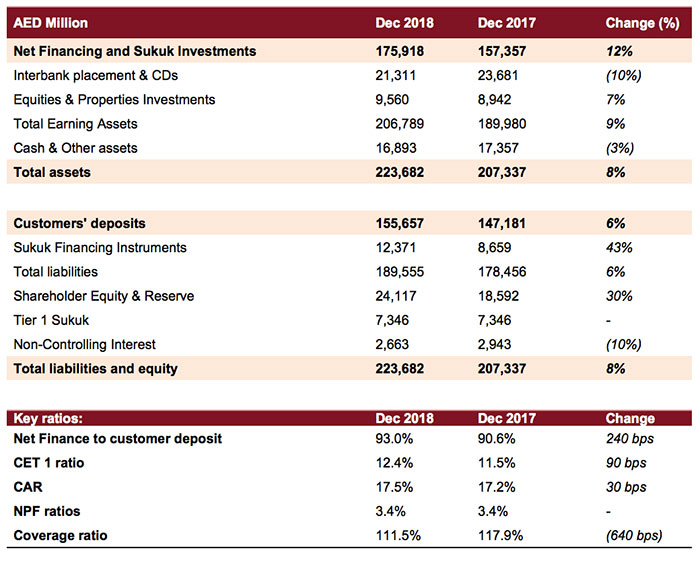

- Net Financing & Sukuk investments rose to AED 175.9 billion up by 11.8%, compared to AED 157.4 billion at the end of 2017.

- Total Assets stood at AED 223.7 billion, up by 7.9%, versus AED 207.3 billion at the end of 2017.

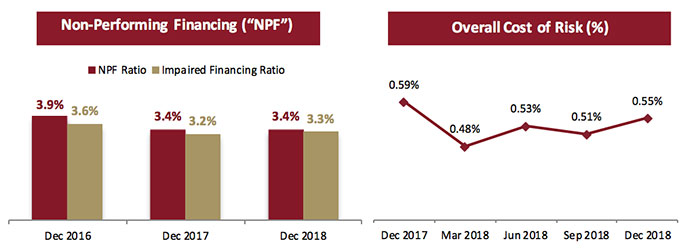

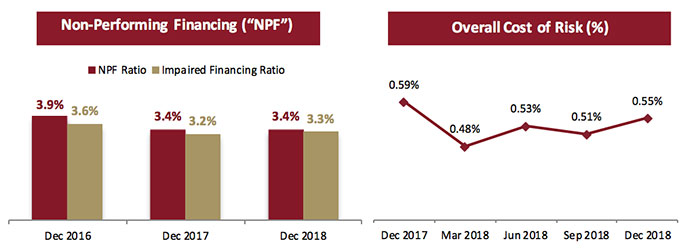

Asset quality indicators remain solid

- NPF ratio steady at 3.4%. Provision coverage ratio is at 112%.

- Overall coverage, including collateral at discounted value, stands at 150%.

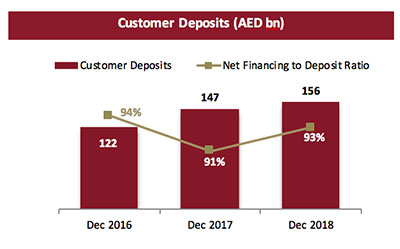

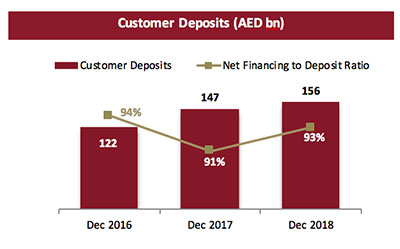

Liquidity and funding continues to remain stable

- Customer deposits up by 5.8% to reach to AED 155.7 billion from AED 147.2 billion in end of 2017.

- CASA deposit rose to AED 54 billion as of full year 2018 despite a rising rate environment.

- Financing to deposit ratio stood at 93%.

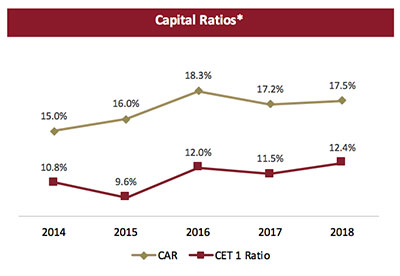

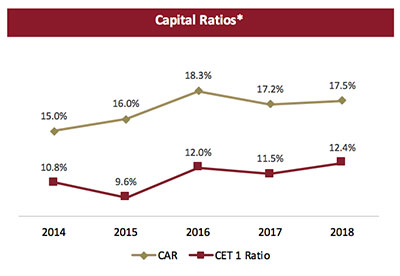

Capitalization well above the regulatory requirements, providing adequate cushion for growth

- Capital adequacy ratio is at 17.5%, as against 12.75% minimum required.

- CET 1 is at 12.4%, as against minimum required of 9.25%, providing significant room for growth under the new Basel III regime.

- ROA at 2.32% and ROE at 18.1%, in line with guidance.

- DIB Board of Directors recommends the distribution of a cash dividend of 35%, as per UAE Central Bank directives, subject to AGM approval.

Management’s comments for the year ending December 31, 2018:

His Excellency Mohammed Ibrahim Al Shaibani, Director-General of His Highness The Ruler’s Court of Dubai and Chairman of Dubai Islamic Bank, said:

- Shariah-compliant banking is on the rise in markets around the world, and DIB, being amongst the top two Shariah-compliant banks in the world, is playing a key role here. We will continue our progress in spreading the popularity of Islamic banking, educating the market on its benefits, and shattering the myth that Shariah-compliant banking is limited to Muslims.

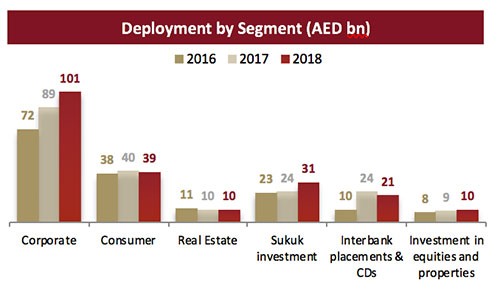

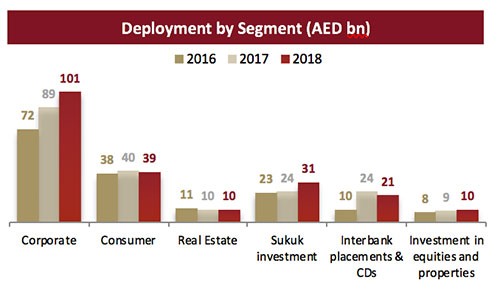

- Our commitment to grow the Islamic capital markets has seen DIB participate and lead nearly USD 23 billion of sukuk and syndication transactions with our book of Sukuk investments growing to AED 31 billion this year.

- Today, UAE is on track towards maintaining sustainable growth, following the new reforms and governmental initiatives to diversify sources of revenue while increasing spending in key sectors. In the face of the unprecedented global challenges, the country has remained steady and resilient in creating new opportunities for growth in a wide variety of sectors including infrastructure, finance and business, healthcare, hospitality and tourism, aviation and transportation and scientific research.

- The growth of the UAE’s economy and its ability to attract global investors and entrepreneurs continues to spur us on the path of success as we progress the bank and the Islamic finance sector to even greater heights in the coming years. We remain confident that the bank will benefit from new reforms and increased government spending, besides development of key sectors.

Dubai Islamic Bank Managing Director, Abdulla Al Hamli, said:

- From promoting positivity and happiness amongst our employees, to encouraging individuals and businesses to be more effective, our strategic partnerships with the UAE government have deepened the connection DIB enjoys with the nation and its people, and we are proud of our contribution to the success of the local economy.

- The year saw us active in the capital markets as well. Early in 2018, we successfully priced US$ 1 Billion Sukuk issued with a 5 year tenor that reopened the regional FI and corporate Debt Capital Markets. Around the 2nd quarter, the rights issuance by the bank, which was aimed to boost the CET1, was massively oversubscribed generating nearly three times the required subscription. Both deals clearly highlighted the continued existence of the strong demand for DIB paper as well as the confidence which global investors have in the UAE’s largest Islamic bank.

Dubai Islamic Bank Group Chief Executive Officer, Dr. Adnan Chilwan, said:

- 2018 proved to be another outstanding year of growth for Dubai Islamic Bank. From earning industry recognition through prestigious awards, to continuously delivering on our promises to customers, we have once again exceeded market expectations, and we remain determined to continue making our mark both locally and globally. It makes us all extremely proud to note that the market now views DIB as a performance benchmark for the entire banking sector, not just for Islamic Finance.

- 2018 Net Profit crossing AED 5 bln is a clear indication of the success of our sustained and continued execution of our proven strategy. Focus on profitability remains the core driver in our growth agenda, clearly evidenced by the strong net profit margin (NPM) of 3.14%, which remains at the higher end of the market. Our ability to innovate around the dynamic market conditions gives us confidence that we will continue to outperform and take market share which has now moved to double digits at around 10%.

- Dubai has strongly positioned itself as a powerful advocate for the Islamic Finance industry as the nation seeks to secure its role as the global capital for the Islamic economy. The implementation of new economic and banking regulations, such as Basel III, IFRS 9 as well as VAT has benefitted the market financial metrics, and strengthened the economy across the UAE.

- We remain focused on returns with strong ROA (2.32%) and ROE (18.1%), both very much in line with our guidance for the year. Our growth in the coming years will be driven by digitalization as the market continues to transform. Having anticipated this revolution, we had initiated the change in our processes and systems a few years ago and 2019 promises to be an incredible year for the bank and the customers in this area. Customer experience and convenience, cost optimization and revenue enhancement remain the key pillars driving DIB as the Digitally Intelligent Bank.

Financial Review

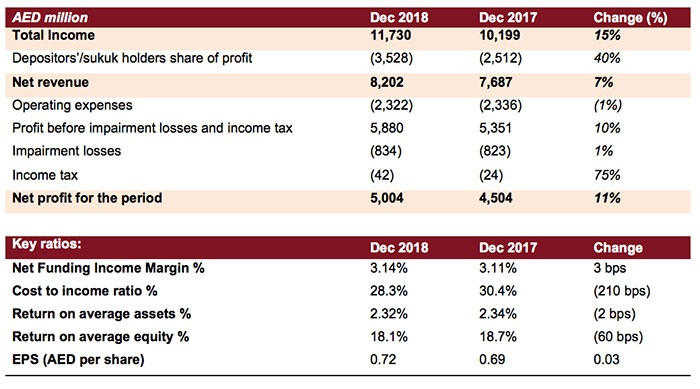

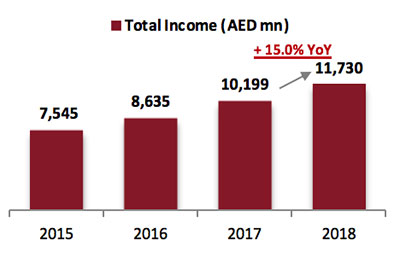

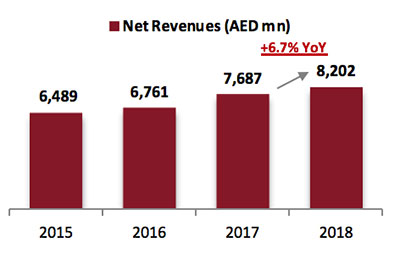

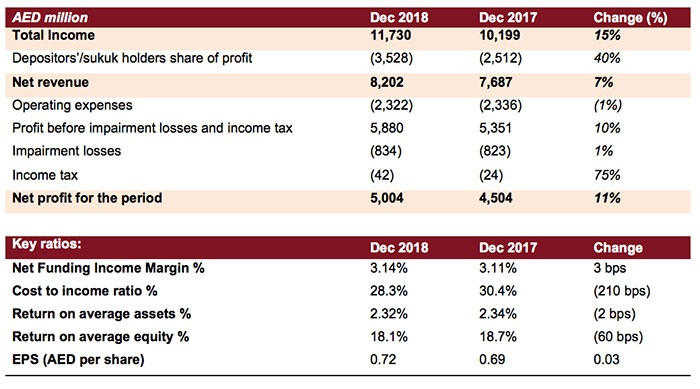

Income Statement highlights:

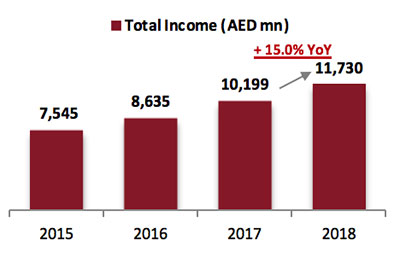

Total Income

Total income for the year ended 2018 was AED 11,730 million, up 15.0% YoY, mainly driven by growth in core Islamic financing and investments book and supported by commissions and fees which increased by 5%.

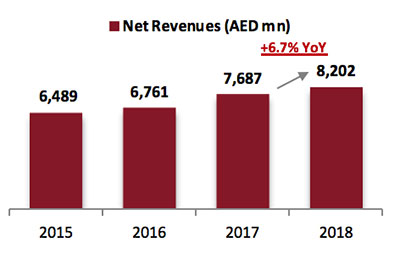

Net revenue

Net revenue for the year ended 2018 amounted to AED 8,202 million, an increase of 6.7% compared with AED 7,687 million in end of 2017.

Operating Expenses

Operating expenses for the year ended 2018 reduced to AED 2,322 million compared to AED 2,336 million for the year 2017. As a result, cost to income ratio significantly improved to 28.3% compared to 30.4% in December 2017.

Net Profit

Net profits grew strongly by 11.1% to AED 5,004 million for the year ended 2018 from AED 4,504 million in 2017. The significant rise in profitability can be attributed to top line income growth due to core business enhancement as well as optimal cost management.

Statement of financial position highlights:

Financing and Sukuk portfolio

Net financing & Sukuk investments increased to AED 175.9 billion for the year ended 2018 from AED 157.4 billion at the end of 2017, an increase of 12%, primarily driven by core business growth. Corporate banking financing assets grew at nearly 13% reaching a milestone of AED 101 billion whilst consumer business is at AED 39 billion, supported by new financing of nearly AED 13 billion. Commercial real estate concentration managed within guidance at around 19%.

Asset Quality

For the year ended 2018, non-performing financing ratio and impaired financing ratio is at 3.4% and 3.3% respectively. Cash coverage for the year ended 2018 stood at 112% and overall coverage ratio including collateral at discounted value reached 150% with cost of risk at 55 bps.

Customer Deposits

Customer deposits for the year ended 2018 increased by 6% to AED 156 billion from AED 147 billion in 2017. CASA deposit rose to AED 54 billion and financing to deposit ratio stood at 93%. Focus on payroll and operating account primarily supported CASA growth.

Capital Adequacy

Capital adequacy ratios remained robust with overall CAR and CET 1 ratio for the year ended 2018 standing at 17.5% and 12.4% respectively. The successful rights issue boosted the bank’s core capital with the issuance generating massive interest across a highly diversified local and international investor base. DIB has been designated a Domestic Systemically Important Bank (D-SIB) by the regulator, which signifies the importance of the franchise to the financial sector in the country.

* Above graph reflects amended prior year values under the new Basel III regime

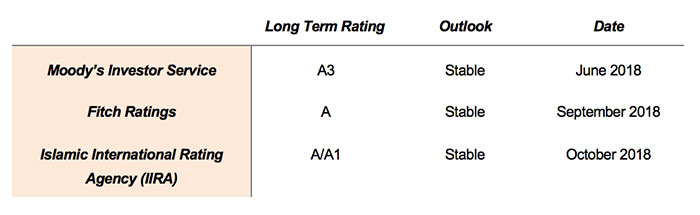

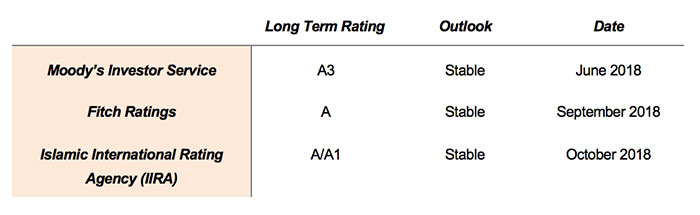

Ratings:

- October 2018 – Islamic International Rating Agency (IIRA) has reaffirmed ratings on Dubai Islamic Bank with international scale ratings of A/A1. The strong ratings are driven by consistent improvement of asset quality indicators over time, continued growth in business assets and strong cost controls leading to robust profitability.

- September 2018 – Fitch Ratings has affirmed Dubai Islamic Bank (DIB) Long-Term Issuer Default Rating (IDR) at ‘A’ with a Stable Outlook and Viability Rating (VR) at ‘bb+’ reflecting strong domestic franchise, healthy profitability and sound liquidity.

- June 2018 – Moody’s publishes note on successful DIB rights issuance indicating that the capital increase is credit positive for the bank and will support the bank’s liquidity, solvency as well as maintain strong and stable capital buffers over the medium term.

Q4 2018 - Key business highlights:

- DIB continued to entrench its position as market leader in the Islamic financing & capital markets with over USD 20 billion in combined deal value completed in 2018. During the year, DIB was appointed in over 30 Sukuk and syndicated financing transactions for supranationals, sovereigns, quasi-sovereigns, corporates and financial institutions and completed the year as the leading Middle Eastern Arranger for International Sukuk and Syndicated financing in the EMEA region. DIB has also been actively involved in liability management exercises for Sukuk issuers which were conducted concurrently with the new issuances. This demonstrates the robust capabilities of the bank as well as the strength of the brand franchise in dealing with complex benchmark sized transactions, extending beyond arranging and selling new issues.

- Treasury had another stellar year primarily due to the enhanced product capabilities and close working relationship with the Corporate and Institutional coverage teams. The Asset Liability Management business delivered exceptional results by positioning the balance sheet to take advantage of rise in profit rates. The fixed income (Sukuk) book, which registered a 33% growth YoY in 2018, also had a 13% growth in revenue with customer base increasing by one and a half times for the same period in UAE alone. Supported by the increased client base, the Treasury Sales growth momentum continued with products like Profit Rate Hedging, Foreign Exchange and Fixed Income (Sukuk) sales all contributing to this performance. Focused on proactive risk management, the business was able to provide solutions around various hedging mechanisms built around the specific and individual client’s requirements.

- In line with DIB's ongoing initiatives to provide innovative, digital solutions to its customers and support the Dubai Smart Government initiative, the bank successfully launched the "Virtual Accounts Solution" – a secure, online real-time Collection (Receivables & Reconciliation) System. DIB is one of the first banks in the UAE to launch VA Solution for its corporate customers.

- The Consumer business continued to enhance its product suite with the launch of “Auto Refinance”, which provides the customer more convenience with minimum documentation and easy funds access making the service simpler, smoother and quicker. The “DIB Bonus Saver Account”, which offers attractive profit rates and convenient bill payment facility, also provides additional benefits for “New to Bank” customers. In addition, DIB customers can now benefit from a larger network with the addition of 41 new ATM and 3-in-1 machines locations in 2018.

- DIB continues to maintain its edge in the home financing sector with its products and partnerships. The recent arrangement with Emaar Development for an exclusive home finance solution brings greater affordability and increased value for customers through benefits such as zero upfront cost and zero cost of financing up to the first five years.

- The year 2018 saw major upgrades and enhanced services on the banks digital capabilities with the launch of the all new Mobile Banking App, the all new online banking platform which offers more than 110 services, and the introduction of the DIB Chat Bot, which is an innovative and revolutionary service enabled with artificial intelligence (AI features) that can provide customer support on various queries and transactions. The bank also introduced Samsung Pay on DIB Cards which offers pay on the go with the mobile phone.

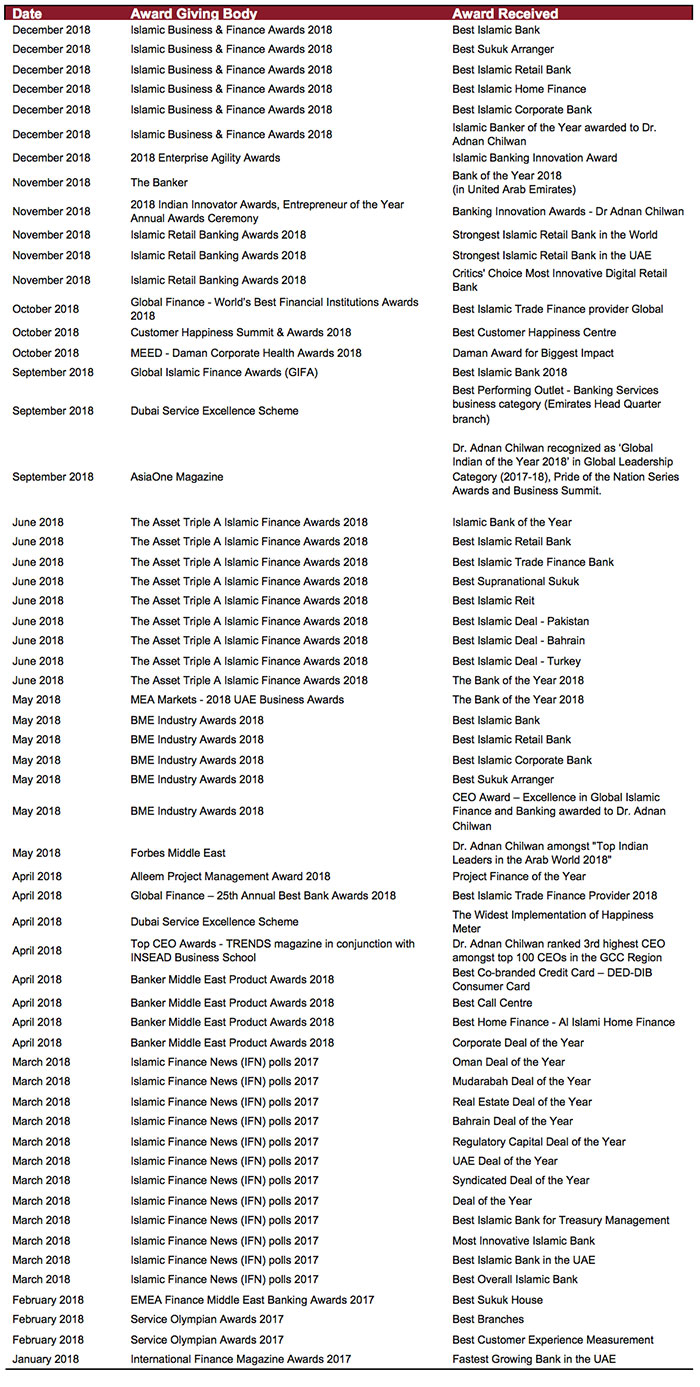

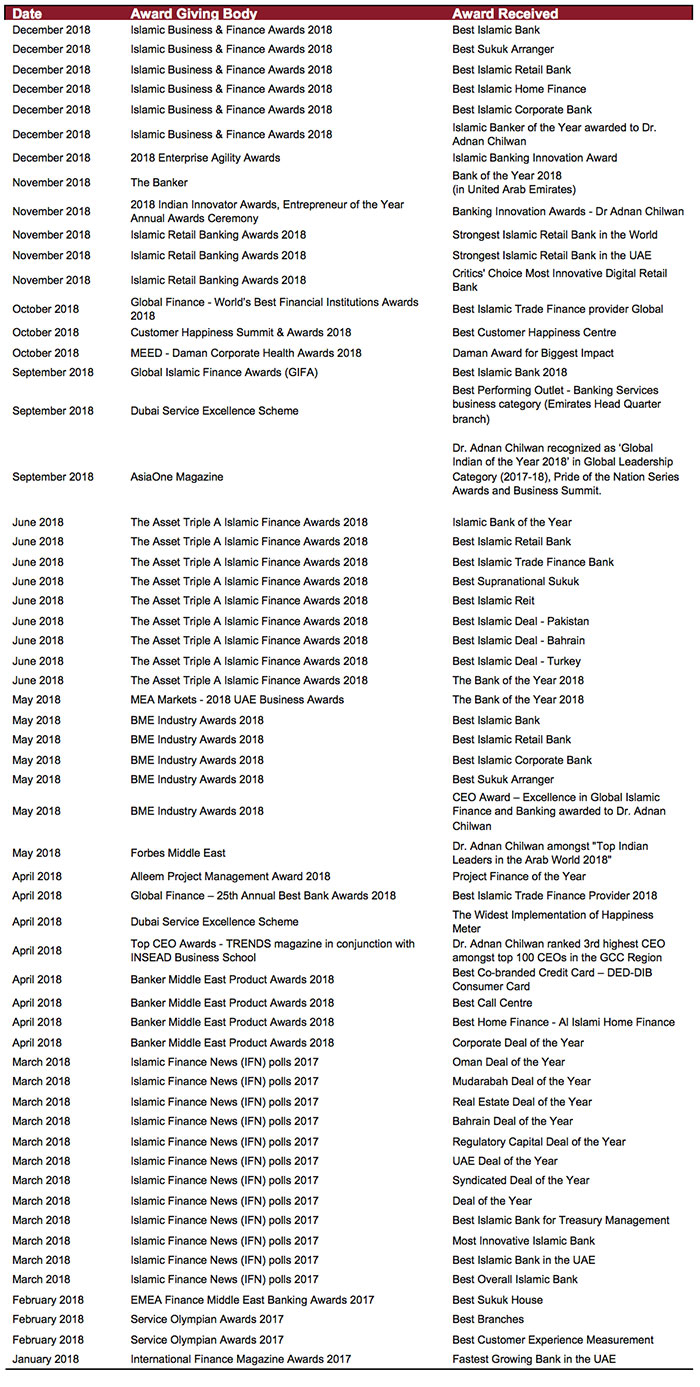

Year to Date 2018 Industry Awards